Aadhar Housing Finance Ltd Share Price Tomorrow Target 2025, 2026, 2027 to 2030: We’ll analyze Aadhar Housing Finance Ltd’s share targets for 2025, 2026, 2027, and 2030. As a leader in affordable housing finance, the company’s strong portfolio, customer focus, and tech-driven efficiency position it for long-term growth.

Overview of Aadhar Housing Finance Ltd

What is Aadhar Housing Finance Ltd?

Aadhar Housing Finance Ltd is a leading housing finance company in India, specializing in affordable home loans for low- and middle-income groups. Established in 2010, the company is headquartered in India and backed by Bcp Topco VII Pte. Ltd. Aadhar Housing Finance aims to make home ownership accessible through innovative financial solutions, customer-centric services, and a strong operational network across the country. The company continues to play a significant role in supporting India’s “Housing for All” initiative.

Key Features of Aadhar Housing Finance Ltd:

- Affordable Housing Focus: Specializes in providing home loans tailored for economically weaker and low-income segments.

- Nationwide Network: Extensive presence across India ensures broad accessibility to its services.

- Customer-Centric Approach: Prioritizes transparent processes and personalized financial solutions to address diverse needs.

- Strong Financial Backing: Owned by Bcp Topco VII Pte. Ltd., ensuring financial stability and strategic growth.

- Digital Innovation: Employs technology to streamline loan applications and improve customer experience.

Information about Aadhar Housing Finance Ltd:

| Information | Details |

|---|---|

| Website | aadharhousing.com |

| CEO | Arvind Hali |

| Founded | 2010 |

| Headquarters | India |

| Number of Employees | 3,931 (2024) |

| Parent Organization | Bcp Topco VII Pte. Ltd. |

| Key Focus Areas | Affordable home loans, housing finance for low- and middle-income groups |

| BSE Symbol | 544176 |

| NSE Symbol | AADHARHFC |

Current Market Position of Aadhar Housing Finance Share

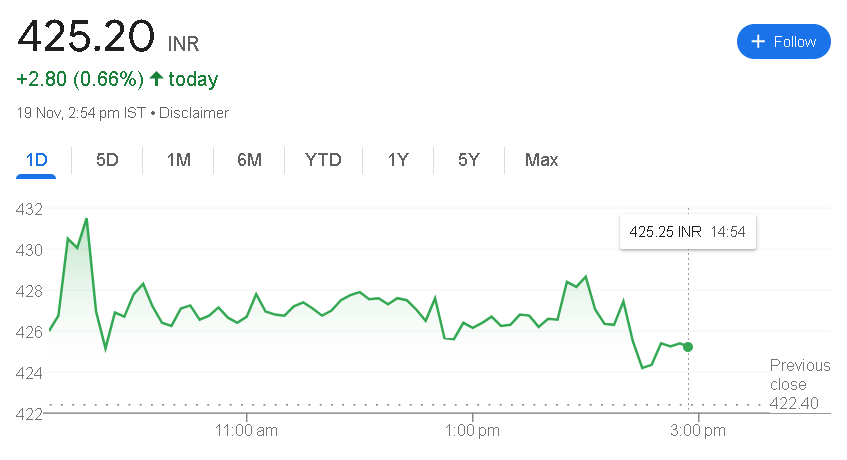

As of November 2024, Aadhar Housing Finance’s share has shown a varied performance. It is up by +0.83% today but has declined by -0.71% over the past week. Over the past month, the share has dropped by -3.0%. In the past three months, it has risen by +8.11%. Data for the past year, three years, and five years is not available, reflecting its relatively recent performance tracking in the market.

Aadhar Housing Finance Share Fundamental Data

- Market Cap: ₹18,277 Cr.

- Current Price: ₹425

- High / Low: ₹517 / ₹292

- Stock P/E: 21.9

- Book Value: ₹137

- Dividend Yield: 0.00%

- ROCE: 11.4%

- ROE: 18.4%

- Face Value: ₹10.0

Market Position of Aadhar Housing Finance Share as of November 2024

| Time Period | Returns of Aadhar Housing Finance Share |

|---|---|

| 1 Day | 0.83% |

| 1 Week | -0.71% |

| 1 Month | -3.0% |

| 3 Months | 8.11% |

| 1 Year | N.A. |

| 3 Years | N.A. |

| 5 Years | N.A. |

Aadhar Housing Finance Share Target for 2024, 2025, 2026, 2027, 2028, 2029, 2030

Aadhar Housing Finance Share Target in 2024

In 2024, the share price target for Aadhar Housing Finance is expected to reach ₹496, supported by its focus on affordable housing finance and growing presence in India’s housing sector.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2024 | ₹450 | ₹490 |

Aadhar Housing Finance Share Target in 2025

For 2025, the share price target for Aadhar Housing Finance is projected to rise to ₹556, reflecting its expanding market reach and steady financial growth.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | ₹500 | ₹560 |

Aadhar Housing Finance Share Target in 2026

In 2026, the share price target for Aadhar Housing Finance is expected to reach ₹623, driven by strong demand for affordable home loans and operational efficiencies.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2026 | ₹570 | ₹620 |

Aadhar Housing Finance Share Target in 2027

By 2027, the share price target for Aadhar Housing Finance is projected to range between ₹620 and ₹690, supported by its continued expansion and innovative financial solutions.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2027 | ₹620 | ₹690 |

Aadhar Housing Finance Share Target in 2028

In 2028, Aadhar Housing Finance’s share price target is expected to reach ₹781, reflecting its sustained growth and strategic focus on technology-driven services.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2028 | ₹700 | ₹780 |

Aadhar Housing Finance Share Target in 2029

For 2029, the share price target for Aadhar Housing Finance is estimated at ₹875, driven by its efforts to strengthen its market position and financial performance.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2029 | ₹800 | ₹880 |

Aadhar Housing Finance Share Target in 2030

By 2030, the share price target for Aadhar Housing Finance is projected to reach ₹1,050, supported by its long-term growth strategies and continued contribution to India’s housing finance sector.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2030 | ₹950 | ₹1,050 |

Financial Health and Performance Analysis of Aadhar Housing Finance (FY 2020 – FY 2024)

FY 2024

| Metric | FY 2024 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹2,586.98 Cr | +26.54% |

| Total Expenses | ₹1,627.39 Cr | +23.04% |

| Profit after Tax (PAT) | ₹749.64 Cr | +37.61% |

| Operating Profit Margin (OPM) | 75.23% | – |

| Net Profit Margin (NPM) | 28.97% | – |

| Basic EPS (₹) | ₹18.99 | +37.61% |

FY 2023

| Metric | FY 2023 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹2,043.52 Cr | +18.23% |

| Total Expenses | ₹1,322.70 Cr | +13.91% |

| Profit after Tax (PAT) | ₹544.76 Cr | +22.46% |

| Operating Profit Margin (OPM) | 74.39% | – |

| Net Profit Margin (NPM) | 26.66% | – |

| Basic EPS (₹) | ₹13.80 | +22.46% |

FY 2022

| Metric | FY 2022 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹1,728.56 Cr | +13.21% |

| Total Expenses | ₹1,161.20 Cr | +1.59% |

| Profit after Tax (PAT) | ₹444.85 Cr | +30.79% |

| Operating Profit Margin (OPM) | 76.87% | – |

| Net Profit Margin (NPM) | 25.73% | – |

| Basic EPS (₹) | ₹11.27 | +30.79% |

FY 2021

| Metric | FY 2021 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹1,575.55 Cr | +12.50% |

| Total Expenses | ₹1,143.04 Cr | -1.25% |

| Profit after Tax (PAT) | ₹340.13 Cr | +79.60% |

| Operating Profit Margin (OPM) | 79.25% | – |

| Net Profit Margin (NPM) | 21.59% | – |

| Basic EPS (₹) | ₹8.62 | +79.60% |

FY 2020

| Metric | FY 2020 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹1,388.46 Cr | +14.13% |

| Total Expenses | ₹1,157.55 Cr | +14.13% |

| Profit after Tax (PAT) | ₹189.38 Cr | +16.63% |

| Operating Profit Margin (OPM) | 73.82% | – |

| Net Profit Margin (NPM) | 13.64% | – |

| Basic EPS (₹) | ₹5.86 | +16.63% |

Analysis Summary:

- Revenue Performance: Aadhar Housing Finance’s total revenue in FY 2024 grew by 26.54%, demonstrating consistent upward growth over the years. This positive growth trend continued from FY 2023, which saw a rise of 18.23%, and reflects the company’s expanding market presence and strong financial foundation.

- Expense Management: Total expenses rose by 23.04% in FY 2024, following a similar increase of 13.91% in FY 2023. While expenses have been rising, the company’s ability to manage them effectively has ensured continued profitability.

- Profitability: Profit after Tax (PAT) saw a significant increase of 37.61% in FY 2024, continuing the positive trajectory of 22.46% growth in FY 2023. This highlights the company’s improved operational efficiency and strong profit generation capabilities.

- Margins: The operating profit margin (OPM) in FY 2024 stood at 75.23%, slightly higher than the previous years, indicating that Aadhar Housing Finance continues to maintain strong operational control. The net profit margin also increased to 28.97%, showcasing strong profitability.

- Earnings Per Share (EPS): Basic EPS rose significantly by 37.61% in FY 2024, reflecting the company’s ability to enhance shareholder value over time.

How to Buy Aadhar Housing Finance Shares:

- Choose a Broker: Select a reliable broker that offers Aadhar Housing Finance shares for trading.

- Open a Trading Account: Create a Demat and trading account with your broker.

- Complete KYC: Provide the necessary documents for identity verification.

- Deposit Funds: Transfer funds to your trading account.

- Search for Aadhar Housing Finance Shares: Locate the shares on your broker’s platform.

- Place an Order: Decide on the number of shares and place a market or limit order.

- Confirm Purchase: Review the details and confirm the transaction.

- Monitor Investment: Regularly track your investment and adjust as needed.

Aadhar Housing Finance Ltd Share Price Target for the Next 5 Years

Aadhar Housing Finance is positioned for continued growth in the housing finance sector, focusing on affordable housing and expanding its market reach. Below are the projected share price targets for Aadhar Housing Finance:

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2024 | ₹450 | ₹490 |

| 2025 | ₹500 | ₹560 |

| 2026 | ₹570 | ₹620 |

| 2027 | ₹620 | ₹690 |

| 2028 | ₹700 | ₹780 |

Shareholding Pattern of Aadhar Housing Finance

Promoters:

- No. of Shares: 3,26,19,1357

- Percentage: 75.89%

- % Change QoQ: -0.59%

Pledge:

- No. of Shares: 0

- Percentage: 0.00%

- % Change QoQ: 0.00%

FII:

- No. of Shares: 1,85,97,552

- Percentage: 4.32%

- % Change QoQ: +0.14%

DII:

- No. of Shares: 3,60,09,745

- Percentage: 8.37%

- % Change QoQ: +0.96%

MF:

- No. of Shares: 2,51,05,871

- Percentage: 5.84%

- % Change QoQ: +0.83%

Others:

- No. of Shares: 4,90,45,861

- Percentage: 11.41%

- % Change QoQ: -0.51%

Pros and Cons of Aadhar Housing Finance

Pros:

- Strong Promoter Ownership: With 75.89% of shares held by promoters, the company maintains significant control and alignment in its strategic decisions.

- No Pledge: There is no pledged shareholding, meaning the promoters’ stake is not vulnerable to market risks or financial challenges.

- Growing Institutional Support: Domestic Institutional Investors (DII) hold 8.37% of the shares, providing a stable foundation for the company.

Cons:

- Declining Promoter Stake: The promoter’s stake decreased by 0.59% QoQ, indicating a slight reduction in their holding.

- Low FII Stake: Foreign Institutional Investors hold just 4.32% of shares, which could limit international interest in the company.

- Market Sensitivity: The performance of Aadhar Housing Finance is still sensitive to market fluctuations and regulatory changes, particularly within the housing sector.

Peer Competitors of Aadhar Housing Finance in the Housing Finance Industry

| Name | Share Price (₹) | Market Cap (₹ Cr) |

|---|---|---|

| Bajaj Housing | 128.10 | 106,683.58 |

| H U D C O | 209.15 | 41,869.69 |

| LIC Housing Finance | 618.05 | 33,996.61 |

| PNB Housing | 872.00 | 22,658.34 |

| Aadhar Housing Finance | 425.20 | 18,276.93 |

| Aptus Value Housing | 314.70 | 15,726.92 |

FAQ)

1. What is Aadhar Housing Finance?

Aadhar Housing Finance is a leading housing finance company that focuses on providing home loans to individuals in India. It primarily targets the affordable housing sector, offering financing options for lower-income groups and rural areas.

2. What is the current share price of Aadhar Housing Finance?

The current share price of Aadhar Housing Finance is ₹425.20.

3. What is the market capitalization of Aadhar Housing Finance?

Aadhar Housing Finance has a market capitalization of ₹18,276.93 Crores.

4. What are the main competitors of Aadhar Housing Finance?

Some of the main competitors in the housing finance sector include:

- Bajaj Housing

- H U D C O

- LIC Housing Finance

- PNB Housing

- Aptus Value Housing

5. Does Aadhar Housing Finance offer home loans to rural areas?

Yes, Aadhar Housing Finance is committed to providing home loans in both urban and rural areas, with a particular focus on affordable housing for the lower-income segment.

6. What is Aadhar Housing Finance’s current P/E ratio?

Aadhar Housing Finance’s current P/E ratio is 21.93.

7. How has Aadhar Housing Finance performed in terms of profits?

Aadhar Housing Finance has shown steady growth in profits, with a quarterly profit variation of 15.31%.

8. Is Aadhar Housing Finance listed on the stock market?

Yes, Aadhar Housing Finance is listed on major stock exchanges in India and is part of indices such as the Nifty 500 and BSE SmallCap.

9. What is the dividend yield of Aadhar Housing Finance?

Aadhar Housing Finance currently has a dividend yield of 0.00%.

10. Can I invest in Aadhar Housing Finance through mutual funds?

Yes, investors can invest in Aadhar Housing Finance through mutual funds that include housing finance companies in their portfolios.

Pingback: Aptus Value Housing Finance India Ltd Share Price Tomorrow Target 2024, 2025 to 2030