Wipro Share Price Target 2025, 2026, 2027 to 2030: We’ll analyze Wipro Limited’s share targets for 2025, 2026, 2027, and 2030. As a global leader in IT services, consulting, and business solutions, Wipro is integral to the digital transformation landscape. With a strong focus on innovation, cloud computing, and artificial intelligence, Wipro is well-positioned for growth as it continues to expand its technology offerings and adapt to evolving industry demands.

Overview of Wipro Limited

What is Wipro Limited?

Wipro Limited is an Indian multinational technology corporation specializing in information technology, consulting, and business process services. Established in 1945, Wipro has grown to become one of India’s leading Big Tech firms, recognized globally for its innovative solutions and digital transformation capabilities. Headquartered in Bengaluru, Wipro operates as a public company, delivering comprehensive IT and business solutions to clients worldwide. Its broad portfolio spans areas such as artificial intelligence, cloud computing, and cybersecurity, making Wipro a significant player in the technology sector.

Key Features of Wipro:

- Business Model: Wipro is an end-to-end IT services provider, offering consulting, technology, and outsourcing services to a global clientele, helping businesses navigate their digital transformations.

- Core Offerings: The company’s core services include IT solutions, cloud services, digital consulting, and cybersecurity, with a focus on innovative technologies to drive efficiency and growth for clients.

- Clientele: Wipro serves a diverse, international client base across industries, including banking, healthcare, and consumer goods.

- Market Position: As one of India’s Big Tech companies with a substantial global footprint, Wipro holds a competitive position in the IT and consulting sector.

| Information | Details |

|---|---|

| Website | www.wipro.com |

| Operator | Wipro Limited |

| Founded | 29 December 1945 |

| Founders | Azim Premji, M.H. Hasham Premji |

| Headquarters | Bengaluru, India |

| Number of Employees | 2,34,000 (2024) |

| Revenue | ₹89,760 crore (US$11 billion, FY24) |

| Share Listing | NSE: WIPRO |

| CEO | Srini Pallia (since 6 April 2024) |

| Subsidiaries | Wipro Digital, Capco, Designit, Appirio, Topcoder |

| Key Focus Areas | IT services, digital consulting, cloud computing, cybersecurity |

Current Market Overview of Wipro Limited Share

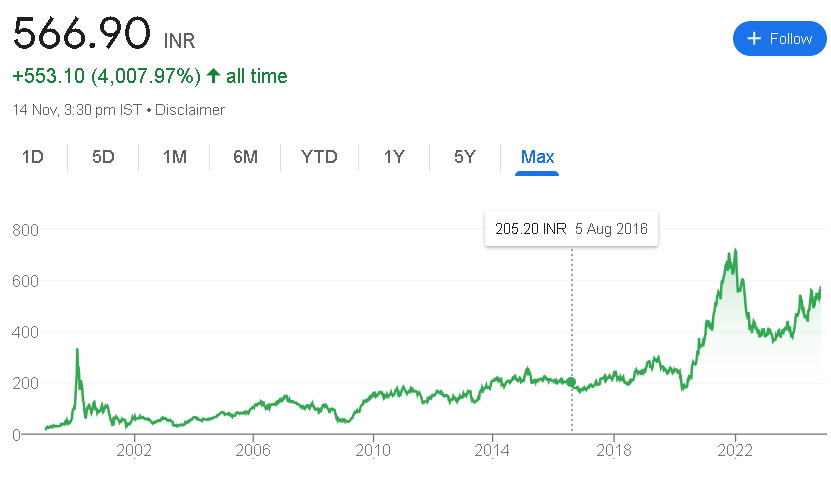

As of November 2024, Wipro’s share shows a strong performance. It is down by -0.37% today and has declined by -0.41% over the past five days. Over the past month, it has gained +3.16%, while it has increased significantly by +24.22% over the past six months. Year-to-date, the share has grown by +18.81%, and over the past year, it has risen by +44.75%. Over the past five years, the share has shown remarkable growth of +124.47%, with an impressive increase of +4,007.97% in all-time performance.

Wipro Limited Share Fundamental Data

- Open: ₹568.95

- High: ₹574.55

- Low: ₹564.20

- Market Cap: ₹2.96 Lakh Crore

- P/E Ratio: 25.29

- Dividend Yield: 0.18%

- 52-Week High: ₹583.20

- 52-Week Low: ₹384.25

The Market Position of Wipro Limited Share as of November 2024

| Time Period | Returns of Wipro |

|---|---|

| Today | -0.37% |

| Past 5 Days | -0.41% |

| Past 1 Month | +3.16% |

| Past 6 Months | +24.22% |

| Year to Date | +18.81% |

| Past 1 Year | +44.75% |

| Past 5 Years | +124.47% |

| All Time | +4,007.97% |

Wipro Share Price Target in 2024, 2025, 2026, 2027, 2028, 2029, 2030

Wipro Share Price Target in 2024

The share price target for Wipro in 2024 is projected to reach ₹600, supported by the company’s strong position in the IT services sector and ongoing investments in digital transformation.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2024 | ₹550 | ₹600 |

Wipro Share Price Target in 2025

In 2025, Wipro’s share price target is expected to rise to ₹680, driven by advancements in cloud services, artificial intelligence, and increased market share in key regions.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | ₹630 | ₹680 |

Wipro Share Price Target in 2026

For 2026, Wipro’s share price target is projected at ₹733, reflecting the company’s focus on enhancing capabilities in cybersecurity and consulting services.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2026 | ₹680 | ₹733 |

Wipro Share Price Target in 2027

The share price target for Wipro in 2027 is anticipated to be ₹773, supported by ongoing digital transformation efforts and expanding services in analytics and automation.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2027 | ₹720 | ₹773 |

Wipro Share Price Target in 2028

In 2028, Wipro’s share price target is estimated at ₹823, driven by the company’s growing role in sustainable IT solutions and innovations in the technology sector.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2028 | ₹770 | ₹823 |

Wipro Share Price Target in 2029

The projected share price target for Wipro in 2029 is ₹872, as the company strengthens its market position through strategic acquisitions and expanded service offerings.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2029 | ₹820 | ₹872 |

Wipro Share Price Target in 2030

The share price target for Wipro in 2030 is expected to reach ₹950, reflecting its position as a leading global technology services provider.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2030 | ₹900 | ₹950 |

Financial Health and Performance Analysis of Wipro (FY 2020 – FY 2024)

FY 2024

| Metric | FY 2024 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹92,391.10 Cr | -0.39% |

| Total Expenses | ₹77,646.80 Cr | -0.43% |

| Profit after Tax (PAT) | ₹11,045.20 Cr | -2.69% |

| Operating Profit Margin | 17.82% | +0.39% |

| Net Profit Margin | 12.30% | -0.24% |

| Basic EPS | ₹20.89 | +0.77% |

FY 2023

| Metric | FY 2023 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹92,753.30 Cr | +13.99% |

| Total Expenses | ₹77,981.90 Cr | +17.73% |

| Profit after Tax (PAT) | ₹11,350.00 Cr | -7.19% |

| Operating Profit Margin | 17.43% | -2.32% |

| Net Profit Margin | 12.54% | -2.87% |

| Basic EPS | ₹20.73 | -7.19% |

FY 2022

| Metric | FY 2022 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹81,373.20 Cr | +26.50% |

| Total Expenses | ₹66,238.10 Cr | +31.33% |

| Profit after Tax (PAT) | ₹12,229.60 Cr | +13.27% |

| Operating Profit Margin | 19.75% | -3.49% |

| Net Profit Margin | 15.41% | -2.02% |

| Basic EPS | ₹22.37 | +13.27% |

FY 2021

| Metric | FY 2021 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹64,325.60 Cr | +0.72% |

| Total Expenses | ₹50,435.70 Cr | -2.28% |

| Profit after Tax (PAT) | ₹10,796.40 Cr | +11.05% |

| Operating Profit Margin | 23.24% | +2.01% |

| Net Profit Margin | 17.43% | +1.53% |

| Basic EPS | ₹19.11 | +11.05% |

FY 2020

| Metric | FY 2020 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹63,862.60 Cr | +3.62% |

| Total Expenses | ₹51,613.60 Cr | +3.05% |

| Profit after Tax (PAT) | ₹9,722.30 Cr | +7.98% |

| Operating Profit Margin | 21.23% | -2.01% |

| Net Profit Margin | 15.90% | -1.53% |

| Basic EPS | ₹16.67 | +7.98% |

Analysis Summary

- Revenue: Wipro’s revenue showed a slight decline of -0.39% in FY 2024 after experiencing strong growth in the preceding years, with a +26.50% increase in FY 2022.

- Profit After Tax (PAT): PAT has decreased by -2.69% in FY 2024, after a smaller decline of -7.19% in FY 2023, following a +13.27% increase in FY 2022.

- Operating Profit Margin: The operating profit margin showed a slight improvement in FY 2024, reaching 17.82%, up from 17.43% in FY 2023, but still below the FY 2022 margin of 19.75%.

- Net Profit Margin: Wipro’s net profit margin has decreased slightly to 12.30% in FY 2024, following a trend of decline from 15.90% in FY 2020 to 12.54% in FY 2023.

- Basic EPS: Basic EPS increased slightly by 0.77% to ₹20.89 in FY 2024, after a decline of -7.19% in FY 2023, continuing the general upward trend from FY 2020.

How to Buy Wipro Shares

- Choose a Broker: Select a reliable brokerage platform that offers Wipro shares.

- Open a Trading Account: Set up a trading and Demat account for executing transactions.

- Complete KYC: Submit identification and address verification documents.

- Deposit Funds: Transfer funds to your trading account.

- Search for Shares: Find Wipro shares on the broker’s platform.

- Place an Order: Specify the quantity and type of order (market or limit).

- Confirm Purchase: Review and finalize your order.

- Monitor Investment: Track performance and make portfolio adjustments as needed.

Wipro Share Price Forecast for the Next 5 Years

Wipro’s share price is poised for steady growth over the next five years, driven by its robust performance in the IT services sector, ongoing investments in digital transformation, and a strategic focus on emerging technologies like artificial intelligence, cloud services, and cybersecurity.

Yearly Share Price Forecast:

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2024 | ₹550 | ₹600 |

| 2025 | ₹630 | ₹680 |

| 2026 | ₹680 | ₹733 |

| 2027 | ₹720 | ₹773 |

| 2028 | ₹770 | ₹823 |

Shareholding Pattern of Wipro

- Promoters:

- Percentage: 72.80%

- % Change QoQ: -0.02%

- Foreign Institutional Investors (FII):

- Percentage: 7.27%

- % Change QoQ: +0.15%

- Domestic Institutional Investors (DII):

- Percentage: 8.70%

- % Change QoQ: +0.46%

- Mutual Funds (MF):

- Percentage: 4.15%

- % Change QoQ: +0.65%

- Others:

- Percentage: 11.23%

- % Change QoQ: -0.59%

Pros and Cons of the Wipro

Pros

- Strong market position with diversified revenue streams, ensuring stability and growth potential.

- Consistent profitability and healthy operating margins, demonstrating operational efficiency.

Cons

- Poor sales growth of 8.75% over the past five years, indicating potential challenges in expanding revenue.

- Low dividend payout at 12.2% of profits over the last three years, which may not appeal to income-focused investors.

Peer Comparison of Wipro: IT – Software Industry (Computers – Software – Large)

| S.No. | Name | CMP Rs. | Market Cap Rs. Cr |

|---|---|---|---|

| 1. | TCS | 4146.15 | 1500583.38 |

| 2. | Infosys | 1866.25 | 774938.21 |

| 3. | HCL Technologies | 1859.35 | 504646.50 |

| 4. | Wipro | 566.00 | 296135.78 |

| 5. | LTIMindtree | 5999.95 | 177568.54 |

| 6. | Tech Mahindra | 1689.10 | 165233.43 |

| 7. | Persistent Sys | 5724.85 | 89012.69 |

Wipro FAQs:

How can I track my Wipro investment?

Investors can track their Wipro shares through their stock broker’s platform or by checking the stock exchange website for real-time updates.

Can I buy Wipro shares online?

Yes, Wipro shares can be purchased online through various stock broking platforms or mobile trading apps.

What is Wipro?

Wipro is an Indian multinational corporation that provides information technology (IT) services, consulting, and business process outsourcing (BPO) solutions.

How to buy Wipro shares?

Wipro shares can be bought through stock brokers or online trading platforms. To purchase shares, investors must open a Demat account with a registered broker.

What products does Wipro offer?

Wipro offers a broad range of IT solutions, including cloud computing, artificial intelligence, cybersecurity, business consulting, and digital transformation services.

Is Wipro a government company?

No, Wipro is a private sector company, listed on major stock exchanges in India.

Pingback: Vedanta Share Price Target 2025, 2026, 2027 to 2030