Coal India Ltd Share Price Tomorrow Target 2024, 2025 to 2030: We’ll analyze Coal India Ltd’s share targets for tomorrow, 2024, 2025, 2026, 2027, and 2030. As one of the largest coal-producing companies globally, Coal India Ltd plays a pivotal role in meeting India’s energy demands. Its strategic focus on increasing production capacity, enhancing operational efficiency, and transitioning toward sustainable practices positions the company for steady growth and long-term resilience in the energy sector.

Overview of Coal India Limited

What is Coal India Limited?

Coal India Limited (CIL) is a premier public sector undertaking and the largest government-owned coal producer in the world. Established in November 1975, the company plays a vital role in meeting India’s energy needs by accounting for approximately 82% of the country’s total coal production. Headquartered in Kolkata, Coal India operates under the administrative control of the Ministry of Coal, Government of India. With a vast workforce and extensive subsidiary network, CIL is a cornerstone of India’s energy infrastructure.

Key Features of Coal India Limited:

- Dominant Market Position: Produces over 80% of India’s coal, serving as a critical energy provider for industries and households.

- Extensive Subsidiary Network: Includes Eastern Coalfields, Central Coalfields, and other units for streamlined operations.

- Government Backing: Operates as a public sector undertaking with strategic importance to India’s energy policies.

- Operational Scale: Employs over 2,28,861 personnel and generates substantial revenue, exceeding ₹1.5 lakh crores (US$19 billion) in 2024.

- Commitment to Sustainability: Focuses on improving efficiency and transitioning toward environmentally friendly mining practices.

Information about Coal India Limited:

| Information | Details |

|---|---|

| Website | coalindia.in |

| Headquarters | Kolkata |

| Founded | November 1975 |

| Founder | Government of India |

| Managing Director & CEO | Pramod Agrawal |

| Number of Employees | 2,28,861 (2024) |

| Revenue | ₹1.5 lakh crores INR (US$19 billion, 2024) |

| Parent Organization | Ministry of Coal, Government of India |

| Subsidiaries | Eastern Coalfields, Central Coalfields |

| BSE Symbol | 533278 |

| NSE Symbol | COALINDIA |

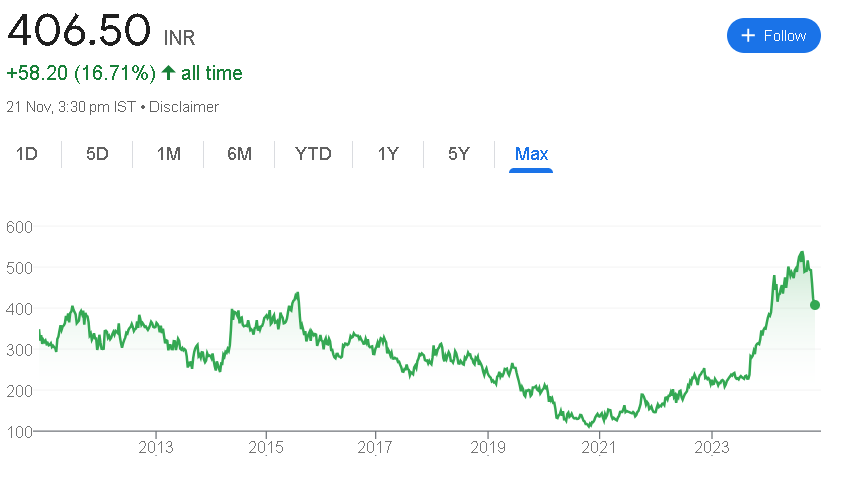

Current Market Position of Coal India Share

As of November 2024, Coal India’s share has experienced varied performance trends. It is down by -1.52% today and -16.36% over the past month, with a slight dip of -0.92% this week. Over the past three months, it has declined by -23.71%. However, the share has gained +21.48% over the year and demonstrated significant long-term growth with +164.67% in three years and +106.51% in five years.

Coal India Share Fundamental Data

- Market Cap: ₹2,50,330 Cr.

- Current Price: ₹406

- High / Low: ₹545 / ₹330

- Stock P/E: 6.95

- Book Value: ₹156

- Dividend Yield: 6.28%

- ROCE: 63.6%

- ROE: 52.0%

- Face Value: ₹10.0

Market Position of Coal India Share as of November 2024

| Time Period | Returns of Coal India Share |

|---|---|

| 1 Day | -1.52% |

| 1 Week | -0.92% |

| 1 Month | -16.36% |

| 3 Months | -23.71% |

| 1 Year | 21.48% |

| 3 Years | 164.67% |

| 5 Years | 106.51% |

Coal India Ltd Share Price Target for 2024, 2025, 2026, 2027, 2028, 2029, 2030

Coal India Share Target in 2024

In 2024, the share target for Coal India is expected to range between ₹480 and ₹590, reflecting steady growth driven by its dominant position in the coal industry and efficient operations.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2024 | ₹480 | ₹590 |

Coal India Share Target in 2025

For 2025, Coal India’s share target is projected to range between ₹590 and ₹700, supported by increased coal production and strong financial performance.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | ₹590 | ₹700 |

Coal India Share Target in 2026

In 2026, the share target for Coal India is expected to range between ₹740 and ₹850, driven by sustained demand for coal and improvements in operational efficiency.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2026 | ₹740 | ₹850 |

Coal India Share Target in 2027

By 2027, Coal India’s share target is projected to range between ₹890 and ₹1,000, reflecting its strong market positioning and long-term growth potential.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2027 | ₹890 | ₹1,000 |

Coal India Share Target in 2028

In 2028, Coal India’s share target is estimated to range between ₹1,115 and ₹1,225, reflecting sustained growth and increased profitability.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2028 | ₹1,115 | ₹1,225 |

Coal India Share Target in 2029

For 2029, the share target for Coal India is expected to range between ₹1,290 and ₹1,400, driven by continued operational improvements and a focus on sustainable practices.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2029 | ₹1,290 | ₹1,400 |

Coal India Share Target in 2030

By 2030, Coal India’s share target is projected to range between ₹1,600 and ₹1,710, supported by its strategic initiatives and long-term growth in the energy sector.

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2030 | ₹1,600 | ₹1,710 |

Financial Health and Performance Analysis of Coal India Ltd. (FY 2020 – FY 2024)

FY 2024

| Metric | FY 2024 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹1,50,293.06 Cr | +3.79% |

| Total Expenses | ₹1,01,907.28 Cr | -4.58% |

| Profit after Tax (PAT) | ₹37,402.29 Cr | +32.80% |

| Operating Profit Margin (OPM) | 34.57% | – |

| Net Profit Margin (NPM) | 26.27% | – |

| Basic EPS (₹) | ₹60.69 | +32.80% |

FY 2023

| Metric | FY 2023 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹1,44,802.57 Cr | +27.45% |

| Total Expenses | ₹1,06,793.62 Cr | +18.67% |

| Profit after Tax (PAT) | ₹28,165.19 Cr | +62.26% |

| Operating Profit Margin (OPM) | 27.98% | – |

| Net Profit Margin (NPM) | 20.37% | – |

| Basic EPS (₹) | ₹45.70 | +62.26% |

FY 2022

| Metric | FY 2022 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹1,13,618.02 Cr | +21.10% |

| Total Expenses | ₹89,993.15 Cr | +18.71% |

| Profit after Tax (PAT) | ₹17,358.10 Cr | +36.68% |

| Operating Profit Margin (OPM) | 22.02% | – |

| Net Profit Margin (NPM) | 15.82% | – |

| Basic EPS (₹) | ₹28.17 | +36.68% |

FY 2021

| Metric | FY 2021 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹93,818.39 Cr | -8.19% |

| Total Expenses | ₹75,806.18 Cr | -2.95% |

| Profit after Tax (PAT) | ₹12,699.89 Cr | -24.02% |

| Operating Profit Margin (OPM) | 20.72% | – |

| Net Profit Margin (NPM) | 14.10% | – |

| Basic EPS (₹) | ₹20.61 | -24.02% |

FY 2020

| Metric | FY 2020 | Y/Y Growth |

|---|---|---|

| Total Revenue | ₹1,02,185.74 Cr | -3.07% |

| Total Expenses | ₹78,113.25 Cr | -0.23% |

| Profit after Tax (PAT) | ₹16,714.19 Cr | -4.28% |

| Operating Profit Margin (OPM) | 25.57% | – |

| Net Profit Margin (NPM) | 17.39% | – |

| Basic EPS (₹) | ₹27.12 | -4.28% |

Analysis Summary:

- Revenue Growth: Coal India achieved moderate revenue growth of +3.79% in FY 2024, building on a strong growth momentum from previous years.

- Expense Management: Total expenses declined by -4.58% in FY 2024, reflecting improved cost control.

- Profitability: Profit after Tax (PAT) surged by +32.80% in FY 2024, showcasing consistent improvement in profitability.

- Margins: Operating Profit Margin (OPM) rose to 34.57%, and the Net Profit Margin (NPM) improved to 26.27%, reflecting strong operational efficiency.

- Earnings Per Share (EPS): Basic EPS increased significantly by +32.80% to ₹60.69, indicating solid returns for shareholders.

How to Buy Coal India Ltd. Shares:

- Choose a Broker: Select a brokerage platform offering Coal India shares for trading.

- Open a Trading Account: Set up a Demat and trading account with the selected broker.

- Complete KYC: Submit necessary identity and address verification documents.

- Deposit Funds: Add funds to your trading account for share purchases.

- Search for Coal India Shares: Locate the shares using their name or ticker symbol.

- Place an Order: Choose the desired quantity and place a market or limit order.

- Confirm Purchase: Verify transaction details and confirm your order.

Coal India Share Price Target for the Next 5 Years

Coal India is poised for steady growth, supported by its dominant position in the coal sector, efficient operations, and increasing demand. Below are the projected share price targets for Coal India:

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2024 | ₹480 | ₹590 |

| 2025 | ₹590 | ₹700 |

| 2026 | ₹740 | ₹850 |

| 2027 | ₹890 | ₹1,000 |

| 2028 | ₹1,115 | ₹1,225 |

Shareholding Pattern of Coal India

Promoters:

- No. of Shares: 3,89,07,35,938

- Percentage: 63.13%

- % Change QoQ: 0.00%

Pledge:

- No. of Shares: 0

- Percentage: 0.00%

- % Change QoQ: 0.00%

FII:

- No. of Shares: 56,47,41,134

- Percentage: 9.16%

- % Change QoQ: +0.76%

DII:

- No. of Shares: 1,38,61,13,143

- Percentage: 22.49%

- % Change QoQ: -0.60%

MF:

- No. of Shares: 64,93,00,543

- Percentage: 10.54%

- % Change QoQ: -0.20%

Others:

- No. of Shares: 32,11,38,112

- Percentage: 5.21%

- % Change QoQ: -0.16%

Pros and Cons of Coal India

Pros:

- Strong Promoter Ownership: Promoters hold 63.13% of the shares, ensuring strong control and alignment in the company’s strategic decisions.

- No Pledge: There is no pledged shareholding, which reduces financial risk and indicates financial stability.

- FII Stake Increase: Foreign Institutional Investors (FIIs) hold 9.16% of the shares, with a 0.76% increase, showing growing confidence from international investors.

Cons:

- High DII Stake but Decrease: Domestic Institutional Investors hold 22.49%, but their stake has decreased by 0.60%, suggesting some decline in institutional confidence.

- Moderate MF Ownership: Mutual Funds hold 10.54% of shares, with a slight reduction of 0.20%, indicating a less significant institutional presence.

- Low Other Shareholding: 5.21% of shares are held by other shareholders, which could limit control over long-term decision-making and strategy.

Peer Competitors of Coal India in the Mining Industry

| Name | Share Price (₹) | Market Cap (₹ Cr) |

|---|---|---|

| Coal India | 406.15 | 250,329.57 |

| Vedanta | 442.55 | 173,171.34 |

| NMDC | 217.65 | 63,804.82 |

| Lloyds Metals | 910.90 | 47,585.29 |

| KIOCL | 349.15 | 21,243.03 |

| G M D C | 321.95 | 10,241.07 |

(FAQs)

1. What is the current share price of Coal India Ltd.?

- The current share price of Coal India Ltd. is ₹406.15.

2. What is the market capitalization of Coal India Ltd.?

- Coal India Ltd. has a market capitalization of ₹250,329.57 Cr.

3. What is the revenue growth of Coal India Ltd. in FY 2024?

- The revenue growth of Coal India Ltd. in FY 2024 is 3.79%.

4. What is the profit after tax (PAT) growth of Coal India Ltd. in FY 2024?

- Coal India Ltd. has reported a PAT growth of 32.80% in FY 2024.

5. What is the operating profit margin (OPM) of Coal India Ltd. in FY 2024?

- The operating profit margin (OPM) of Coal India Ltd. in FY 2024 is 34.57%.

6. What is the net profit margin (NPM) of Coal India Ltd. in FY 2024?

- Coal India Ltd. reported a net profit margin (NPM) of 26.27% in FY 2024.

7. What is the basic EPS of Coal India Ltd. in FY 2024?

- The basic earnings per share (EPS) of Coal India Ltd. in FY 2024 is ₹60.69.

8. What is the shareholding pattern of Coal India Ltd.?

- Promoters: 63.13% (No change QoQ)

- Pledge: 0%

- Foreign Institutional Investors (FII): 9.16% (+0.76% QoQ)

- Domestic Institutional Investors (DII): 22.49% (-0.60% QoQ)

- Mutual Funds (MF): 10.54% (-0.20% QoQ)

- Others: 5.21% (-0.16% QoQ)

9. What are the projected share price targets for Coal India Ltd. in 2024 and beyond?

- 2024: ₹480 to ₹590

- 2025: ₹590 to ₹700

- 2026: ₹740 to ₹850

- 2027: ₹890 to ₹1,000

- 2028: ₹1,115 to ₹1,225

10. What are the key competitors of Coal India Ltd.?

- Vedanta: ₹442.55 share price, ₹173,171.34 Cr market cap

- NMDC: ₹217.65 share price, ₹63,804.82 Cr market cap

- Lloyds Metals: ₹910.90 share price, ₹47,585.29 Cr market cap

- KIOCL: ₹349.15 share price, ₹21,243.03 Cr market cap

- G M D C: ₹321.95 share price, ₹10,241.07 Cr market cap

11. How to purchase shares of Coal India Ltd.?

- Choose a Broker: Select a broker that allows access to Coal India shares.

- Open a Trading Account: Open a Demat and trading account with your chosen broker.

- Complete KYC: Submit the necessary documents for verification.

- Deposit Funds: Transfer funds to your trading account.

- Search for Coal India Shares: Look for the shares by name or ticker symbol.

- Place an Order: Choose the number of shares and type of order (market/limit).

- Confirm the Purchase: Review your order and confirm the transaction.

12. What is the future outlook for Coal India Ltd.?

- Coal India Ltd. is expected to maintain steady growth, driven by its strong market position and increasing demand for coal. Strategic initiatives aimed at improving operational efficiency and profitability will also contribute to the company’s long-term performance.

Pingback: Gold Price in Ludhiana Today: Rates for 22nd November 2024 ( 18k, 22K and 24K)

Pingback: MRF Ltd Share Price Target 2024, 2025 to 2030, Performance and More Details

Pingback: Variman Global Share Price Target 2024, 2025 to 2030, Performance & Key Insights