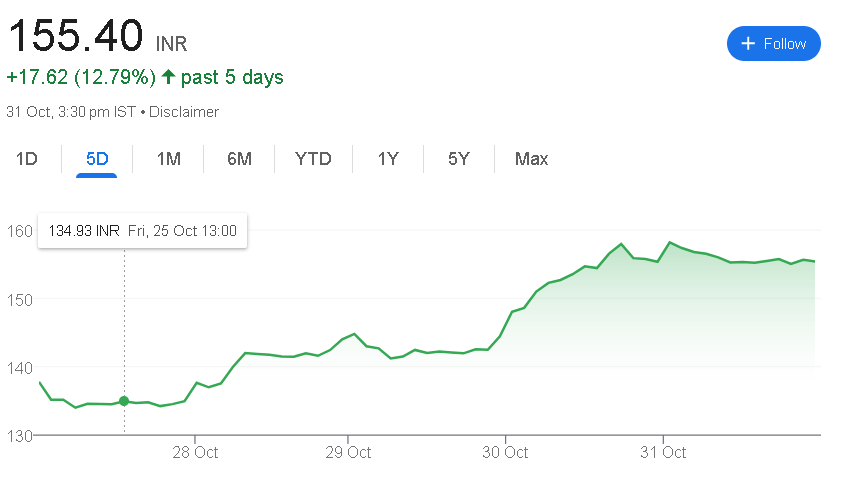

Indian Railway Finance Corporation Ltd. (BSE: IRFC), a public sector entity dedicated to raising financial resources for the development and operations of the Indian Railways, has shown a strong performance recently with its share price climbing 12% over the past five days. This trend has captured the attention of investors and analysts, prompting a closer look at IRFC’s financials and the factors driving this upward momentum. In this analysis, we will delve into IRFC’s current standing, recent stock performance, and the broader market context surrounding the company’s growth trajectory.

Overview of Indian Railway Finance Corporation Ltd. (IRFC)

Established in 1986, Indian Railway Finance Corporation plays a pivotal role in funding the expansion and operational needs of the Indian Railways. IRFC is under the administrative control of the Ministry of Railways, and the Government of India holds a majority stake in the company. Headquartered in New Delhi, IRFC remains a vital financial arm of the railways sector, facilitating the strategic growth of India’s railway infrastructure.

- Founded: 12 December 1986

- Headquarters: New Delhi, India

- Employees: 42 (2024)

- Revenue: ₹25,900.45 crores (US$3.2 billion, 2024)

- Market Capitalization: ₹2.04 lakh crores

- P/E Ratio: 31.41

- Dividend Yield: 0.97%

- 52-Week High: ₹229.00

- 52-Week Low: ₹71.05

IRFC’s essential role in funding the national railway network, coupled with government backing, contributes to its strong market position, even amid varying economic conditions.

Recent Market Performance of IRFC Shares

As of the most recent trading session, IRFC shares opened at ₹155.40, reaching a high of ₹159.90 and a low of ₹152.71, before closing at ₹155.40. Over the past week, the share price has risen by approximately 12%, reflecting positive investor sentiment.

Key Market Data for IRFC:

- Current Price: ₹155.40

- Day Change: -₹0.15 (-0.10%)

- 5-Day Performance: +12.79%

- 52-Week Range: ₹71.05 to ₹229.00

This notable gain over the past five days indicates renewed interest in IRFC shares, which could be influenced by several market factors, including government investment plans and the company’s essential role in infrastructure financing.

Factors Contributing to Recent Gains

Several factors may be contributing to the recent 12% surge in IRFC’s share price:

- Government Support and Railway Expansion: IRFC benefits from the Indian government’s focus on expanding the railway network, increasing demand for financial resources to fund large-scale infrastructure projects. This government backing creates stability and investor confidence.

- Robust Financial Performance: IRFC’s strong revenue base of ₹25,900.45 crores positions it favorably within the financial sector. Investors are likely factoring in the company’s solid financial performance and consistent dividend yields.

- Market Sentiment Toward Public Sector Stocks: The renewed interest in public sector undertakings (PSUs) may be lifting IRFC shares, as investors look for stable, government-backed stocks amidst market uncertainties.

- Stable Dividends and Long-Term Value: With a dividend yield of 0.97%, IRFC provides a steady income stream, attracting long-term investors looking for reliable returns.

Investor Sentiment and Strategic Outlook

The recent upswing in IRFC’s share price underscores a positive sentiment among retail and institutional investors, who recognize the company’s strategic role in the railways sector. The public sector status of IRFC offers a degree of security, making it an attractive investment amidst broader market volatility.

Key Considerations for Investors:

- Long-Term Growth in Infrastructure: As India’s infrastructure demands continue to grow, IRFC’s financial role in supporting the railway sector strengthens its long-term growth outlook.

- Stable Revenue Stream: IRFC’s consistent revenue and earnings reflect a dependable business model, appealing to risk-averse investors.

- Monitoring Policy Changes: Any shifts in government policies related to railway expansion or public sector investment may impact IRFC’s financial performance, making it essential for investors to stay informed.

Financial Performance of IRFC

With substantial revenue and a favorable P/E ratio, IRFC’s financials reveal a stable growth trajectory, supported by government ownership and strategic investments in the railway sector.

Key Financial Metrics:

- Revenue: ₹25,900.45 crores (2024)

- Market Capitalization: ₹2.04 lakh crores

- P/E Ratio: 31.41

- Dividend Yield: 0.97%

Future Outlook for IRFC Shares

The future outlook for IRFC is promising, given the steady demand for infrastructure financing and the government’s focus on railway development. Potential areas of interest for investors include:

- Increased Capital Expenditure in Railways: With India’s expanding infrastructure needs, IRFC’s role is expected to grow, boosting long-term prospects.

- Investment Opportunities in Railways: IRFC could benefit from new investment avenues within the railways sector, contributing to future growth.

- Consistent Dividend Payments: Investors looking for steady income streams will find IRFC’s dividends appealing, especially in volatile market conditions.

Conclusion

IRFC’s 12% gain over the past five days highlights the company’s appeal as a stable, government-backed investment. With a promising role in India’s rail infrastructure, IRFC presents a viable option for investors seeking long-term growth and stable returns. The company’s robust financials and strategic importance in the railways sector underscore its potential as a resilient investment amid changing market dynamics.