P N Gadgil Jewellers Share Price Target 2024, 2025 to 2030 – Comprehensive Analysis: This article delves into P N Gadgil Jewellers’ share target for 2024-2030, providing insights into its market performance, share trends, financial health, shareholding structure, and competitive positioning. P N Gadgil Jewellers is a prominent name in India’s jewellery sector, celebrated for its exquisite gold, silver, and diamond jewellery collections, rich legacy, and expanding retail presence.

Overview of P N Gadgil Jewellers Limited

What is P N Gadgil Jewellers Limited?

P N Gadgil Jewellers Limited, also known as Purshottam Narayan Gadgil Jewellers, is one of India’s oldest and most prestigious jewellery companies. Founded in 1832 by Ganesh Gadgil in Sangli, Maharashtra, the company is renowned for its exquisite jewellery designs inspired by the cultural heritage of the Maharashtra region. With a legacy spanning over 190 years, P N Gadgil Jewellers has established itself as a trusted name in the jewellery industry, offering a diverse range of gold, diamond, and silver jewellery to cater to various customer preferences and occasions.

Key Features of P N Gadgil Jewellers Limited

- Rich Legacy: Established in 1832, the company has over 190 years of expertise in crafting fine jewellery.

- Extensive Market Reach: Known for jewellery styles distinct to the Maharashtra region, reflecting cultural craftsmanship.

- Subsidiary Presence: Operates PNG Jewelers Inc, expanding its brand globally.

- Financial Stability: Trades on both BSE and NSE, attracting strong investor confidence.

- Employee Strength: Employs 1,418 individuals as of 2024, showcasing its significant workforce and operational scale.

Information about P N Gadgil Jewellers Limited

| Information | Details |

|---|---|

| Website | pngadgil.com |

| Headquarters | India |

| Founded | 29 November 1832, Sangli |

| Founder | Ganesh Gadgil |

| Managing Director & CEO | Saurabh Vidyadhar Gadgil |

| Number of Employees | 1,418 (2024) |

| Subsidiary | PNG Jewelers Inc |

| BSE Symbol | 544256 |

| NSE Symbol | PNGJL |

Current Market Overview of P N Gadgil Jewellers Limited Share

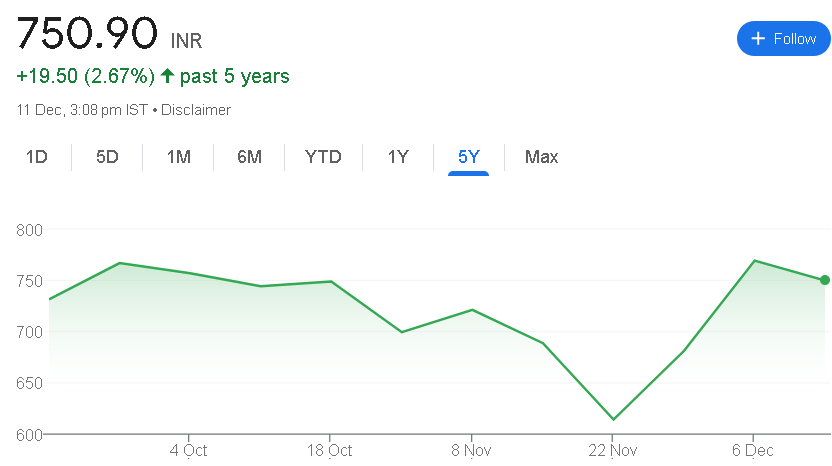

As of December 2024, P N Gadgil Jewellers Limited’s share is up by +1.57% today and has seen a marginal decline of -0.11% over the past week. It has gained +4.85% in the last month. Data for the past three months, one year, three years, and five years is currently unavailable, reflecting the need for a longer observation period for comprehensive trend analysis.

P N Gadgil Jewellers Limited Share Fundamental Data

- Market Cap: ₹10,230 Cr.

- Current Price: ₹752

- High / Low: ₹848 / ₹611

- Stock P/E: 66.4

- Book Value: ₹105

- Dividend Yield: 0.00%

- ROCE: 30.8%

- ROE: 32.4%

- Face Value: ₹10.0

Market Position of P N Gadgil Jewellers Limited Share as of December 2024

| Time Period | Returns of P N Gadgil Jewellers Share |

|---|---|

| 1 Day | 1.57% |

| 1 Week | -0.11% |

| 1 Month | 4.85% |

| 3 Months | N.A. |

| 1 Year | N.A. |

| 3 Years | N.A. |

| 5 Years | N.A. |

P N Gadgil Jewellers Limited Share Target for 2024, 2025, 2026, 2027, 2028, 2029, 2030

P N Gadgil Jewellers Limited Share Target in 2024

In 2024, the share target for P N Gadgil Jewellers Limited is expected to be ₹890, reflecting growth driven by the company’s heritage and market demand for its jewellery products.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2024 | ₹850 | ₹890 |

P N Gadgil Jewellers Limited Share Target in 2025

For 2025, P N Gadgil Jewellers’ share target is projected to range between ₹940 and ₹980, supported by expansion efforts and sustained market trends.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | ₹940 | ₹980 |

P N Gadgil Jewellers Limited Share Target in 2026

In 2026, the share target for P N Gadgil Jewellers is estimated to range between ₹1,200 and ₹1,250, driven by operational efficiency and positive market conditions.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2026 | ₹1,200 | ₹1,250 |

P N Gadgil Jewellers Limited Share Target in 2027

By 2027, P N Gadgil Jewellers’ share target is projected to be ₹1,500 and ₹1,548, supported by sustained growth and investor confidence.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2027 | ₹1,500 | ₹1,548 |

P N Gadgil Jewellers Limited Share Target in 2028

In 2028, the share target for P N Gadgil Jewellers is expected to range between ₹1,850 and ₹1,895, reflecting continued market optimism and growth.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2028 | ₹1,850 | ₹1,895 |

P N Gadgil Jewellers Limited Share Target in 2029

For 2029, P N Gadgil Jewellers’ share target is projected to reach ₹2,250 and ₹2,286, driven by favourable market dynamics and strategic initiatives.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2029 | ₹2,250 | ₹2,286 |

P N Gadgil Jewellers Limited Share Target in 2030

By 2030, the share target for P N Gadgil Jewellers is estimated to range between ₹2,650 and ₹2,679, supported by long-term growth potential and innovative business strategies.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2030 | ₹2,650 | ₹2,679 |

Financial Health and Performance Analysis of P N Gadgil Jewellers Limited (FY 2022 – FY 2023)

P N Gadgil Jewellers Limited Financials: Revenue (FY 2022 – FY 2023)

| Year | Total Revenue (₹ Cr) | Total Revenue Growth (%) |

|---|---|---|

| FY 2023 | ₹4,559.31 | 76.29% |

| FY 2022 | ₹2,586.31 | 33.01% |

P N Gadgil Jewellers Limited Financials: Assets (FY 2022 – FY 2023)

| Year | Total Assets (₹ Cr) | Total Assets Growth (%) |

|---|---|---|

| FY 2023 | ₹1,062.55 | -4.30% |

| FY 2022 | ₹1,110.24 | 9.47% |

P N Gadgil Jewellers Limited Financials: Cash Flow (FY 2022 – FY 2023)

| Year | Net Cash Flow (₹ Cr) |

|---|---|

| FY 2023 | ₹5.18 |

| FY 2022 | ₹5.40 |

P N Gadgil Jewellers Limited Financials: Key Ratios (FY 2022 – FY 2023)

| Year | Return on Equity (%) | Return on Capital Employed (%) | Return on Assets (%) |

|---|---|---|---|

| FY 2023 | 23.90% | 29.72% | 6.99% |

| FY 2022 | 23.37% | 29.91% | 5.18% |

Analysis Summary

- Revenue Growth: P N Gadgil Jewellers showed a strong revenue increase of 76.29% in FY 2023, following a 33.01% growth in FY 2022. This demonstrates robust growth in sales and demand for its products during the two-year period.

- Asset Growth: The total assets of the company declined by -4.30% in FY 2023, after a growth of 9.47% in FY 2022. The decrease in assets highlights a potential issue in asset management or reduction in investments in growth initiatives.

- Cash Flow: Cash flow remained relatively stable, with a slight decline in FY 2023 to ₹5.18 Cr from ₹5.40 Cr in FY 2022. Despite the small reduction, the company continues to generate positive cash flow, indicating healthy financial operations.

- Profitability Ratios:

- Return on Equity (ROE): P N Gadgil Jewellers maintained strong profitability with a ROE of 23.90% in FY 2023, slightly improving from 23.37% in FY 2022. This indicates good returns for shareholders.

- Return on Capital Employed (ROCE): ROCE remained stable, with a minor decrease from 29.91% in FY 2022 to 29.72% in FY 2023, reflecting consistent capital efficiency.

- Return on Assets (ROA): ROA improved to 6.99% in FY 2023, up from 5.18% in FY 2022, signaling better utilization of assets to generate profits.

How to Buy PNG Jewellers Shares

- Choose a Broker: Select a reliable brokerage platform like Zerodha, Upstox, Angel One, ICICI Direct, or HDFC Securities that allows access to PNG Jewellers shares.

- Open a Trading Account: Open a Demat and trading account with your chosen broker using platforms such as Kite (Zerodha), Upstox Pro, or Angel Broking app.

- Complete KYC: Submit the required documents for Know Your Customer (KYC) verification, including proof of identity, address, and PAN card.

- Deposit Funds: Transfer the necessary funds into your trading account to proceed with the purchase of shares.

- Search for the Company Shares: Locate PNG Jewellers shares by searching for its name or ticker symbol.

- Place an Order: Choose the number of shares you wish to buy and place either a market or limit order, according to your preference.

- Confirm Purchase: Carefully review the order details and confirm the transaction to successfully complete the purchase.

P N Gadgil Jewellers Limited Share Price Target for the Next 5 Years

P N Gadgil Jewellers is expected to experience consistent growth over the next few years, driven by its heritage, expansion efforts, and strong market demand for its jewellery products. Below are the share price targets for the next five years:

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2024 | ₹850 | ₹890 |

| 2025 | ₹940 | ₹980 |

| 2026 | ₹1,200 | ₹1,250 |

| 2027 | ₹1,500 | ₹1,548 |

| 2028 | ₹1,850 | ₹1,895 |

Shareholding Pattern of P N Gadgil Jewellers Limited

Promoters:

- No. of Shares: 11,27,91,917

- Percentage: 83.11%

- % Change QoQ: –

Pledge:

- No. of Shares: 0

- Percentage: 0.00%

- % Change QoQ: –

FII (Foreign Institutional Investors):

- No. of Shares: 51,51,449

- Percentage: 3.80%

- % Change QoQ: –

DII (Domestic Institutional Investors):

- No. of Shares: 77,64,702

- Percentage: 5.73%

- % Change QoQ: –

MF (Mutual Funds):

- No. of Shares: 64,15,442

- Percentage: 4.73%

- % Change QoQ: –

Others:

- No. of Shares: 1,00,00,265

- Percentage: 7.35%

- % Change QoQ: –

Pros and Cons of P N Gadgil Jewellers Limited

Pros:

- Strong brand heritage and customer loyalty.

- Wide range of jewellery catering to various tastes.

- Expanding market presence with more outlets.

- Focus on high-quality craftsmanship.

Cons:

- High dependence on the Indian market.

- Vulnerability to price fluctuations in precious metals.

- Intense competition from both organized and local players.

- Limited global presence.

- Exposure to regulatory changes affecting the jewellery sector.

Peer Comparison of P N Gadgil Jewellers Limited in the Diamond, Gems, and Jewellery Sector

| S.No. | Name | Share Price (₹) | Market Cap (₹ Cr) |

|---|---|---|---|

| 1. | Titan Company | 3469.00 | 308101.88 |

| 2. | Kalyan Jewellers | 763.65 | 78790.91 |

| 3. | P N Gadgil Jewellers | 752.45 | 10230.23 |

| 4. | PC Jeweller | 179.00 | 9732.09 |

| 5. | Senco Gold | 1153.65 | 8964.08 |

| 6. | Rajesh Exports | 240.25 | 7085.08 |

| 7. | Sky Gold | 4500.00 | 6644.21 |