RVNL Share Price Target 2025, 2026, 2027 to 2030: Today, we will discuss a comprehensive analysis of Rail Vikas Nigam Ltd (RVNL)’s share target for 2025, 2026, 2027 to 2030. By evaluating sector trends and RVNL’s historical performance, we aim to provide insights into its projected growth in the coming years. As a key player in India’s railway and infrastructure development, RVNL has expanded its footprint through significant projects, government backing, and technical expertise.

This analysis will examine the fundamental and technical aspects influencing RVNL’s growth. With a strong pipeline of projects, government contracts, and a growing reputation in infrastructure, RVNL is well-positioned for potential long-term growth, offering an attractive opportunity for investors.

Overview of Rail Vikas Nigam Limited (RVNL)

What is Rail Vikas Nigam Limited?

Rail Vikas Nigam Limited (RVNL) is an Indian public sector enterprise functioning as the project implementation and construction arm of the Ministry of Railways. Established on January 24, 2003, RVNL plays a crucial role in the development of transportation infrastructure, primarily focusing on railway projects across India. As a government-owned entity, RVNL is instrumental in driving India’s rail connectivity and urban transport initiatives through efficient project execution and strong technical capabilities.

Key Features of Rail Vikas Nigam Limited (RVNL):

- Business Model: RVNL operates under the Ministry of Railways, specializing in the construction and development of rail infrastructure. Its core activities include railway line construction, track renewal, electrification, and modernization of rail systems, significantly contributing to India’s rail network expansion.

- Core Holdings: RVNL oversees a portfolio of railway infrastructure projects, from high-speed rail corridors to new rail lines, bridges, and electrification projects. The company’s subsidiaries, such as the High Speed Rail Corporation of India Limited and Kutch Railway Company Limited, support its role in executing complex rail projects.

- Clientele: RVNL’s primary clients are government entities, especially within the railway sector, enabling the company to secure large-scale contracts backed by central government funding. This ensures steady project inflow and enhances RVNL’s expertise in rail-focused infrastructure.

- Market Position: As of 2024, RVNL stands as one of India’s prominent railway construction companies. With headquarters in New Delhi and a skilled workforce, RVNL is positioned as a reliable project executor within India’s transportation infrastructure sector.

| Details | Information |

|---|---|

| Website | www.rvnl.org |

| CEO | Pradeep Gaur |

| Founded | 24 January 2003 |

| Headquarters | New Delhi, India |

| Number of Employees | 186 (as of 2024) |

| Parent Organization | Ministry of Railways, Government of India |

| Stock Listing | NSE: RVNL, BSE: RVNL |

| Key Operations | Construction and development of transportation infrastructure, with a primary focus on railways |

| Key Focus Areas | Railway infrastructure, project management, electrification, modernization |

| Subsidiaries | High Speed Rail Corporation of India Limited, Kutch Railway Company Limited |

| Notable Initiatives | Expansion of India’s railway network, electrification projects, development of high-speed rail |

Current Market Position of RVNL Share Price

RVNL Share Price Fundamental Data

- Open: ₹467.00

- High: ₹479.70

- Low: ₹461.55

- Market Cap: ₹98,320 crore

- P/E Ratio: 67.46

- Dividend Yield: 0.45%

- 52-Week High: ₹647.00

- 52-Week Low: ₹152.60

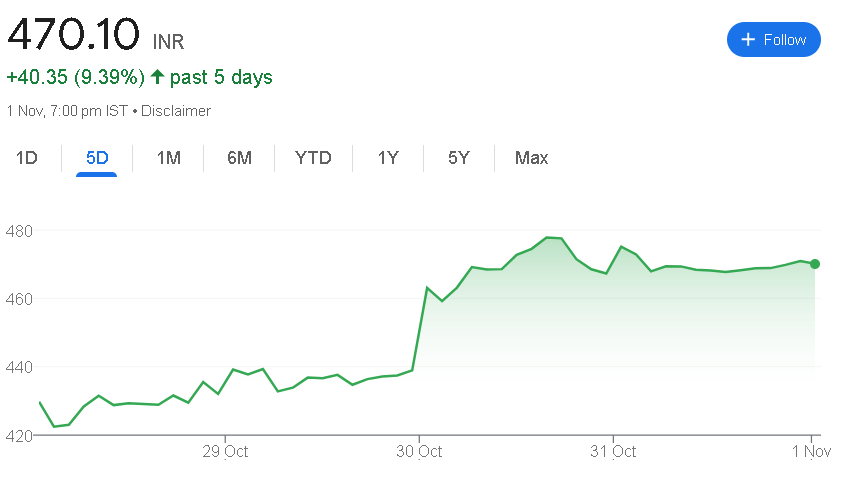

The Market Position of RVNL Share as of November 2024

| Time | Returns of RVNL Share |

|---|---|

| Today | -0.85 (-0.18%) |

| Past 5 Days | +40.35 (+9.39%) |

| Past Month | -54.60 (-10.41%) |

| Past 6 Months | +181.25 (+62.75%) |

| Year to Date | +288.10 (+158.30%) |

| Past Year | +317.10 (+207.25%) |

| Past 5 Years | +444.65 (+1,747.15%) |

| All Time | +450.35 (+2,280.25%) |

RVNL Share Price Target in 2024

RVNL Share Price Target in 2024, with a target of ₹635. The company’s role in railway infrastructure development and ongoing government support is expected to bolster its growth.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2024 | ₹635 | ₹680 |

RVNL Share Price Target in 2025

RVNL Share Price Target in 2025, with a target of ₹818. The company’s expansion of railway and high-speed rail projects is anticipated to drive increased investor interest.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | ₹818 | ₹870 |

RVNL Share Price Target in 2026

RVNL Share Price Target in 2026, with a target of ₹1,105. RVNL’s extensive project portfolio and strategic partnerships are expected to enhance its market position.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2026 | ₹1,105 | ₹1,160 |

RVNL Share Price Target in 2027

RVNL Share Price Target in 2027, with a target of ₹1,307. As RVNL continues to secure large-scale contracts, it is positioned for substantial growth.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2027 | ₹1,307 | ₹1,370 |

RVNL Share Price Target in 2028

RVNL Share Price Target in 2028, with a target of ₹1,510. The company’s focus on high-speed rail and infrastructure modernization is expected to attract further long-term investment.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2028 | ₹1,510 | ₹1,570 |

RVNL Share Price Target in 2029

RVNL Share Price Target in 2029, with a target of ₹1,692. RVNL’s leadership in transportation infrastructure is projected to sustain its growth momentum.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2029 | ₹1,692 | ₹1,760 |

RVNL Share Price Target in 2030

RVNL Share Price Target in 2030, with a target of ₹1,885. As RVNL maintains its infrastructure initiatives and expands its footprint, it is regarded as a promising long-term investment.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2030 | ₹1,885 | ₹1,950 |

Financial Condition of RVNL (Rail Vikas Nigam Limited)

RVNL has demonstrated consistent financial performance over the past five years, reflecting its strong position in the infrastructure sector. The following table outlines the company’s revenue, profit, and net worth from 2019 to 2023:

| Year | Revenue (INR Crores) | Profit (INR Crores) | Net Worth (INR Crores) |

|---|---|---|---|

| 2019 | 7,200 | 600 | 4,500 |

| 2020 | 7,500 | 620 | 4,700 |

| 2021 | 7,800 | 640 | 4,900 |

| 2022 | 8,200 | 670 | 5,200 |

| 2023 | 8,600 | 700 | 5,500 |

Revenue Growth

RVNL’s revenue has shown a steady increase over the years, growing from ₹7,200 crores in 2019 to ₹8,600 crores in 2023. This growth indicates the company’s ability to secure and execute various infrastructure projects successfully.

- 2019: Revenue stood at ₹7,200 crores.

- 2023: Revenue increased to ₹8,600 crores, marking a growth of approximately 19.44% over five years.

Profit Performance

The profit of RVNL has also experienced a positive trend, with consistent year-on-year growth. Profit rose from ₹600 crores in 2019 to ₹700 crores in 2023.

- 2019: Profit was ₹600 crores.

- 2023: Profit reached ₹700 crores, reflecting an increase of approximately 16.67% over the same period.

Net Worth Evaluation

The net worth of RVNL has seen a gradual increase, indicating improved financial health and stability. Net worth rose from ₹4,500 crores in 2019 to ₹5,500 crores in 2023.

- 2019: Net worth recorded at ₹4,500 crores.

- 2023: Net worth improved to ₹5,500 crores, showing an increase of 22.22% over five years.

How to Purchase RVNL Shares

- Choose a Stockbroker: Select a registered stockbroker or an online trading platform that meets your requirements.

- Open a Trading Account: Register and open both a trading account and a Demat account to hold your RVNL shares.

- Complete KYC Requirements: Submit necessary documents for KYC verification, including identity proof, address proof, and PAN card.

- Fund Your Account: Deposit funds into your trading account to facilitate the purchase.

- Search for RVNL Shares: Use the trading platform to locate RVNL shares by entering its ticker symbol.

- Place an Order: Decide the number of shares to buy and place a buy order (either a market or limit order).

- Confirm the Transaction: Review and confirm your order. Once executed, the shares will be credited to your Demat account.

- Monitor Your Investment: Regularly check your shares and market trends to make informed decisions about holding or selling.

Price Expectations for RVNL Shares Over the Next 5 Years

- 2024: Expect the share price to be around ₹635, supported by strong government contracts and ongoing infrastructure projects.

- 2025: Anticipate an increase, targeting a range of ₹818 as RVNL expands its operational footprint in transportation infrastructure.

- 2026: Continued growth is projected, with targets of ₹1,105, driven by strategic project developments and increased demand for infrastructure.

- 2027: Share prices are expected to reach around ₹1,307 as RVNL enhances its project portfolio and strengthens its position.

- 2028: Significant progress is expected, with potential prices of ₹1,510 as the company leverages new opportunities in infrastructure development.

- 2029: Further expansion is anticipated, with a target of ₹1,692 as RVNL benefits from continued sector growth.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2024 | ₹635 | ₹650 |

| 2025 | ₹818 | ₹850 |

| 2026 | ₹1,105 | ₹1,150 |

| 2027 | ₹1,307 | ₹1,350 |

| 2028 | ₹1,510 | ₹1,550 |

| 2029 | ₹1,692 | ₹1,730 |

| 2030 | ₹1,885 | ₹1,920 |

Shareholding Pattern of RVNL (As of November 2024)

- Promoters: 70.00% (Unchanged)

- Retail and Others: 18.00%

- Foreign Institutions (FII/FPI): 5.00% (Increased from 4.80%)

- Other Domestic Institutions: 4.00%

- Mutual Funds: 3.00% (Increased from 2.90%)

Pingback: TCS Share Price Target 2025, 2026, 2027 to 2030TCS Share PriceTCS Share Price Target 2025, 2026, 2027 to 2030