Aptus Value Housing Finance India Ltd Share Price Tomorrow Target 2024, 2025, 2026, 2027 to 2030: We’ll analyze Aptus Value Housing Finance India Ltd’s share targets for 2025, 2026, 2027, and 2030. As a prominent player in the affordable housing finance sector, the company’s robust growth strategy, solid financial foundation, and increasing market penetration provide a positive outlook for long-term performance.

Overview of Aptus Value Housing Finance India Ltd

What is Aptus Value Housing Finance India Ltd?

Aptus Value Housing Finance India Ltd is a leading housing finance company in India, specializing in providing affordable home loans to the low- and middle-income segments. Established in 2009, the company is headquartered in India and operates with a strong emphasis on serving underserved customer bases with accessible financial products. Aptus Value Housing Finance is committed to empowering homeownership through customer-centric services, a wide operational reach, and the efficient use of technology to enhance the customer experience.

Key Features of Aptus Value Housing Finance India Ltd:

- Affordable Housing Focus: Specializes in offering home loans to low- and middle-income groups, ensuring affordability and accessibility.

- Nationwide Network: Extensive presence across India, enabling easy access to its services and products.

- Customer-Centric Approach: Focuses on delivering personalized financial solutions, with transparency and customer satisfaction as key priorities.

- Financial Stability: Backed by strong management and strategic planning, ensuring continued growth and sustainability.

- Technological Innovation: Utilizes digital solutions to simplify loan processes and improve user experiences.

Information about Aptus Value Housing Finance India Ltd:

| Information | Details |

|---|---|

| Website | aptusindia.com |

| CEO | Not listed |

| Founded | 2009 |

| Headquarters | India |

| Number of Employees | 2,918 (2024) |

| Subsidiary | Aptus Finance India Private Limited |

| Key Focus Areas | Affordable housing loans, financial services for low- and middle-income groups |

| BSE Symbol | 543335 |

| NSE Symbol | APTUS |

Current Market Position of Aptus Value Housing Finance Share

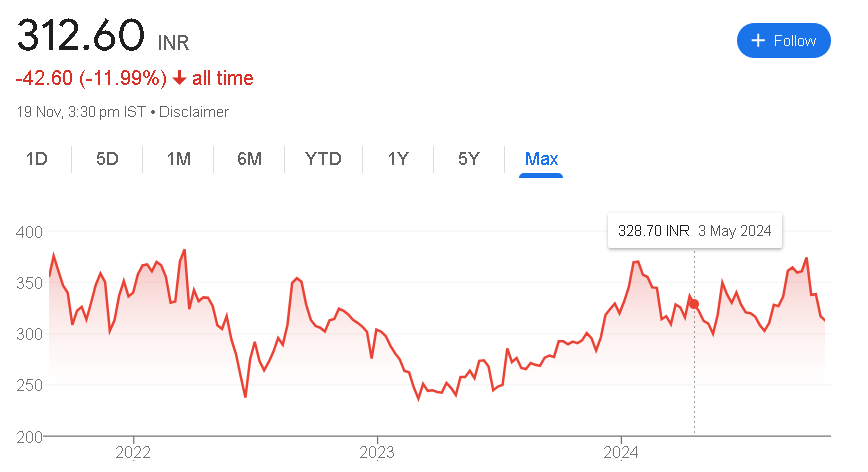

As of November 2024, Aptus Value Housing Finance’s share has shown a mixed performance. It is down by -0.72% today and has dropped by -4.2% over the past week. Over the past month, the share has declined by -16.18%. In the past three months, it has risen by +2.89%. Over the past year, the share has increased by +6.14%. However, data for the past three years and five years indicates a decline of -10.4%, with no available data for the five-year performance, reflecting its fluctuating market performance.

Aptus Value Housing Finance Share Fundamental Data

- Market Cap: ₹15,639 Cr.

- Current Price: ₹313

- High / Low: ₹402 / ₹281

- Stock P/E: 23.2

- Book Value: ₹80.3

- Dividend Yield: 1.40%

- ROCE: 14.7%

- ROE: 17.2%

- Face Value: ₹2.00

Market Position of Aptus Value Housing Finance Share as of November 2024

| Time Period | Returns of Aptus Value Housing Finance Share |

|---|---|

| 1 Day | -0.72% |

| 1 Week | -4.2% |

| 1 Month | -16.18% |

| 3 Months | 2.89% |

| 1 Year | 6.14% |

| 3 Years | -10.4% |

| 5 Years | N.A. |

Aptus Value Housing Finance Share Target for 2024, 2025, 2026, 2027, 2028, 2029, 2030

Aptus Value Housing Finance Share Price Target in 2024

In 2024, the share price target for Aptus Value Housing Finance is expected to reach ₹340, supported by its steady performance in the affordable housing finance sector and expanding presence across India.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2024 | ₹320 | ₹340 |

Aptus Value Housing Finance Share Price Target in 2025

For 2025, the share price target for Aptus Value Housing Finance is projected to rise to ₹380, reflecting its growing market penetration and continued financial stability.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | ₹350 | ₹380 |

Aptus Value Housing Finance Share Price Target in 2026

In 2026, the share price target for Aptus Value Housing Finance is expected to reach ₹420, driven by increased demand for affordable housing loans and improved operational efficiencies.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2026 | ₹390 | ₹420 |

Aptus Value Housing Finance Share Price Target in 2027

By 2027, the share price target for Aptus Value Housing Finance is projected to range between ₹460 and ₹490, supported by its continued growth in the affordable housing market and technological advancements.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2027 | ₹460 | ₹490 |

Aptus Value Housing Finance Share Price Target in 2028

In 2028, Aptus Value Housing Finance’s share price target is expected to reach ₹540, reflecting sustained growth, financial strength, and strategic market positioning.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2028 | ₹510 | ₹540 |

Aptus Value Housing Finance Share Price Target in 2029

For 2029, the share price target for Aptus Value Housing Finance is estimated at ₹580, driven by its efforts to strengthen market dominance and enhance operational efficiency.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2029 | ₹550 | ₹580 |

Aptus Value Housing Finance Share Price Target in 2030

By 2030, the share price target for Aptus Value Housing Finance is projected to reach ₹620, supported by long-term growth strategies and its continued contribution to India’s affordable housing sector.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2030 | ₹590 | ₹620 |

Financial Health and Performance Analysis of Aptus Value Housing Finance (FY 2020 – FY 2024)

FY 2024

| Metric | FY 2024 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹1,416.84 Cr | +25.50% |

| Total Expenses | ₹623.69 Cr | +31.23% |

| Profit after Tax (PAT) | ₹611.90 Cr | +21.65% |

| Operating Profit Margin (OPM) | 86.50% | – |

| Net Profit Margin (NPM) | 44.82% | – |

| Basic EPS (₹) | ₹12.27 | +21.65% |

FY 2023

| Metric | FY 2023 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹1,129.00 Cr | +34.37% |

| Total Expenses | ₹475.28 Cr | +31.95% |

| Profit after Tax (PAT) | ₹503.01 Cr | +35.90% |

| Operating Profit Margin (OPM) | 85.02% | – |

| Net Profit Margin (NPM) | 46.00% | – |

| Basic EPS (₹) | ₹10.11 | +35.90% |

FY 2022

| Metric | FY 2022 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹840.22 Cr | +28.23% |

| Total Expenses | ₹360.20 Cr | +16.14% |

| Profit after Tax (PAT) | ₹370.14 Cr | +38.66% |

| Operating Profit Margin (OPM) | 84.52% | – |

| Net Profit Margin (NPM) | 45.43% | – |

| Basic EPS (₹) | ₹7.58 | +38.66% |

FY 2021

| Metric | FY 2021 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹655.24 Cr | +25.11% |

| Total Expenses | ₹310.15 Cr | +12.20% |

| Profit after Tax (PAT) | ₹266.94 Cr | +26.51% |

| Operating Profit Margin (OPM) | 86.64% | – |

| Net Profit Margin (NPM) | 41.93% | – |

| Basic EPS (₹) | ₹5.56 | +26.51% |

FY 2020

| Metric | FY 2020 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹523.72 Cr | +55.35% |

| Total Expenses | ₹276.43 Cr | +49.90% |

| Profit after Tax (PAT) | ₹211.01 Cr | +89.28% |

| Operating Profit Margin (OPM) | 86.31% | – |

| Net Profit Margin (NPM) | 42.17% | – |

| Basic EPS (₹) | ₹4.77 | +89.28% |

Analysis Summary:

- Revenue Growth: Aptus Value Housing Finance saw a 25.50% increase in total revenue for FY 2024, reflecting strong market growth, although slightly lower than the 34.37% growth in FY 2023.

- Expense Management: Total expenses grew by 31.23% in FY 2024, slightly outpacing revenue growth, but the company managed costs effectively, maintaining profitability.

- Profitability: Profit after Tax (PAT) increased by 21.65% in FY 2024, continuing the positive trend, though at a slower rate compared to previous years.

- Margins: Operating Profit Margin remained strong at 86.50%, and Net Profit Margin stood at 44.82%, indicating efficient operations and robust profitability.

- Earnings Per Share (EPS): Basic EPS rose by 21.65% to ₹12.27, demonstrating continued value creation for shareholders.

How to Buy Aptus Value Housing Finance Shares:

- Choose a Broker: Select a broker that provides access to Aptus Value Housing Finance shares for trading.

- Open a Trading Account: Open a Demat and trading account with your chosen broker.

- Complete KYC: Submit the necessary documents for identity verification.

- Deposit Funds: Transfer the required funds to your trading account.

- Search for Aptus Value Housing Finance Shares: Look up the shares using their ticker or name.

- Place an Order: Decide the number of shares and place a market or limit order.

- Confirm Purchase: Review the details and confirm your transaction.

Aptus Value Housing Finance Ltd Share Price Target for the Next 5 Years

Aptus Value Housing Finance is expected to experience steady growth in the housing finance sector, particularly in the affordable housing segment, with continued market expansion. Below are the projected share price targets for Aptus Value Housing Finance:

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2024 | ₹320 | ₹340 |

| 2025 | ₹350 | ₹380 |

| 2026 | ₹390 | ₹420 |

| 2027 | ₹460 | ₹490 |

| 2028 | ₹510 | ₹540 |

Shareholding Pattern of Aptus Value Housing Finance

Promoters:

- No. of Shares: 2,69,19,0879

- Percentage: 53.91%

- % Change QoQ: -0.17%

Pledge:

- No. of Shares: 0

- Percentage: 0.00%

- % Change QoQ: 0.00%

FII:

- No. of Shares: 1,12,13,0035

- Percentage: 22.45%

- % Change QoQ: -0.35%

DII:

- No. of Shares: 47,28,45,557

- Percentage: 9.47%

- % Change QoQ: +0.33%

MF:

- No. of Shares: 41,82,63,332

- Percentage: 8.38%

- % Change QoQ: +0.24%

Others:

- No. of Shares: 70,73,79,905

- Percentage: 14.17%

- % Change QoQ: +0.20%

Pros and Cons of Aptus Value Housing Finance

Pros:

- Strong Promoter Ownership: Promoters hold 53.91% of the shares, ensuring a solid base of control and alignment in strategic decisions.

- No Pledge: There is no pledged shareholding, reducing risk for the promoters and enhancing financial stability.

- Growing Domestic Institutional Support: Domestic institutional investors (DII) have increased their stake by 0.33%, indicating a stable base of institutional confidence.

Cons:

- Declining FII Stake: Foreign Institutional Investors hold 22.45% of shares, but their stake has decreased by 0.35% QoQ, which could indicate reduced international interest.

- Moderate Ownership by Others: With 14.17% in the hands of other shareholders, there is still a significant portion of the company held by external investors, which could affect control in the long term.

Peer Competitors of Aptus Value Housing Finance in the Housing Finance Industry

| Name | Share Price (₹) | Market Cap (₹ Cr) |

|---|---|---|

| Bajaj Housing | 127.00 | 1,05,767.51 |

| H U D C O | 206.85 | 41,409.23 |

| LIC Housing Finance | 612.00 | 33,663.84 |

| PNB Housing | 856.40 | 22,252.99 |

| Aadhar Housing Finance | 418.00 | 17,967.44 |

| Aptus Value Housing | 312.95 | 15,639.47 |

(FAQ)

1. What is the role of housing finance companies?

Housing finance companies (HFCs) provide loans for the purchase, construction, or renovation of residential properties. They play a significant role in making homeownership accessible by offering financial products that cater to various income groups.

2. What are the key factors influencing the share price of housing finance companies?

The share price of housing finance companies is influenced by factors such as interest rates, demand for housing loans, economic conditions, government policies, and the financial performance of the company, including its profitability and loan book growth.

3. What does the term ‘Market Capitalization’ mean?

Market capitalization (market cap) refers to the total market value of a company’s outstanding shares. It is calculated by multiplying the share price by the total number of shares. It provides a quick estimate of a company’s overall financial strength and size.

4. Why is P/E (Price-to-Earnings) ratio important for investors?

The P/E ratio is a common valuation metric that compares a company’s share price to its earnings per share (EPS). It helps investors determine if a stock is overvalued or undervalued relative to its earnings potential.

5. How does the financial health of a housing finance company affect its stock price?

A strong financial performance, including stable revenue growth, low non-performing loans (NPLs), and robust profit margins, often leads to an increase in stock price. On the other hand, weak financial health can lead to stock price declines due to concerns over the company’s future prospects.

6. What does the “Quarterly Profit Variation” signify?

Quarterly Profit Variation shows the percentage change in profit from one quarter to the next. A higher percentage indicates that the company has shown growth, while a negative percentage suggests a decline in profitability.

7. What is the significance of ‘Div Yld %’ (Dividend Yield)?

Dividend Yield represents the percentage of a company’s share price that is paid out in the form of dividends. It provides investors with an idea of the income they can expect to receive from owning the company’s shares.

8. How can investors assess the performance of a housing finance company?

Investors can assess the performance of a housing finance company by looking at its key financial metrics such as revenue growth, profit margins, loan disbursement growth, asset quality (NPLs), and return on capital employed (ROCE). Comparing these metrics with industry peers can provide additional insights.

9. What are the benefits of investing in housing finance companies?

Investing in housing finance companies offers benefits such as stable growth in the long term, driven by the growing demand for affordable housing. Many companies in this sector also pay regular dividends, providing a steady stream of income for investors.

10. How can I buy shares of housing finance companies?

To buy shares, you need to open a trading account with a broker. Once your account is set up, you can place orders to buy shares of housing finance companies through the broker’s platform or app. Always consider researching the company’s financials and prospects before making an investment decision.

Pingback: SML Isuzu Ltd Share Price Tomorrow Target 2024, 2025 to 2030