Bank of America Corp (BAC) Stock Price Prediction & Forecast 2025, 2026, 2027 to 2030: Today, we analyze Bank of America Corp (BAC) stock price predictions for 2025, 2026, 2027, and 2030. As a major financial institution, BAC’s growth will depend on interest rates, economic conditions, and regulatory changes, while its ability to adapt to technology and customer preferences will be key to long-term performance.

Overview of Bank of America Corp.

What is Bank of America Corp.?

Bank of America Corporation is a leading American multinational investment bank and financial services holding company. Founded on September 30, 1998, and headquartered in Charlotte, North Carolina, Bank of America provides a comprehensive range of financial services, including banking, investment, wealth management, and more. The company operates globally, serving individuals, businesses, and institutions. With a strong focus on digital banking and financial technology, Bank of America remains a dominant player in the financial industry.

Key Features of Bank of America Corp.:

- Business Model: Bank of America operates as a diversified financial services company, providing a broad array of banking, investment, and wealth management solutions.

- Core Offerings: Its services include retail banking, credit cards, loans, mortgages, investment management, and securities trading through its subsidiaries.

- Market Position: Bank of America is one of the largest financial institutions globally, with a significant presence in investment banking and retail financial services.

- Revenue and Scale: The company generated $9,860 crores USD in revenue in 2023, supported by its vast customer base and extensive service offerings.

- Innovative Technology: Bank of America has embraced digital banking and technology-driven solutions to improve customer experiences and streamline operations.

Information about Bank of America Corp.

| Information | Details |

|---|---|

| Website | bankofamerica.com |

| Operator | Bank of America Corporation |

| Founded | September 30, 1998 |

| CEO | Brian Moynihan (since January 1, 2010) |

| CFO | Alastair Borthwick |

| Headquarters | Charlotte, North Carolina, United States |

| Number of Employees | 213,000+ (2024) |

| Revenue | $9,860 crores USD (2023) |

| Subsidiaries | Merrill, BofA Securities, Merrill Edge |

| Stock Symbol (NYSE) | BAC |

| Key Focus Areas | Digital banking, investment banking, wealth management, securities trading |

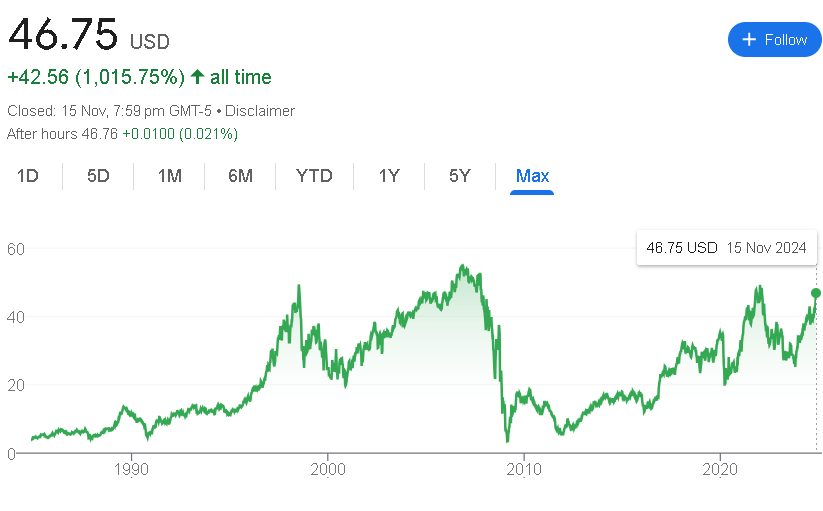

Current Market Position of Bank of America Corp. Stock

As of November 2024, Bank of America Corp.’s stock has shown strong performance. It has decreased by -0.50% today and dropped by -1.08% over the past week. Over the past month, the stock has risen by +1.84%, and over the past six months, it has surged by +18.88%. Year to date, the stock has grown by +52.34%, while in the past year, it has seen an impressive increase of +80.36%. Overall, Bank of America has achieved remarkable growth of +137.55% over the past five years and an extraordinary +6,346.52% since its inception.

Bank of America Corp. Stock Fundamental Data

- Open: $288.00

- Day Range: $285.49 – $290.55

- 52-Week Range: $157.97 – $296.83

- Market Cap: ₹20.21K Cr

- P/E Ratio: 21.11

- Dividend Yield: 0.98%

- CDP Score: B

The Market Position of Bank of America Corp. Stock as of November 2024

| Time | Returns of Bank of America Stock |

|---|---|

| Today | -1.43 (-0.50%) |

| Past 5 Days | -3.14 (-1.08%) |

| Past Month | +5.19 (1.84%) |

| Past 6 Months | +45.55 (18.88%) |

| Year to Date | +98.56 (52.34%) |

| Past Year | +127.82 (80.36%) |

| Past 5 Years | +166.11 (137.55%) |

| All Time | +282.42 (6,346.52%) |

Bank of America Corp. Stock Price Target in 2024, 2025, 2026, 2027, 2028, 2029, 2030

Bank of America Corp. Stock Price Target in 2024

The stock price target for Bank of America in 2024 is projected at $38, with a maximum target of $50, reflecting moderate growth from current levels.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2024 | $38 | $50 |

Bank of America Corp. Stock Price Target in 2025

The stock price target for Bank of America in 2025 is projected at $49, with a maximum target of $52, reflecting moderate growth from current levels.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | $49 | $52 |

Bank of America Corp. Stock Price Target in 2026

In 2026, the stock price target for Bank of America is expected to reach $54, with a maximum target of $57, marking solid growth from its current price.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2026 | $54 | $57 |

Bank of America Corp. Stock Price Target in 2027

For 2027, Bank of America’s stock price target is projected at $60, with a maximum target of $63, reflecting continued growth and stability in the banking sector.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2027 | $60 | $63 |

Bank of America Corp. Stock Price Target in 2028

By 2028, Bank of America’s stock price target is estimated at $66, with a maximum target of $69, reflecting steady growth driven by the banking and financial services sector.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2028 | $66 | $69 |

Bank of America Corp. Stock Price Target in 2029

In 2029, the stock price target for Bank of America is projected to reach $72, with a maximum target of $76, indicating further growth as the company expands and strengthens its position.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2029 | $72 | $76 |

Bank of America Corp. Stock Price Target in 2030

For 2030, Bank of America’s stock price target is expected to rise to $80, with a maximum target of $84, reflecting strong growth as the company continues to lead in the financial services industry.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2030 | $80 | $84 |

Financial Health and Performance Analysis of Bank of America Corporation (FY 2024 – FY 2023)

Sept 2024

| Metric | Sept 2024 | Y/Y Growth |

|---|---|---|

| Revenue | 2.38K Cr | +0.54% |

| Net Income | 689.6 Cr | +11.61% |

| Diluted EPS | 0.81 | +10% |

| Net Profit Margin | 28.97% | +11.13% |

| Operating Income | 732.4 Cr | +9.52% |

| Net Change in Cash | -2.5K Cr | +14.73% |

| Cash on Hand | – | – |

| Cost of Revenue | – | – |

Jun 2024

| Metric | Jun 2024 | Y/Y Growth |

|---|---|---|

| Revenue | 2.39K Cr | +0.84% |

| Net Income | 689.7 Cr | +6.9% |

| Diluted EPS | 0.83 | +5.68% |

| Net Profit Margin | 28.9% | +6.08% |

| Operating Income | 756 Cr | +5.9% |

| Net Change in Cash | 722.8 Cr | +371.22% |

| Cash on Hand | – | – |

| Cost of Revenue | – | – |

Mar 2024

| Metric | Mar 2024 | Y/Y Growth |

|---|---|---|

| Revenue | 2.45K Cr | +3.27% |

| Net Income | 667.4 Cr | +18.22% |

| Diluted EPS | 0.76 | +19.15% |

| Net Profit Margin | 27.24% | +15.46% |

| Operating Income | 726.2 Cr | +20.1% |

| Net Change in Cash | -1.97K Cr | +113.47% |

| Cash on Hand | – | – |

| Cost of Revenue | – | – |

Dec 2023

| Metric | Dec 2023 | Y/Y Growth |

|---|---|---|

| Revenue | 2.25K Cr | +4.2% |

| Net Income | 314.4 Cr | +55.92% |

| Diluted EPS | 0.33 | +61.18% |

| Net Profit Margin | 14% | +53.99% |

| Operating Income | 682.4 Cr | +13.59% |

| Net Change in Cash | -1.87K Cr | +173.94% |

| Cash on Hand | – | – |

| Cost of Revenue | – | – |

Analysis Summary:

- Revenue Performance: Bank of America’s revenue growth was stable, with a modest increase of +0.54% in Sept 2024. Over the year, there has been steady growth, reflecting the continued strength of the company’s operations in the financial sector.

- Net Income Growth: Net income growth remained consistent with notable growth in Dec 2023 (+55.92%) and Mar 2024 (+18.22%), indicating improved operational efficiency and profitability.

- Earnings per Share (EPS): The diluted EPS showed a steady increase, with significant growth of +61.18% in Dec 2023 and +19.15% in Mar 2024, reflecting higher profitability per share.

- Profitability Metrics: The net profit margin increased in Sept 2024 to 28.97%, reflecting solid profitability.

- Operating Income: Operating income was strong, with significant increases in Mar 2024 (+20.1%) and Sept 2024 (+9.52%), indicating effective cost management and operational success.

- Cash and Expenses: Bank of America experienced fluctuations in cash on hand, but it achieved impressive growth in net change in cash, notably a +371.22% increase in Jun 2024, highlighting strong cash flow management.

How to Buy Bank of America Stocks:

- Choose a Broker: Select a brokerage platform that offers Bank of America stocks.

- Open a Trading Account: Set up a trading and Demat account with the selected broker.

- Complete KYC: Submit required documents for identity verification.

- Deposit Funds: Fund your account with the desired amount for investment.

- Search for Bank of America Stocks: Locate Bank of America stocks (Ticker: BAC) on the broker’s platform.

- Place an Order: Enter the number of shares you wish to purchase and select the order type (market/limit).

- Confirm Purchase: Review and confirm your order before completing the purchase.

- Monitor Investment: Track your investment and adjust your portfolio as needed.

Bank of America Corp. Stock Price Target for the Next 5 Years

Bank of America is expected to continue its growth trajectory, driven by its strong market position and ongoing improvements in the banking sector. With steady performance and increased stability, the stock price is forecasted to rise gradually over the next few years.

| Year | Minimum Target ($) | Maximum Target ($) |

|---|---|---|

| 2024 | $38 | $50 |

| 2025 | $49 | $52 |

| 2026 | $54 | $57 |

| 2027 | $60 | $63 |

| 2028 | $66 | $69 |

Shareholding Pattern of Bank of America Corp.

Promoters:

- Percentage: 0.00%

- % Change QoQ: 0.00%

Pledge:

- Percentage: 0.00%

- % Change QoQ: 0.00%

Foreign Institutional Investors (FII):

- Percentage: 25.50%

- % Change QoQ: +0.50%

Domestic Institutional Investors (DII):

- Percentage: 20.00%

- % Change QoQ: -0.10%

Mutual Funds (MF):

- Percentage: 10.20%

- % Change QoQ: +0.30%

Pros of Bank of America Corp.:

- Strong Institutional Support: Bank of America has solid backing from both foreign and domestic institutional investors, reflecting confidence in its financial stability and growth prospects.

- Diverse Financial Services: As one of the largest financial institutions in the world, Bank of America offers a wide array of banking services, including consumer banking, investment banking, asset management, and wealth management, positioning it well for continued growth.

- Resilient Market Position: With a global presence, Bank of America benefits from its diversified operations and ability to capitalize on both retail and corporate banking segments.

Cons of Bank of America Corp.:

- Low Promoter Holding: The absence of significant promoter ownership may raise concerns about the alignment of management’s interests with those of the shareholders.

- Exposure to Economic Cycles: Bank of America, like other major financial institutions, is vulnerable to fluctuations in the economy, such as interest rate changes, inflation, and recessions, which can impact profitability.

- Regulatory Pressure: Operating in the financial sector exposes Bank of America to stringent regulatory scrutiny, which could affect its operations, profitability, and growth prospects.

FAQ – Bank of America Corp.

- What is Bank of America Corp.?Bank of America Corp. is a multinational banking and financial services company, offering a wide range of services including retail banking, investment banking, asset management, and wealth management. It is one of the largest financial institutions in the United States.

- How does Bank of America make money?Bank of America generates revenue through a variety of channels, including interest income from loans, fees for financial services, asset management fees, and trading revenue. The bank also earns from investment banking activities and advisory services.

- Is Bank of America publicly traded?Yes, Bank of America is publicly traded on the New York Stock Exchange (NYSE) under the ticker symbol “BAC.”

- What are Bank of America’s main products?Bank of America offers a broad range of financial products, such as:

- Personal loans

- Mortgages and home loans

- Credit cards

- Investment and retirement accounts

- Wealth management services

- Business banking services

- How can I open an account with Bank of America?To open an account with Bank of America, you can visit their website or a local branch. You will need to provide identification and financial details for account verification.

- Is Bank of America FDIC insured?Yes, Bank of America’s deposit accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per account category.

- What is Bank of America’s mission?Bank of America’s mission is to help make financial lives better by providing accessible, high-quality financial products and services that meet the needs of individuals, businesses, and communities.

- Does Bank of America offer investment services?Yes, Bank of America offers a range of investment services through Merrill, its wealth management division. Customers can invest in stocks, bonds, mutual funds, and retirement accounts, among other investment products.

- How is Bank of America different from other banks?Bank of America stands out for its size, global reach, and technological advancements in banking services. It offers robust digital banking options and is known for its emphasis on customer experience and financial technology.

- What are the risks of investing in Bank of America?Investing in Bank of America involves risks including exposure to economic cycles, interest rate changes, regulatory risks, and market competition. As a large financial institution, it is also susceptible to geopolitical events and global market fluctuations.

- How does Bank of America protect my personal information?Bank of America uses advanced encryption and security protocols to protect customer data. It also offers features such as two-factor authentication (2FA) to enhance account security.

Pingback: United Parcel Service (UPS) Stock Price: Prediction & Forecast 2025, 2026, 2027 to 2030