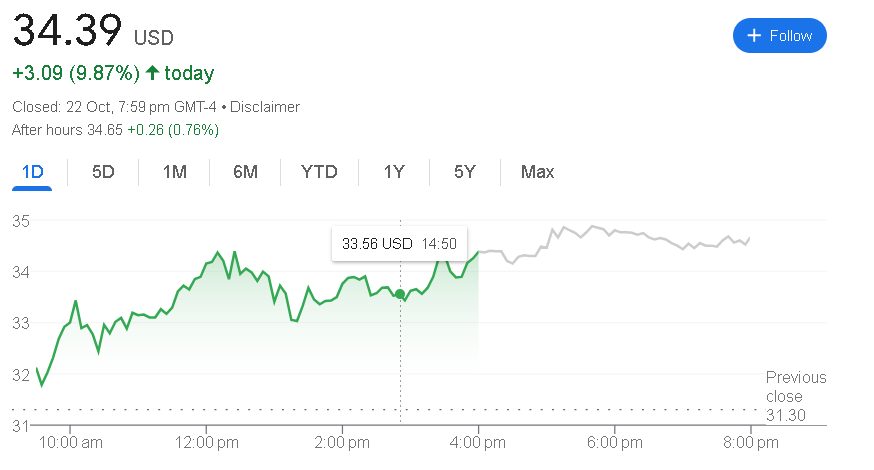

Trump Media & Technology Group Corp. (DJT), the parent company behind Truth Social, saw its stock soar by nearly 10% today, closing at $34.39, with after-hours trading pushing it even higher to $34.65. The surge in DJT’s stock price has caught the attention of investors and market analysts alike, prompting many to wonder: what’s behind this rally? In this article, we’ll provide an in-depth analysis of the factors influencing DJT’s price movement, its financial performance, and the broader market sentiment.

Overview of Trump Media & Technology Group Corp. (DJT)

Founded on February 8, 2021, by former U.S. President Donald Trump and Andy Dean, Trump Media & Technology Group (TMTG) is an American media and technology company based in Sarasota, Florida. The company operates Truth Social, a social media platform intended as an alternative to major platforms, particularly for conservative voices. Despite being a relatively new player in the media and tech space, TMTG has managed to maintain a significant presence, largely due to Trump’s influence and the loyal following he commands.

- Founded: February 8, 2021

- Founders: Donald Trump, Andy Dean

- Headquarters: Sarasota, Florida

- Number of Employees: 36 (as of 2023)

- Revenue: $413,000 (2023)

Though still in its infancy, DJT has been making waves in both the tech and political spheres, attracting investors who are betting on its long-term success. Today’s 10% surge is a reflection of investor confidence, but what are the specific drivers of this price movement?

Market Overview of DJT Stock

DJT’s stock price opened at $31.30 today and quickly gained momentum, hitting a high of $34.50 before closing at $34.39. In after-hours trading, the stock edged slightly higher, settling at $34.65, a 0.76% gain. This marks a significant jump in a single day, prompting questions about the underlying catalysts.

Key Market Data for DJT Stock:

- Current Price: $34.39

- Day Change: +$3.09 (9.87%)

- After-Hours Price: $34.65 (+0.76%)

- 5-Day Performance: +15.45%

- 1-Month Performance: +25.68%

- Year-to-Date (YTD): +37.12%

- 1-Year Performance: +45.89%

Over the past year, DJT’s stock has experienced consistent upward growth, fueled by growing user engagement on Truth Social and anticipation of future expansion plans. The 10% gain today reflects a mix of factors, from market speculation to broader industry trends.

Factors Driving Today’s Rally

Several elements have contributed to today’s surge in DJT stock price:

1. Market Anticipation of New Developments

The media and technology sector is often driven by speculation, and DJT is no exception. Rumors of upcoming product launches or strategic partnerships have sparked interest in the company’s future growth. Investors are eagerly waiting for new announcements that could push DJT further into the tech and social media mainstream.

2. Political Influence and Sentiment

Donald Trump remains a polarizing figure in U.S. politics, and his influence extends to DJT’s stock price. With Trump expected to be a major political player in the 2024 U.S. elections, many investors are betting on his continued relevance. Any increase in his public activity or news surrounding his political ambitions often impacts the stock. Today’s rally may be partially driven by Trump’s recent public appearances and speculation about his potential 2024 presidential run.

3. Strong User Engagement on Truth Social

Truth Social, TMTG’s flagship product, has been steadily growing its user base. While it lags behind major social media platforms in terms of size, it has carved out a dedicated audience. Strong user engagement and increasing downloads of the Truth Social app have positively impacted investor sentiment. The platform’s ability to sustain its audience amid competition from larger players is critical to DJT’s long-term success.

4. Broader Tech Sector Rally

Today’s market surge wasn’t limited to DJT alone. The broader tech sector saw significant gains, with major indices like the NASDAQ up for the day. Tech stocks tend to move in tandem, and DJT benefited from the general positive momentum in the market. Optimism surrounding the sector, particularly in light of potential regulatory changes, has created a favorable environment for companies like TMTG.

5. Short Squeeze and Investor Speculation

Like many small-cap stocks, DJT is vulnerable to short squeezes. Speculation about a potential short squeeze in DJT stock has been circulating among traders. As short-sellers rush to cover their positions, the stock price is driven higher, creating a feedback loop of buying pressure. Today’s rally could be partially attributed to this phenomenon, as short-term traders capitalize on the momentum.

DJT Stock Technical Analysis

DJT’s stock is currently trading near key resistance levels, indicating a potential test of its upper price limits. Investors are closely monitoring these levels to determine if the stock will break out or retrace some of its recent gains.

Key Technical Indicators:

- Relative Strength Index (RSI): 70 (Overbought)

- Moving Average Convergence Divergence (MACD): +1.42 (Bullish momentum)

- Key Resistance Levels: $35.00, $36.50

- Key Support Levels: $32.00, $30.50

The RSI suggests that the stock is approaching overbought territory, a sign that the current rally may be losing steam in the short term. However, the bullish MACD indicates that momentum remains in favor of further upside potential.

Investor Sentiment and Market Perception

Investor sentiment around DJT stock is a mix of optimism and caution. The 10% gain today has sparked renewed interest, especially among retail investors who view the company’s association with Trump as a significant advantage. On the other hand, some analysts remain skeptical about DJT’s long-term prospects, citing challenges in scaling Truth Social to compete with larger platforms.

The current rally reflects a positive market perception of TMTG’s future growth, but it is important to note that volatility remains a key concern for investors. As a relatively new company with a limited revenue base, DJT is subject to rapid price swings, driven largely by speculation rather than fundamental factors.

Financial Performance of DJT

Despite the excitement surrounding DJT’s stock price, its financial performance remains modest. For the fiscal year 2023, TMTG reported a revenue of just $413,000, a relatively small figure compared to larger tech companies. However, the company’s low revenue is expected to grow as Truth Social gains traction and TMTG expands its business lines.

Key Financial Metrics for DJT:

- Revenue (2023): $413,000

- Number of Employees: 36 (2023)

- Profitability: Still in early growth stage

- Key Operations: Social media, digital content distribution

Future Outlook for DJT Stock

The future outlook for DJT stock is uncertain. On one hand, the company’s association with Donald Trump and its growing user base on Truth Social provide a unique market position. On the other hand, the company faces significant challenges in terms of competition, scalability, and regulatory risks.

In the coming months, investors will be watching for:

- Growth in Truth Social’s user base

- Announcements of new products or partnerships

- Political developments involving Donald Trump

- Overall market conditions in the tech sector

In conclusion, DJT’s 10% rally today reflects a mix of market speculation, political sentiment, and optimism surrounding the company’s future. However, investors should remain cautious, as the stock is highly volatile and influenced by external factors.

Pingback: Suzlon Energy Share Price: Drop 15% Over the Past Month