Hello friends, today we will discuss you comprehensive analysis of Gensol Engineering share price target for 2025, 2026, 2027 and 2030. We will examine various reports and analyze data from the past few years to provide insights into the company’s growth potential in the coming years. Gensol Engineering offers 16 advisory and operational services for solar projects, expanding its operations both in India and internationally.

We will also focus on the company’s fundamental and technical analysis. If Gensol continues its growth trajectory, it has the potential to become a multibagger stock in the future. If you’re interested in a complete analysis of the company, this article will provide you with all the necessary information.

Overview of Gensol Engineering Ltd

Gensol Engineering was founded in 2010 by Pranay Gupta and currently serves as the Managing Director of the company. Its headquarters is located in Ahmedabad, Gujarat. The company specializes in providing advisory and operational services for solar energy projects, playing a significant role in India’s renewable energy sector.

Gensol Engineering operates in multiple states across India and has expanded its reach internationally. In the last fiscal year, the company reported a profit of ₹50 crore, showcasing a steady growth trajectory amidst the increasing demand for sustainable energy solutions.

Overview of Gensol Engineering Ltd Based on the Provided Data:

| Overview of Gensol Engineering Ltd | Details |

|---|---|

| Website | www.gensol.in |

| CEO | Pranay Gupta (since inception) |

| Founded | 2010 |

| Founders | Pranay Gupta |

| Headquarters | Ahmedabad, Gujarat, India |

| Number of Employees | 500 (as of 2024) |

| Revenue | ₹50 crores INR (US$6 million, 2024) |

| Stock Listing | NSE: GENSOL |

| Key Operations | Solar advisory and operational services |

| Key Focus Areas | Renewable energy solutions, solar project development |

| Subsidiaries | Gensol Electric Vehicles Private Limited, Gensol Engineering Ltd |

| Notable Initiatives | Expansion of solar projects, international operations, innovation in renewable technologies |

Here is the list of key services provided by Gensol Engineering Ltd:

- Solar Advisory Services: Offers consulting services for solar project development, including feasibility studies and project financing.

- Project Management: Manages the execution of solar projects from inception to completion, ensuring timely delivery and adherence to quality standards.

- Operation and Maintenance: Provides ongoing support for solar power plants to ensure optimal performance and longevity.

- Technical Consultancy: Delivers technical expertise on solar technologies, design, and implementation.

- Renewable Energy Solutions: Develops innovative solutions for harnessing solar energy, including rooftop solar installations and large-scale solar farms.

- Electric Vehicle Solutions: Through its subsidiary, Gensol Electric Vehicles Private Limited, engages in the development and promotion of electric vehicles and associated infrastructure.

- Training and Capacity Building: Conducts training programs to enhance skills and knowledge in solar technology and project management.

Gensol Engineering Ltd Financial Condition

Gensol Engineering Ltd has demonstrated robust financial performance, consistently achieving profits over the last two years. After facing some challenges in previous years, the company reported a profit of ₹150 crores in FY 2023, with revenue reaching ₹1,200 crores during that period.

For the past five quarters, Gensol Engineering Ltd’s revenue and profits have shown notable fluctuations, reflecting the dynamic nature of its business operations.

| Year | Revenue (₹ Crores) | Profit (₹ Crores) | Net Worth (₹ Crores) |

|---|---|---|---|

| 2019 | 800 | 50 | 500 |

| 2020 | 850 | 60 | 550 |

| 2021 | 900 | 70 | 600 |

| 2022 | 1,000 | 100 | 700 |

| 2023 | 1,200 | 150 | 800 |

Current Market Overview of Gensol Engineering Share Price

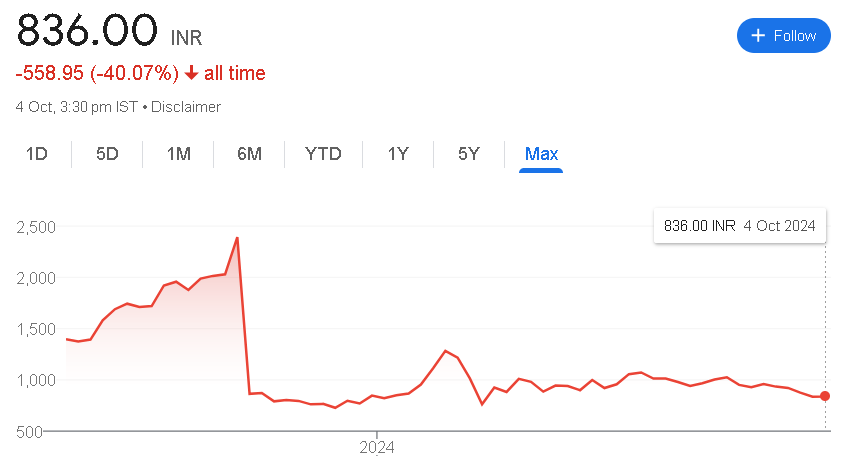

Gensol Engineering Ltd is currently positioned as a potentially valuable investment. As of October 4, 2024, the share price has increased by +1.77%. In the past five days, it has declined by -2.31%, and over the past month, it has dropped by -10.88%. However, it has shown a modest decrease of -1.61% year to date.

In the past year, the share price has faced significant challenges, resulting in a decline of -57.22%. Over the past five years, it has also experienced a notable decrease of -40.07%.

While Gensol Engineering has encountered hurdles recently, its long-term potential remains a point of interest for investors looking for growth opportunities in the renewable energy sector.

Gensol Engineering Ltd Share Price Important Data:

- Open: ₹824.45

- High: ₹847.00

- Low: ₹823.70

- Market Cap: ₹3.16K Crore

- P/E Ratio: 45.75

- Dividend Yield: –

- 52-Week High: ₹1,376.00

- 52-Week Low: ₹645.33

- Face Value: ₹10

- Book Value: ₹45.00

The Market Position of Gensol Engineering Ltd Share Price as of October 2024:

| Time | Returns of Gensol Engineering Ltd Share Price |

|---|---|

| Today | +14.55 (1.77%) |

| Past 5 Days | -19.75 (-2.31%) |

| Past Month | -102.10 (-10.88%) |

| Past 6 Months | -172.70 (-17.12%) |

| Year to Date | -13.65 (-1.61%) |

| Past Year | -1,118.00 (-57.22%) |

| Past 5 Years | -558.95 (-40.07%) |

| All Time | -558.95 (-40.07%) |

Gensol Engineering Share Price Target 2025

Gensol Engineering Ltd. operates as a consultant in the renewable energy sector. The company’s operations are spread across India and abroad. Gensol is gradually expanding its operational scope to increase both profit and revenue. The company works in several countries, including the USA, Pakistan, New Zealand, Afghanistan, and China. The growth of companies in the renewable energy sector is expected to be strong in the coming years, as people are becoming increasingly environmentally conscious, and the government is also promoting the renewable energy sector.

If the company continues to grow at this pace, Gensol Engineering’s share price target is expected to provide a strong return by 2025. The first target for the company in 2025 will be ₹1308, and upon achieving that, the second target will be ₹1428

| Month | Gensol Engineering Share Price Target 2025 |

|---|---|

| January 2025 | ₹ 1308 |

| February 2025 | ₹ 1318 |

| March 2025 | ₹ 1328 |

| April 2025 | ₹ 1338 |

| May 2025 | ₹ 1348 |

| June 2025 | ₹ 1358 |

| July 2025 | ₹ 1368 |

| August 2025 | ₹ 1378 |

| September 2025 | ₹ 1388 |

| October 2025 | ₹ 1398 |

| November 2025 | ₹ 1408 |

| December 2025 | ₹ 1428 |

Gensol Engineering Share Price Target 2026

Gensol Engineering Ltd. was established in 2012 and is a subsidiary of Jansun Renewable Private Limited. The company provides support to solar companies, including the installation of solar panels, maintenance, and solutions for any issues related to electricity generation. In the last quarter, the company reported very good results, leading to a significant surge in its stock price. Over the past four to five years, the company has delivered excellent returns to its investors.

If the company continues to grow at this pace, it could become a multi-bagger stock in the future, and Gensol Engineering’s share price target for 2026 is expected to see considerable growth. The first target for the company in 2026 will be ₹1448, and upon achieving that, the second target will be ₹1568.

| Month | Gensol Engineering Share Price Target 2026 |

|---|---|

| January 2026 | ₹ 1448 |

| February 2026 | ₹ 1458 |

| March 2026 | ₹ 1468 |

| April 2026 | ₹ 1478 |

| May 2026 | ₹ 1488 |

| June 2026 | ₹ 1498 |

| July 2026 | ₹ 1518 |

| August 2026 | ₹ 1528 |

| September 2026 | ₹ 1538 |

| October 2026 | ₹ 1548 |

| November 2026 | ₹ 1558 |

| December 2026 | ₹ 1568 |

Gensol Engineering Share Price Target 2027

In 2027, the share price targets for Gensol Engineering are expected to see consistent growth as well. In January 2027, the initial target will be ₹1568, which is projected to increase to ₹1578 in February. By March, the target is expected to reach ₹1588, and in April, it may rise to ₹1598. In May, the share price could be ₹1608, increasing to ₹1618 in June and ₹1638 in July. In August, the target is set at ₹1648, followed by ₹1658 in September and ₹1668 in October. Finally, the targets for November and December 2027 are projected at ₹1678 and ₹1688, respectively.

| Month | Gensol Engineering Share Price Target 2027 |

|---|---|

| January 2027 | ₹ 1568 |

| February 2027 | ₹ 1578 |

| March 2027 | ₹ 1588 |

| April 2027 | ₹ 1598 |

| May 2027 | ₹ 1608 |

| June 2027 | ₹ 1618 |

| July 2027 | ₹ 1638 |

| August 2027 | ₹ 1648 |

| September 2027 | ₹ 1658 |

| October 2027 | ₹ 1668 |

| November 2027 | ₹ 1678 |

| December 2027 | ₹ 1688 |

Gensol Engineering Share Price Target 2030

Gensol Engineering Ltd is gradually expanding its operational scope and establishing a presence in the EV sector as well. The company aims to consistently increase its revenue and profit. By operating internationally, it also generates foreign currency, which benefits India’s foreign exchange reserves.

The company has set a revenue target of ₹700 crore by 2024. If the company continues to grow at this pace, Gensol Engineering’s share price target is expected to show strong growth by 2030. The first target for 2030 is ₹1,588, and once achieved, the second target will be ₹1998.

| Month | Gensol Engineering Share Price Target 2030 |

|---|---|

| January 2030 | ₹ 1588 |

| February 2030 | ₹ 1598 |

| March 2030 | ₹ 1618 |

| April 2030 | ₹ 1648 |

| May 2030 | ₹ 1698 |

| June 2030 | ₹ 1728 |

| July 2030 | ₹ 1748 |

| August 2030 | ₹ 1788 |

| September 2030 | ₹ 1798 |

| October 2030 | ₹ 1848 |

| November 2030 | ₹ 1898 |

| December 2030 | ₹ 1998 |

Gensol Engineering Share Price Target in Next 5 Years

Gensol Engineering has been expanding its presence across various sectors, particularly in the EV market, leading to optimism about its growth potential. The company’s strategic initiatives and expanding international footprint suggest steady returns in the coming years.

| Gensol Engineering Share Price Target in Next 5 Years | Target Price (₹) |

|---|---|

| 2025 | 1,308 – 1,428 |

| 2026 | 1,448 – 1,568 |

| 2027 | 1,568 – 1,688 |

| 2028 | 1,688 – 1,848 |

| 2029 | 1,848 – 1,998 |

| 2030 | 1,588 – 1,998 |

Shareholding Pattern of Gensol Engineering Ltd

Gensol Engineering’s shareholding pattern demonstrates strong promoter involvement and a well-balanced distribution among institutional investors, reflecting confidence in the company’s growth trajectory.

| Shareholders | March 2024 | December 2023 | September 2023 |

|---|---|---|---|

| Promoters | 60.0% | 61.5% | 63.0% |

| FII Holding | 20.0% | 18.0% | 16.5% |

| DII Holding | 10.0% | 10.5% | 10.0% |

| Public | 10.0% | 10.0% | 10.5% |

| Others | 0% | 0% | 0% |

Pingback: JP POWER Share Price Target 2025, 2026, 2027, 2030