Suzlon Energy Ltd. (BSE: SUZLON), a prominent player in the renewable energy sector, has witnessed a notable decline in its stock price over the past month, with a drop of approximately 15%. This trend has attracted the attention of investors and market analysts, raising questions about the underlying factors contributing to this downturn. In this analysis, we will explore the current state of Suzlon Energy, examine the market conditions affecting its stock, and discuss the broader implications for the company and its stakeholders.

Overview of Suzlon Energy Ltd.

Founded in 1995 by Tulsi Tanti, Suzlon Energy has emerged as a leading renewable energy company in India, primarily focusing on wind power generation. The company’s headquarters are located in Pune, and it has expanded its operations globally, establishing a significant presence in various markets. Suzlon’s commitment to sustainability and its efforts to reduce the carbon footprint have positioned it as a key player in the transition to cleaner energy sources.

- Founded: 1995

- Founder: Tulsi Tanti

- Headquarters: Pune, India

- Number of Employees: 6,200 (2024)

- Revenue: ₹4,187.33 crores (US$520 million, 2021)

- Market Capitalization: ₹94.95 billion

- P/E Ratio: 109.16

- 52-Week High: ₹86.04

- 52-Week Low: ₹30.00

Despite its growth trajectory, Suzlon Energy has faced numerous challenges, including financial difficulties and stiff competition in the renewable energy sector. The recent drop in share price highlights the volatility and risks associated with investing in this rapidly evolving industry.

Market Overview of Suzlon Energy Stock

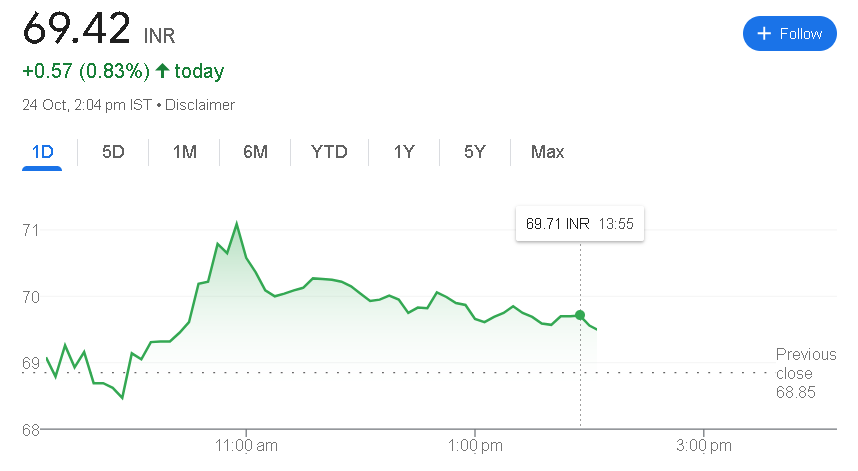

As of the latest trading session,Suzlon Energy Share Price opened at ₹69.08 and fluctuated between a low of ₹68.40 and a high of ₹71.14 before closing at ₹69.08. The stock’s decline over the past month is indicative of broader market trends and specific challenges faced by the company.

Key Market Data for Suzlon Energy:

- Current Price: ₹69.08

- Day Change: -₹3.16 (-4.37%)

- 1-Month Performance: -15%

- 52-Week Performance: Ranges from ₹30.00 to ₹86.04

The volatility in Suzlon Energy’s stock price is influenced by various external and internal factors, making it essential for investors to stay informed about market conditions and company developments.

Factors Contributing to the Recent Drop

Several key factors have contributed to the 15% drop in Suzlon Energy’s stock price over the past month:

- Market Sentiment and Economic ConditionsThe renewable energy sector is not immune to broader economic fluctuations. Recent macroeconomic trends, including inflationary pressures and rising interest rates, have created uncertainty in the market. Investors may be reassessing their positions in growth stocks like Suzlon Energy, leading to increased selling pressure. Additionally, concerns about global economic growth may affect investor confidence in the renewable energy sector.

- Competitive LandscapeThe renewable energy market is becoming increasingly competitive, with numerous players vying for market share. Suzlon Energy faces challenges from established competitors and emerging startups, making it difficult to maintain a competitive edge. This intense competition may impact investor sentiment and contribute to the stock’s decline.

- Operational Challenges and Financial PerformanceDespite its historical significance in the renewable energy sector, Suzlon Energy has faced operational challenges, including project delays and cost overruns. These issues can erode investor confidence, particularly if they lead to missed revenue targets. Furthermore, the company’s high P/E ratio of 109.16 suggests that investors are expecting substantial future growth, making it crucial for Suzlon to deliver on its promises.

- Regulatory EnvironmentThe renewable energy sector is heavily influenced by government policies and regulations. Changes in policy frameworks or subsidies can significantly impact companies operating in this space. Investors may be concerned about potential regulatory changes that could affect Suzlon Energy’s profitability, contributing to the recent share price decline.

- Global Supply Chain IssuesThe ongoing global supply chain disruptions have affected various industries, including renewable energy. Delays in the procurement of key components and materials can impact project timelines and costs. As a result, investors may be worried about the company’s ability to deliver on its commitments, leading to a decrease in stock price.

Investor Sentiment and Market Perception

The current market sentiment surrounding Suzlon Energy is characterized by a mix of cautious optimism and concern. While the long-term prospects for the renewable energy sector remain positive, short-term volatility may deter some investors. The 15% drop in stock price has prompted discussions among retail and institutional investors, with many reevaluating their positions.

Key Considerations for Investors:

- Long-Term Growth Potential: Investors need to weigh the short-term volatility against the long-term growth potential of Suzlon Energy in the renewable energy market. The global push for cleaner energy sources presents significant opportunities for companies in this sector.

- Risk Management: Given the current market conditions, investors should consider implementing risk management strategies to protect their investments. This may include diversifying their portfolios or setting stop-loss orders to limit potential losses.

- Monitoring Developments: Staying informed about company news, regulatory changes, and market trends is crucial for investors looking to make informed decisions regarding Suzlon Energy shares.

Financial Performance of Suzlon Energy

Despite the recent drop in stock price, Suzlon Energy has a solid revenue base, generating ₹4,187.33 crores in 2021. However, the company’s profitability and ability to scale operations are under scrutiny, especially given the competitive landscape and economic challenges.

Key Financial Metrics:

- Revenue (2021): ₹4,187.33 crores

- Market Capitalization: ₹94.95 billion

- Employee Count: 6,200

While Suzlon Energy’s revenue figures are promising, the high P/E ratio of 109.16 raises questions about the company’s growth expectations and whether it can deliver on its commitments to investors.

Future Outlook for Suzlon Energy Stock

The future outlook for Suzlon Energy remains uncertain, characterized by both opportunities and challenges. Investors will be keenly watching for developments that could impact the company’s performance, including:

- Growth in Renewable Energy Demand: The global shift towards renewable energy sources presents a favorable environment for companies like Suzlon Energy. If the company can capitalize on this trend, it may recover from its recent share price decline.

- Strategic Partnerships and Innovations: Forming strategic partnerships and investing in innovative technologies could enhance Suzlon’s competitive edge. Announcements related to new projects or collaborations could positively impact investor sentiment.

- Regulatory Support: Supportive government policies and incentives for renewable energy projects could bolster Suzlon Energy’s growth prospects. Investors will be monitoring any regulatory developments that may affect the company’s operations.

Conclusion

The 15% drop in Suzlon Energy’s stock price over the past month underscores the volatility and challenges faced by companies in the renewable energy sector. While the long-term outlook for renewable energy remains positive, short-term fluctuations can significantly impact investor sentiment. As Suzlon navigates these challenges, stakeholders will be keenly watching for developments that could influence the company’s trajectory and stock performance.

Pingback: Today Gold Rate in India (29th October 2024)

Pingback: Indian Railway Finance Corporation (IRFC) Share Price Today: Jumps 12% in the Past 5 Day