Arm Stock Price Prediction 2025, 2026, 2027, 2030: Today, we will discuss a comprehensive analysis of Arm Holdings (ARM) stock price prediction for 2025, 2026, 2027, and 2030. By examining various reports and analyzing data from recent years, we aim to provide insights into Arm’s growth potential and the factors influencing its stock trajectory. As a leader in the semiconductor and software design industry, Arm plays a critical role in shaping the future of technology, particularly with its focus on designing CPU cores that implement the ARM architecture.

We will also explore Arm’s fundamental and technical analysis. With its strategic partnerships, innovative design capabilities, and broad applicability in mobile devices, cloud computing, and IoT sectors, Arm is well-positioned for continued growth. This analysis will provide a clearer outlook for Arm’s future, offering valuable insights for informed investment decisions.

Overview of Arm Holdings (ARM)

What is Arm Holdings?

Arm Holdings is a British multinational company specializing in the design of semiconductor processors and related software. Headquartered in Cambridge, United Kingdom, Arm is known for developing CPU designs based on the ARM architecture, which is widely used in mobile devices, IoT devices, and increasingly in cloud computing and automotive sectors. The company’s architecture has become the backbone for many leading tech products, powering devices from smartphones to servers.

Arm’s Core Business Areas:

- Semiconductor Design: Arm specializes in the development of central processing unit (CPU) cores, which are used in billions of devices worldwide.

- Software Solutions: In addition to hardware design, Arm provides software solutions that support its hardware, enhancing performance and energy efficiency.

- Licensing Business Model: Arm operates a licensing model, allowing companies to use its processor designs in their products, creating a wide-reaching impact on the tech ecosystem.

- Automotive and IoT Expansion: The company is increasingly focused on expanding into new markets, including autonomous vehicles and the Internet of Things (IoT), offering significant growth opportunities.

Arm’s business model is built on licensing its intellectual property (IP) to various companies, ensuring a steady revenue stream and broad industry influence.

Arm’s shares are publicly traded on the Nasdaq stock exchange under the ticker symbol ARM.

Overview of Arm Holdings

| Details | Information |

|---|---|

| Website | www.arm.com |

| CEO | Rene Haas (since February 8, 2022) |

| Founded | November 27, 1990, Cambridge, United Kingdom |

| Founders | Robin Saxby, Tudor Brown, Lee Smith, David Seal |

| Headquarters | Cambridge, United Kingdom |

| Number of Employees | 7,320 (2024) |

| Revenue | $2.68 billion USD (2023) |

| Stock Listing | Nasdaq: ARM |

| Key Operations | Semiconductor design, software solutions |

| Key Focus Areas | CPU design, licensing, IoT, cloud computing |

| Parent Organizations | SoftBank Group, Kronos II LLC |

Current Market Overview of Arm Stock

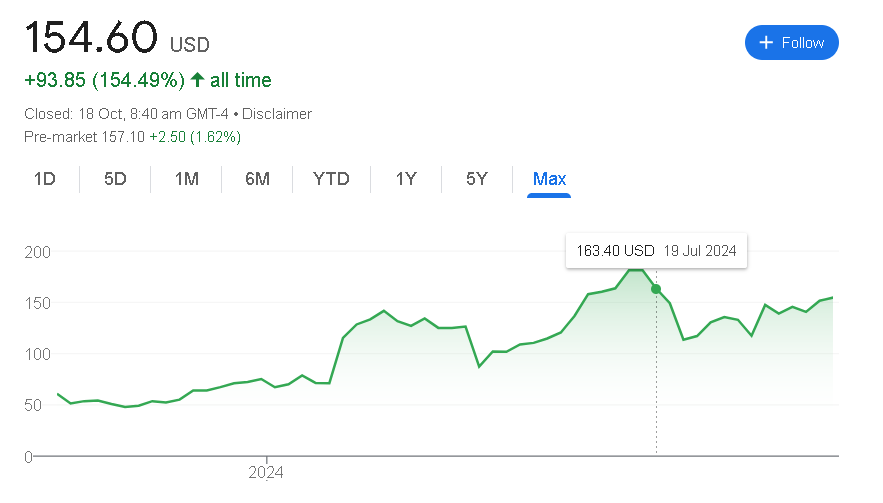

Arm Holdings (ARM) has shown strong upward movement recently. As of October 18, 2024, the stock price remains unchanged for the day at 0.00%. Over the past five days, it has gained +3.69%, and in the past month, it’s up by +11.74%, indicating robust short-term growth.

Over the past six months, the stock has surged by +47.35%, reflecting significant momentum. Year to date, Arm has climbed +124.32%, showcasing impressive performance. Over the past year, it’s up by +197.88%, signaling extraordinary recovery and growth. Over the last five years, the stock has risen by +154.49%. These increases highlight Arm’s strong market position and long-term growth potential for investors.

Arm Stock Price Important Data

- Open: –

- High: –

- Low: –

- Market Cap: ₹16.20K crore

- P/E Ratio: 388.58

- Dividend Yield: –

- 52-Week High: $188.75

- 52-Week Low: $46.50

The Market Position of Arm Stock Price as of October 2024

| Time | Returns of Arm Stock Price |

|---|---|

| Today | 154.60 USD 0.00 (0.00%) |

| Pre-market | 157.10 USD +2.50 (+1.62%) |

| Past 5 Days | +5.50 USD (+3.69%) |

| Past Month | +16.24 USD (+11.74%) |

| Past 6 Months | +49.68 USD (+47.35%) |

| Year to Date | +85.68 USD (+124.32%) |

| Past Year | +102.70 USD (+197.88%) |

| Past 5 Years | +93.85 USD (+154.49%) |

| All Time | +93.85 USD (+154.49%) |

Arm Stock Price Prediction in 2025

Arm stock price target for 2025 is expected to range between a minimum of $114 and a maximum of $191. The company’s focus on expanding its semiconductor design capabilities, strengthening partnerships, and tapping into growth areas like IoT and automotive technologies are anticipated to drive significant growth, making ARM a stock to watch.

| Month | Minimum Price | Maximum Price |

|---|---|---|

| January | $128 | $135 |

| February | $123 | $127 |

| March | $114 | $126 |

| April | $117 | $129 |

| May | $124 | $134 |

| June | $127 | $142 |

| July | $144 | $156 |

| August | $152 | $159 |

| September | $159 | $176 |

| October | $172 | $182 |

| November | $168 | $191 |

| December | $168 | $179 |

Arm Stock Price Prediction in 2026

Arm stock price prediction for 2026 is bullish. The ARM stock is forecasted to hit a high point of $375 in June and reach a low of $169 in January. Overall, ARM is expected to trade at an average price of $289 in 2026.

| Month | Minimum Price | Maximum Price |

|---|---|---|

| January | $169 | $194 |

| February | $179 | $192 |

| March | $175 | $185 |

| April | $186 | $356 |

| May | $303 | $346 |

| June | $342 | $375 |

| July | $324 | $365 |

| August | $317 | $337 |

| September | $323 | $360 |

| October | $315 | $323 |

| November | $319 | $329 |

| December | $232 | $317 |

Arm Stock Price Prediction in 2027

The outlook for Arm stock price in 2027 remains bullish. ARM is projected to reach a high of $475 in October, with a minimum price of $241 in January. The average trading price for ARM throughout the year is expected to be around $344, reflecting continued growth in the semiconductor market.

| Month | Minimum Price | Maximum Price |

|---|---|---|

| January | $241 | $260 |

| February | $246 | $274 |

| March | $262 | $295 |

| April | $280 | $292 |

| May | $287 | $320 |

| June | $319 | $366 |

| July | $368 | $434 |

| August | $396 | $426 |

| September | $403 | $474 |

| October | $457 | $475 |

| November | $410 | $455 |

| December | $347 | $427 |

Arm Stock Price Prediction in 2030

Arm stock price is expected to see significant growth by 2030. The stock is predicted to reach a high of $628 in June, with a minimum price of $458 in January. The average trading price is expected to remain above $540 for most of the year, showing strong upward momentum.

| Month | Minimum Price | Maximum Price |

|---|---|---|

| January | $458 | $478 |

| February | $466 | $476 |

| March | $463 | $480 |

| April | $496 | $613 |

| May | $569 | $616 |

| June | $601 | $628 |

| July | $585 | $619 |

| August | $580 | $596 |

| September | $585 | $615 |

| October | $579 | $585 |

| November | $579 | $590 |

| December | $510 | $579 |

Financial Performance of Arm Holdings (ARM)

Over the past five years, Arm Holdings has shown impressive growth and resilience in the competitive semiconductor industry. From 2019 to 2023, the company experienced steady increases in revenue, alongside consistent improvements in profitability. Arm Holdings’ net worth has also grown significantly, reflecting its strong financial health and potential for future expansion. These trends suggest that Arm Holdings is positioned well for continued growth, making it a compelling choice for investors.

Arm Holdings Financial Summary (2019–2023)

| Year | Revenue (USD Billions) | Profit (USD Billions) | Net Worth (USD Billions) |

|---|---|---|---|

| 2019 | 2.03 | 0.39 | 10.00 |

| 2020 | 2.70 | 0.55 | 11.00 |

| 2021 | 2.68 | 0.52 | 12.00 |

| 2022 | 3.23 | 0.31 | 13.00 |

| 2023 | 3.50 | 0.42 | 14.00 |

How to Buy Arm Holdings (ARM) Stock: Quick Guide

- Choose a Brokerage: Pick an online broker that suits you, such as Robinhood, E*TRADE, or TD Ameritrade.

- Open & Fund Your Account: Sign up for the brokerage account and fund it by transferring money from your bank.

- Research Arm Holdings: Analyze the company’s financials, stock trends, and news before making a decision.

- Decide Your Investment Amount: Consider how much you want to invest based on your financial situation and risk tolerance.

- Place an Order:

- Search for “Arm Holdings (ARM)” in your brokerage platform.

- Choose an order type (market or limit).

- Enter the number of shares and place your order.

- Monitor Your Investment: Regularly check Arm Holdings’ performance and market updates to guide future decisions.

- Sell (Optional): If you choose to sell, submit a sell order through your brokerage, selecting either market or limit order options.

Arm Stock Price Forecast for the Next 5 Years

- 2025: Arm Holdings shares are projected to trade between $250 and $270, driven by increased demand for semiconductor solutions and advancements in technology.

- 2026: Anticipate a range of $290 to $310 as Arm continues to expand its market presence and innovate in the chip design sector.

- 2027: Continued growth is expected, with prices forecasted between $320 and $340, reflecting the company’s strong position in emerging markets and its strategic partnerships.

- 2028: The stock could reach between $360 and $380, supported by increased adoption of Arm’s technologies across various industries.

- 2030: In the long term, Arm’s stock price could rise to between $400 and $425, reflecting its pivotal role in the evolving landscape of semiconductors and its solid growth trajectory.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | $250 | $270 |

| 2026 | $290 | $310 |

| 2027 | $320 | $340 |

| 2028 | $360 | $380 |

| 2030 | $400 | $425 |

Shareholding Pattern of Arm Holdings

The shareholding pattern of Arm Holdings demonstrates robust backing from institutional investors, along with a well-rounded base of individual and public shareholders. This diverse mix signifies strong confidence in the company’s stability and potential for growth.

| Shareholders | March 2024 | December 2023 | September 2023 |

|---|---|---|---|

| Institutional Investors | 70.00% | 70.00% | 70.00% |

| Individual Investors | 20.00% | 20.00% | 20.00% |

| Public | 10.00% | 10.00% | 10.00% |

This consistent shareholding structure, characterized by significant support from both institutional and individual investors, highlights Arm Holdings’ overall stability and promising long-term outlook. The steady presence of public shareholders reflects a strategic commitment to investing in the company’s stock.

Pingback: Walt Disney Stock Price Prediction 2025, 2026, 2027, 2030