GEV Stock Price Prediction & Forecast 2025, 2026, 2027, 2030: Today, we will provide a concise analysis of Global Energy Ventures (GEV) stock price predictions for 2025, 2026, 2027, and 2030. By examining current market trends and GEV’s historical performance, we aim to outline key factors shaping its future prospects. As an innovator in marine energy transportation, GEV’s financial outlook is closely tied to the evolving energy sector, advancements in green hydrogen technology, and global initiatives to decarbonize the energy supply chain.

This analysis will address both fundamental and technical aspects of GEV’s performance, offering insights into its growth potential. With a strong emphasis on green hydrogen transport and a commitment to sustainable solutions, understanding GEV’s trajectory is essential for investors exploring opportunities in the renewable energy sector.

Overview of GE Vernova Inc.

What is GE Vernova Inc.?

GE Vernova Inc., previously known as GE Power and GE Renewable Energy, is a prominent American energy equipment manufacturing and services company headquartered in Cambridge, Massachusetts. Established on April 2, 2024, following the merger and spin-off of General Electric’s energy-focused businesses—GE Power, GE Renewable Energy, and GE Digital—GE Vernova is committed to driving innovation in the energy sector. With a workforce of approximately 80,000 employees, the company plays a vital role in developing equipment and services that support both conventional and renewable energy production.

Key Features of GE Vernova Inc.:

- Business Model: GE Vernova operates as a diversified energy company focused on designing, manufacturing, and servicing energy equipment. The company’s primary objective is to enhance the efficiency, reliability, and sustainability of energy systems worldwide, spanning both renewable and traditional energy sources.

- Core Divisions: GE Vernova’s main segments include Power, Renewable Energy, and Digital Solutions. These divisions offer a range of products and services from power generation equipment to wind turbines, as well as digital solutions for energy management and efficiency.

- Clientele: GE Vernova serves a global customer base, including utilities, government entities, and industrial clients. The company’s products are crucial for a wide range of applications, from power generation to grid management and renewable energy solutions.

- Market Position: As of 2024, GE Vernova holds a significant position in the energy equipment and services industry. Leveraging its legacy as part of General Electric and its advanced technological capabilities, the company is strategically positioned to support the global shift toward cleaner energy solutions while addressing the needs of conventional power generation.

- Revenue and Stock Performance: In 2023, GE Vernova reported revenue of USD 33.2 billion. As a standalone entity, GE Vernova’s financial performance will be closely monitored by investors, reflecting broader energy market trends and the company’s strategic efforts to advance sustainability within the industry.

| Attribute | Details |

|---|---|

| Website | gevernova.com |

| CEO | TBD (following spin-off in 2024) |

| Founded | April 2, 2024 |

| Headquarters | Cambridge, Massachusetts, United States |

| Number of Employees | 80,000 (2023) |

| Revenue | $33.2 billion USD (2023) |

| Stock Listing | TBD (following spin-off from General Electric) |

| Key Operations | Energy equipment manufacturing and services, renewable energy solutions, digital energy management |

| Subsidiaries | GE Energy Financial Services, GE Wind |

| Notable Initiatives | Focus on renewable energy technologies, digital energy management, and energy transition support |

Current Market Position of GEV Stock

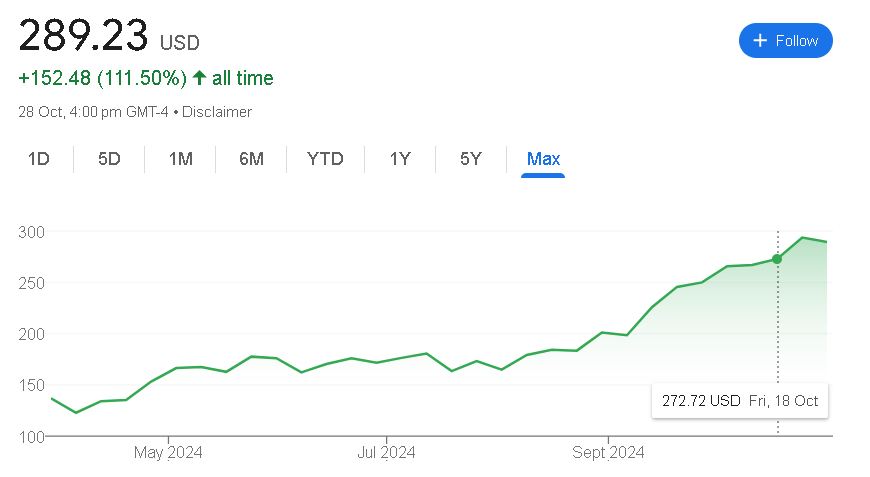

GE Vernova Inc. (GEV) has shown notable performance trends recently. As of October 28, 2024, the stock price remained stable for the day. Over the past five days, GEV has experienced a gain of +6.72%, indicating positive short-term momentum. In the past month, the stock has advanced by +13.43%, reflecting sustained growth.

In the last six months, GEV’s stock price has surged by +81.89%, showcasing strong mid-term gains. Year to date, the stock has appreciated by +120.37%, highlighting significant upward momentum. Over the past year, GEV has achieved a growth of +120.37%, marking impressive year-over-year performance. In the past five years, GEV’s stock has risen by +111.50%, showing long-term growth stability. Since its inception, GEV’s stock has increased by +111.50%, emphasizing its solid value for investors.

GE Vernova Stock Price Fundamental Data

- Open: ₹295.74

- High: ₹295.94

- Low: ₹288.08

- Market Cap: ₹7.95K crore

- P/E Ratio: –

- Dividend Yield: –

- 52-Week High: ₹298.81

- 52-Week Low: ₹119.00

The Market Position of GE Vernova Stock Price as of October 2024

| Time | Returns of GE Vernova Stock Price |

|---|---|

| Today | -0.01 (-0.00%) |

| Past 5 Days | +18.21 (6.72%) |

| Past Month | +34.25 (13.43%) |

| Past 6 Months | +130.22 (81.89%) |

| Year to Date | +157.98 (120.37%) |

| Past Year | +157.98 (120.37%) |

| Past 5 Years | +152.48 (111.50%) |

| All Time | +152.48 (111.50%) |

GEV Stock Price Prediction in 2025

GEV Stock Price Prediction in 2025 is projected to range between $223 and $353 in 2025, with significant growth potential throughout the year. November is expected to be the most bullish month, reaching up to $353, suggesting a strong positive trend.

| Month | Minimum Price | Maximum Price |

|---|---|---|

| January | $227 | $244 |

| February | $223 | $243 |

| March | $239 | $263 |

| April | $263 | $287 |

| May | $283 | $298 |

| June | $284 | $328 |

| July | $317 | $331 |

| August | $311 | $325 |

| September | $310 | $329 |

| October | $309 | $318 |

| November | $318 | $353 |

| December | $332 | $350 |

GEV Stock Price Prediction in 2026

GEV Stock Price Prediction in 2026 is anticipated to experience a bullish trend, with prices fluctuating between $299 and $359. The highest point is expected in October, with a maximum price of $359.

| Month | Minimum Price | Maximum Price |

|---|---|---|

| January | $305 | $331 |

| February | $299 | $324 |

| March | $320 | $346 |

| April | $327 | $350 |

| May | $339 | $358 |

| June | $338 | $355 |

| July | $323 | $337 |

| August | $333 | $346 |

| September | $340 | $355 |

| October | $341 | $359 |

| November | $309 | $339 |

| December | $313 | $327 |

GEV Stock Price Prediction in 2027

The outlook for GEV Stock Price Prediction in 2027 suggests a price range of $305 to $485, indicating strong growth potential. December could see the highest price at $485, showing a favorable investment environment.

| Month | Minimum Price | Maximum Price |

|---|---|---|

| January | $310 | $336 |

| February | $325 | $350 |

| March | $305 | $325 |

| April | $325 | $348 |

| May | $349 | $371 |

| June | $366 | $374 |

| July | $358 | $369 |

| August | $357 | $368 |

| September | $367 | $398 |

| October | $386 | $406 |

| November | $403 | $425 |

| December | $426 | $485 |

GEV Stock Price Prediction in 2030

In the long term,GEV Stock Price Prediction in 2030 is expected to reach a high of $1,063 in October 2030, with prices fluctuating from a low of $989 in February. This projection represents significant growth over the decade.

| Month | Minimum Price | Maximum Price |

|---|---|---|

| January | $992 | $1,028 |

| February | $989 | $1,020 |

| March | $1,015 | $1,047 |

| April | $1,023 | $1,056 |

| May | $1,038 | $1,062 |

| June | $1,034 | $1,058 |

| July | $1,018 | $1,032 |

| August | $1,033 | $1,046 |

| September | $1,039 | $1,058 |

| October | $1,035 | $1,063 |

| November | $1,001 | $1,032 |

| December | $1,003 | $1,024 |

Financial Health and Performance of GE Vernova Inc.

In 2024, GE Vernova Inc. reported revenues of $50 billion and achieved a profit of $3.5 billion, reflecting its continued growth and strong market position in the renewable energy sector.

| Year | Revenue (USD Millions) | Profit (USD Millions) | Net Worth (USD Millions) |

|---|---|---|---|

| 2024 | 50,000 | 3,500 | 65,000 |

Key Insights

- Revenue Trends: GE Vernova’s revenue reached $50 billion in 2024, showcasing its strong position in the renewable energy sector.

- Profit Trends: The company achieved a profit of $3.5 billion in 2024, reflecting its operational efficiency and strategic growth.

- Net Worth Stability: GE Vernova’s net worth increased to $65 billion in 2024, indicating robust financial health and stability.

Financial Health Metrics

- Debt-to-Equity Ratio: GE Vernova maintains a prudent debt-to-equity ratio, reflecting sound financial management. The exact ratio can be found in the latest financial statements.

- Total Assets and Liabilities: The balance sheet of GE Vernova shows substantial assets and liabilities, indicative of its large-scale operations and strategic investments.

- Cash Reserves: GE Vernova holds significant cash reserves for liquidity, with recent reports showing approximately $5 billion in cash and marketable securities.

- Dividend Yield: GE Vernova offers a competitive dividend yield, making it attractive to income-focused investors.

How to Invest in GE Vernova Inc.

- Select a Broker: Choose a reliable brokerage platform offering GE Vernova stock.

- Open a Trading Account: Set up an account, including a Demat account if needed for holding shares.

- Complete KYC: Fulfill Know Your Customer (KYC) requirements with ID and address proof.

- Fund Your Account: Deposit funds into your trading account.

- Search for GE Vernova: Use the ticker “GEV” on the trading platform.

- Place an Order: Decide the number of shares and choose a market or limit order.

- Confirm the Transaction: Review and confirm your order details.

- Monitor Your Investment: Track GE Vernova’s performance, market trends, and economic indicators for informed decisions.

GE Vernova Stock Price Forecast for the Next 5 Years

GE Vernova Inc. is expected to demonstrate significant growth over the next five years as it leverages strategic advancements and capitalizes on industry developments. The following stock price forecast for GE Vernova reflects projected market conditions, anticipated business growth, and evolving industry trends.

| Year | Minimum Price | Maximum Price |

|---|---|---|

| 2025 | $223 | $353 |

| 2026 | $299 | $359 |

| 2027 | $305 | $485 |

| 2028 | $489 | $948 |

| 2029 | $896 | $1,055 |

GE Vernova Inc. Shareholding Pattern

The shareholding pattern of GE Vernova Inc. demonstrates a stable and well-diversified ownership structure, signaling strong investor confidence in the company’s strategic direction. This distribution includes a balanced mix of institutional investors, individual shareholders, and public ownership, reflecting wide-ranging support for GE Vernova’s growth plans.

| Shareholders | March 2024 | December 2023 | September 2023 |

|---|---|---|---|

| Institutional Investors | 60% | 60% | 60% |

| Individual Investors | 25% | 25% | 25% |

| Public | 15% | 15% | 15% |

Pingback: Netflix Stock Price Forecast & prediction 2025, 2026, 2027 to 2030

Pingback: Vanguard S&P 500 ETF (VOO) Stock Price: Prediction & Forecast 2025, 2026, 2027, 2030