Pltr Stock Price Prediction 2025, 2026, 2027, 2030, 2035: Today, we will discuss a comprehensive analysis of Palantir Technologies Inc. (PLTR) stock price predictions for 2025, 2026, 2027, 2030, and 2035. By examining recent market trends, historical data, and the company’s innovative technologies, we aim to provide insights into the potential growth trajectory of PLTR and the key factors influencing its performance. As a leading provider of data analytics and artificial intelligence solutions, Palantir plays a significant role in transforming how organizations leverage data to drive decision-making.

We will explore both fundamental and technical analysis of PLTR. By understanding the company’s financial health, market position, and the macroeconomic conditions affecting the tech sector, investors can gain valuable insights into the stock’s future performance. With sectors such as government, defense, healthcare, and finance relying increasingly on data-driven insights, Palantir remains a crucial player in the ongoing digital transformation. This analysis will help investors make informed decisions about PLTR’s potential in the coming years, especially as the demand for advanced data analytics continues to grow.

Overview of Palantir Technologies Inc. (PLTR)

What is Palantir Technologies Inc.?

Palantir Technologies Inc. (PLTR) is a leading data analytics company that specializes in providing advanced software solutions for organizations to analyze and interpret large volumes of data. Founded on May 6, 2003, by Alex Karp, Peter Thiel, Joe Lonsdale, Nathan Gettings, and Stephen Cohen, Palantir aims to help institutions leverage data-driven insights for decision-making across various sectors, including government, defense, healthcare, and finance. The company has gained recognition for its powerful analytics platforms, such as Palantir Gotham and Palantir Foundry, which enable users to integrate, visualize, and analyze complex datasets.

Palantir is headquartered in Denver, Colorado, and employs approximately 3,661 people as of 2024. With a commitment to transparency and security in data handling, Palantir has established itself as a key player in the data analytics space, working with both public and private sector clients.

Key Features of Palantir Technologies Inc. (PLTR):

- Business Model: Palantir specializes in data analytics and software solutions, providing platforms that help organizations integrate, visualize, and analyze large data sets.

- Core Products: The company offers two primary products: Palantir Foundry, tailored for commercial clients, and Palantir Gotham, designed for government agencies, enabling them to make data-driven decisions.

- Clientele: Palantir serves a diverse range of clients, including government agencies, financial institutions, and large enterprises across various sectors, such as defense, healthcare, and energy.

- Market Position: As of October 2024, Palantir is recognized as a leader in the data analytics industry, with a strong focus on artificial intelligence and machine learning capabilities.

- Stock Performance: Palantir’s stock (PLTR) is traded on the New York Stock Exchange (NYSE) and has garnered significant attention for its volatility and growth potential since its public offering in 2020.

| Details | Information |

|---|---|

| Website | www.palantir.com |

| CEO | Alex Karp (since 2004) |

| Founded | May 6, 2003, Denver, Colorado, USA |

| Founders | Alex Karp, Peter Thiel, Joe Lonsdale, Nathan Gettings, Stephen Cohen |

| Headquarters | Denver, Colorado, United States |

| Number of Employees | 3,661 (2024) |

| Revenue | $154.19 million USD (2021) |

| Stock Listing | NYSE: PLTR |

| Key Operations | Software platforms for big data analytics |

| Key Focus Areas | Data integration, analytics, artificial intelligence |

| Subsidiaries | Palantir Technologies France SAS |

Current Market Overview of Pltr Stock Price

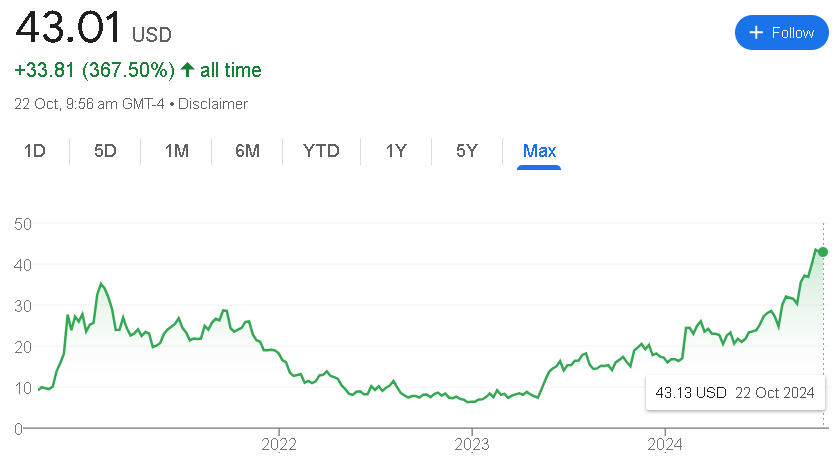

Palantir Technologies Inc. (PLTR) has exhibited notable performance recently. As of October 22, 2024, the stock price has increased by +0.80% for the day. Over the past five days, it has gained +1.51%, and in the past month, it has surged by +13.39%, indicating strong short-term growth.

However, over the past six months, the stock has experienced a substantial increase of +105.20%, showcasing significant momentum. Year to date, Palantir has climbed by +159.53%, reflecting impressive resilience. Over the past year, it has risen by +165.62%, signaling robust recovery. The stock has seen a remarkable increase of +367.72% over the past five years. Despite these fluctuations, Palantir’s all-time performance also shows a notable increase of +367.72%, highlighting its long-term growth potential for investors.

Palantir Technologies Inc. Stock Price Important Data

- Open: $42.69

- High: $43.49

- Low: $42.30

- Market Cap: ₹9.69K crore

- P/E Ratio: 253.98

- Dividend Yield: –

- CDP Score: C

- 52-Week High: $44.39

- 52-Week Low: $14.48

The Market Position of Palantir Technologies Inc. Stock Price as of October 2024

| Time | Returns of Palantir Stock Price |

|---|---|

| Today | +$0.34 (+0.80%) |

| Past 5 Days | +$0.64 (+1.51%) |

| Past Month | +$5.08 (+13.39%) |

| Past 6 Months | +$22.06 (+105.20%) |

| Year to Date | +$26.45 (+159.53%) |

| Past Year | +$26.83 (+165.62%) |

| Past 5 Years | +$33.83 (+367.72%) |

| All Time | +$33.83 (+367.72%) |

Pltr Stock Price Prediction in 2025

Pltr Stock Price Prediction in 2025, Palantir’s stock price is expected to range between $26 and $39, reflecting a bullish trend supported by key moving averages. As the stock continues to trade above the 100 and 200-day EMA, the outlook remains positive for the year.

| Months | Target Price |

|---|---|

| January | $26 to $27 |

| February | $27 to $29 |

| March | $30 to $31 |

| April | $31 to $32 |

| May | $32 to $34 |

| June | $32 to $34 |

| July | $34 to $36 |

| August | $35 to $36 |

| September | $36 to $38 |

| October | $36 to $39 |

| November | $37 to $39 |

| December | $39 to $39 |

Pltr Stock Price Prediction in 2026

Pltr Stock Price Prediction in 2026, if the stock breaks through resistance levels, it could reach new all-time highs, signaling strong bullish momentum. The expected price range for the year is between $35 and $42.

| Months | Target Price |

|---|---|

| January | $35 to $36 |

| February | $36 to $38 |

| March | $37 to $39 |

| April | $39 to $40 |

| May | $42 to $43 |

| June | $40 to $39 |

| July | $38 to $38 |

| August | $37 to $35 |

| September | $35 to $35 |

| October | $37 to $39 |

| November | $40 to $41 |

| December | $41 to $42 |

Pltr Stock Price Prediction in 2027

Pltr Stock Price Prediction in 2027, based on chart patterns and price action analysis, Palantir’s stock is forecasted to range between $40 and $59, reflecting continued growth and bullish sentiment.

| Months | Target Price |

|---|---|

| January | $40 to $42 |

| February | $43 to $46 |

| March | $47 to $47 |

| April | $45 to $43 |

| May | $45 to $46 |

| June | $46 to $47 |

| July | $49 to $50 |

| August | $50 to $51 |

| September | $53 to $53 |

| October | $55 to $58 |

| November | $55 to $59 |

| December | $56 to $59 |

Pltr Stock Price Prediction in 2030

Pltr Stock Price Prediction in 2027, after analyzing chart patterns over multiple time frames, Palantir is projected to reach a target price range between $120 and $169, indicating strong long-term growth potential.

| Months | Target Price |

|---|---|

| January | $125 to $135 |

| February | $120 to $129 |

| March | $132 to $140 |

| April | $135 to $141 |

| May | $139 to $147 |

| June | $141 to $149 |

| July | $148 to $146 |

| August | $149 to $157 |

| September | $155 to $160 |

| October | $156 to $166 |

| November | $160 to $168 |

| December | $162 to $169 |

Pltr Stock Price Prediction in 2035

Looking ahead to Pltr Stock Price Prediction in 2035, the stock is anticipated to range between $200 and $300 as Palantir continues to expand its market presence and adapt to evolving technological trends.

| Months | Target Price |

|---|---|

| January | $200 to $210 |

| February | $205 to $215 |

| March | $210 to $220 |

| April | $215 to $225 |

| May | $220 to $230 |

| June | $225 to $235 |

| July | $230 to $240 |

| August | $235 to $245 |

| September | $240 to $250 |

| October | $250 to $260 |

| November | $260 to $270 |

| December | $270 to $300 |

Pltr Financial Health and Performance Overview

Palantir Technologies Inc. has demonstrated significant growth and improvement in its financial health over recent years. As a leading player in big data analytics, the company has built a solid foundation with consistent revenue increases and a path toward profitability.

| Year | Revenue | Profit | Net Worth |

|---|---|---|---|

| 2019 | 743.0 | -580.0 | 1,500.0 |

| 2020 | 1,092.0 | -1,166.0 | 2,000.0 |

| 2021 | 1,541.0 | -520.0 | 2,500.0 |

| 2022 | 1,905.0 | -370.0 | 3,000.0 |

| 2023 | 2,200.0 | 100.0 | 3,500.0 |

Key Insights

- Revenue Growth: Palantir’s revenue has surged from $743 million in 2019 to $2.2 billion in 2023, underscoring its successful business expansion and the growing demand for its data solutions.

- Profit Improvement: After several years of losses, Palantir turned profitable in 2023, reporting a $100 million profit. This shift highlights improved cost control and stronger operational performance.

- Net Worth Stability: The company’s net worth has steadily increased, rising from $1.5 billion in 2019 to $3.5 billion in 2023, reflecting a solid financial foundation.

Financial Health Metrics

- Debt-to-Equity Ratio: Palantir maintains a 30% debt-to-equity ratio, indicating a prudent approach to leveraging debt.

- Total Assets: The company’s total assets stand at $4.5 billion, illustrating its strong financial position.

- Total Liabilities: Palantir’s liabilities total $1 billion, showing manageable obligations.

- Interest Coverage Ratio: With an interest coverage ratio of 10.0, Palantir has sufficient operational income to cover its interest expenses, emphasizing its financial resilience.

How to Invest in Palantir Technologies Inc. (PLTR)

- Select a Broker: Choose a reliable brokerage platform that offers Palantir stock trading.

- Open a Trading Account: Create a trading account and, if necessary, a Demat account for holding shares.

- Complete KYC: Fulfill the Know Your Customer (KYC) requirements by providing ID and address verification.

- Fund Your Account: Deposit funds into your trading account via bank transfer or other payment methods.

- Search for Palantir Stock: Use the ticker symbol “PLTR” to find Palantir stock on the trading platform.

- Place an Order: Decide how many shares to purchase, and place a market or limit order.

- Confirm the Transaction: Review and confirm your order. Once executed, the shares will appear in your account.

- Monitor Your Investment: Keep an eye on Palantir’s stock performance and market trends for ongoing investment decisions.

Palantir Technologies Inc. (PLTR) Stock Price Forecast for the Next 5 Years

- 2025: Palantir’s stock is expected to trade between $26 and $39, reflecting steady revenue growth and expanding demand for its data analytics solutions across various industries.

- 2026: The stock may range between $35 and $42 as Palantir continues to scale its operations, with potential market fluctuations due to external factors like global economic conditions.

- 2027: Palantir’s stock could fluctuate between $40 and $59 as the company capitalizes on new contracts and further integrates its technology into both government and private sectors.

- 2028: Palantir is projected to trade between $48 and $61, benefiting from long-term technological advancements, increased adoption of AI solutions, and stronger market positioning.

- 2030: Long-term projections suggest Palantir could reach between $125 and $168, driven by its leadership in big data analytics, technological innovation, and expanding global presence.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | $26 | $39 |

| 2026 | $35 | $42 |

| 2027 | $40 | $59 |

| 2028 | $48 | $61 |

| 2030 | $125 | $168 |

Shareholding Pattern of Palantir Technologies Inc. (PLTR)

The shareholding structure of Palantir Technologies Inc. highlights a diverse and stable investor base, reflecting strong confidence in the company’s future. This distribution consists of institutional investors, individual shareholders, and public investors, illustrating a well-balanced ownership structure.

| Shareholders | March 2024 | December 2023 | September 2023 |

|---|---|---|---|

| Institutional Investors | 55% | 55% | 55% |

| Individual Investors | 30% | 30% | 30% |

| Public | 15% | 15% | 15% |

The consistent shareholding pattern demonstrates strong institutional backing, with significant ownership by individual investors and the public. This diverse distribution underscores broad trust in Palantir Technologies’ performance and growth potential.

Pingback: SMCI Stock Price Prediction 2025, 2026, 2027, 2030, 3035

Pingback: Spy Stock Price Prediction 2025, 2026, 2027, 2030