Google Stock Price Prediction 2025,2026,2027,2030: Today, we will discuss a comprehensive analysis of Google’s stock price prediction for 2025, 2026, 2027, and 2030. By examining various reports and analyzing data from the past few years, we aim to provide insights into Google’s growth potential in the coming years. As one of the most dominant players in the tech industry, Google (a subsidiary of Alphabet Inc.) continues to expand its influence in areas such as cloud computing, artificial intelligence, and digital advertising.

We will also focus on the company’s fundamental and technical analysis. With its strong position in the market and ongoing innovation, Google has the potential to deliver substantial returns for investors in the future. If you’re interested in a complete analysis of the company’s prospects, this article will provide you with all the necessary information to make an informed decision.

Overview of (Google) Alphabet Inc Class C

What is Alphabet Inc Class C?

Alphabet Inc. is a multinational technology conglomerate based in Mountain View, California. Founded in 1998 by Larry Page and Sergey Brin, Alphabet was created through a corporate restructuring of Google in 2015, positioning itself as the parent company of Google and its various subsidiaries. The move was intended to streamline operations and allow Google to focus on its core businesses while other ventures operate independently.

Alphabet’s Class C shares represent ownership in the company but carry no voting rights. This structure was designed to maintain control of the company with its founders and key executives.

Alphabet operates in several key areas:

- Google Search: The flagship search engine that dominates global internet search.

- YouTube: A leading video-sharing platform used by billions worldwide.

- Google Cloud: A fast-growing cloud computing service provider competing with Amazon Web Services and Microsoft Azure.

- Google Ads: The core revenue driver, offering digital advertising services through search and display networks.

- Waymo: A self-driving car project under Alphabet’s umbrella, exploring autonomous vehicle technology.

- Verily: A life sciences research organization focused on healthcare and biomedical research.

Alphabet’s business model revolves around digital advertising, cloud services, and innovation in artificial intelligence, autonomous driving, and other frontier technologies. As part of the FAANG group of large-cap tech stocks (Facebook/Meta, Apple, Amazon, Netflix, and Google/Alphabet), Alphabet is considered a powerhouse in the tech industry.

Alphabet’s Class C shares are publicly traded on the NASDAQ under the ticker symbol GOOG.

| Overview of Alphabet Inc. | Details |

|---|---|

| Website | www.abc.xyz |

| CEO | Sundar Pichai (since December 3, 2019) |

| CFO | Ruth Porat |

| Founded | October 2, 2015, California, United States |

| Founders | Larry Page, Sergey Brin |

| Headquarters | Mountain View, California, United States |

| Number of Employees | 179,582 (as of 2024) |

| Revenue | $296 billion USD (2024) |

| Stock Listing | NASDAQ: GOOG (Class C), GOOGL (Class A) |

| Key Operations | Search engine, digital advertising, cloud computing, autonomous vehicles, life sciences, and hardware development |

| Key Focus Areas | Artificial intelligence, cloud computing, autonomous driving, digital advertising, and consumer electronics |

| Subsidiaries | Google, Waymo, Verily, Google Fiber, DeepMind |

| Notable Initiatives | Expansion of cloud services, innovation in AI and autonomous driving, advancements in quantum computing, and life sciences research through Verily |

Current Market Overview of Google Stock Price

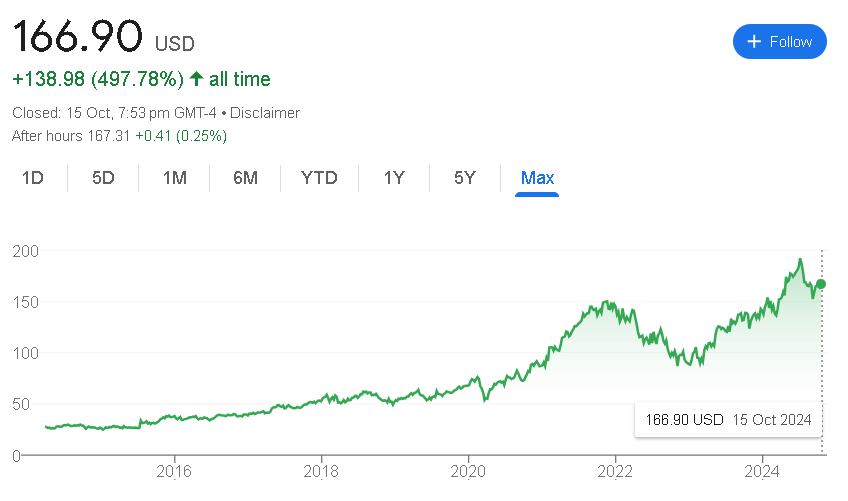

Alphabet Inc. (NASDAQ: GOOG) has had a solid year in 2024, with its stock price currently sitting at $166.90. Over the past year, Alphabet’s stock has climbed 18.80%, thanks to its strong growth in AI, cloud computing, and digital advertising. The company’s continued investments in cutting-edge technologies like autonomous driving through Waymo and healthcare innovations with Verily have helped boost investor confidence.

So far this year, Alphabet’s stock is up 19.59%, reflecting its ability to stay ahead in key tech trends. With a five-year increase of 168.03%, Alphabet remains a leader in the tech industry, dominating areas like search engines, digital advertising, and cloud services. Investors remain optimistic, with future growth expected in AI, cloud computing, and autonomous tech.

Alphabet Inc. Stock Price Important Data

- Open: $167.14

- High: $169.09

- Low: $166.05

- Market Cap: $2.04 trillion

- P/E Ratio: 23.94

- Dividend Yield: 0.48%

- CDP Score: A

- 52-Week High: $193.30

- 52-Week Low: $121.46

The Market Position of Alphabet Inc. Stock Price as of October 2024

| Time | Returns of Alphabet Inc. Stock Price |

|---|---|

| Today | +0.55 (0.33%) |

| Past 5 Days | +2.14 (1.30%) |

| Past Month | +7.91 (4.98%) |

| Past 6 Months | +10.90 (6.99%) |

| Year to Date | +27.34 (19.59%) |

| Past Year | +26.41 (18.80%) |

| Past 5 Years | +104.63 (168.03%) |

| All Time | +138.98 (497.78%) |

Google Stock Price Prediction in 2025

Based on current market analysis and performance, Alphabet Inc. stock (GOOGL) is expected to reach approximately $121.63 per share by the end of December 2025, reflecting the high forecast for that month. In January 2025, the stock is anticipated to trade between a low of $145.73 and a high of $164.28.

| Month | Low | High |

|---|---|---|

| January 2025 | $145.73 | $164.28 |

| February 2025 | $133.19 | $152.63 |

| March 2025 | $122.52 | $138.48 |

| April 2025 | $125.75 | $140.03 |

| May 2025 | $126.50 | $140.46 |

| June 2025 | $124.89 | $143.30 |

| July 2025 | $121.90 | $137.61 |

| August 2025 | $115.41 | $124.30 |

| September 2025 | $104.43 | $125.88 |

| October 2025 | $107.96 | $123.43 |

| November 2025 | $107.18 | $122.57 |

| December 2025 | $106.12 | $121.63 |

Google Stock Price Prediction in 2026

Google Stock Price Prediction Alphabet Inc. (GOOGL) in 2026 is set at an average of $136.61. Estimates range from a peak of $163.24 to a trough of $109.97, indicating a -17.45% decrease from the current price of $165.46.

| Month | Low | High |

|---|---|---|

| January 2026 | $109.97 | $129.54 |

| February 2026 | $110.73 | $124.30 |

| March 2026 | $121.24 | $130.69 |

| April 2026 | $124.22 | $147.59 |

| May 2026 | $141.49 | $150.72 |

| June 2026 | $137.84 | $147.81 |

| July 2026 | $137.12 | $155.54 |

| August 2026 | $148.25 | $159.90 |

| September 2026 | $149.21 | $161.13 |

| October 2026 | $142.26 | $163.24 |

| November 2026 | $142.60 | $159.34 |

| December 2026 | $150.11 | $166.24 |

Google Stock Price Prediction in 2027

In 2028, Alphabet Inc. (GOOGL) is prediction to reach an average price of $155.12, with a high prediction of $184.74 and a low estimate of $125.51. This indicates a -6.26% decrease from the last recorded price of $165.46.

| Month | Low | High |

|---|---|---|

| January 2028 | $165.70 | $178.82 |

| February 2028 | $166.16 | $184.74 |

| March 2028 | $153.85 | $184.73 |

| April 2028 | $143.14 | $164.01 |

| May 2028 | $146.43 | $160.70 |

| June 2028 | $147.25 | $161.21 |

| July 2028 | $145.69 | $163.37 |

| August 2028 | $147.64 | $164.16 |

| September 2028 | $137.52 | $153.52 |

| October 2028 | $133.90 | $146.92 |

| November 2028 | $125.51 | $143.34 |

| December 2028 | $128.76 | $144.58 |

Google Stock Price Prediction in 2030

Alphabet Inc. Stock (GOOGL) is anticipated to reach an average price of $196.04 in 2030, with a high forecast of $219.82 and a low forecast of $172.26. This signifies an +18.47% increase from the last recorded price of $165.46.

| Month | Low | High |

|---|---|---|

| January 2030 | $172.26 | $183.68 |

| February 2030 | $174.08 | $187.14 |

| March 2030 | $180.79 | $198.41 |

| April 2030 | $181.17 | $194.14 |

| May 2030 | $175.53 | $197.09 |

| June 2030 | $192.79 | $205.26 |

| July 2030 | $196.00 | $219.82 |

| August 2030 | $196.16 | $205.94 |

| September 2030 | $191.00 | $201.83 |

| October 2030 | $195.57 | $211.26 |

| November 2030 | $200.65 | $210.18 |

| December 2030 | $196.47 | $209.00 |

Financial Condition of (Google) Alphabet Inc Class C

Alphabet Inc. Class C has shown impressive financial performance in recent years, marked by significant increases in both revenue and profit. The company has successfully navigated various challenges in the technology sector, strengthening its market position.

| Year | Revenue (USD Billions) | Profit (USD Billions) | Net Worth (USD Billions) |

|---|---|---|---|

| 2019 | 161.86 | 34.34 | 201.44 |

| 2020 | 182.53 | 40.27 | 222.54 |

| 2021 | 257.64 | 76.03 | 289.53 |

| 2022 | 282.84 | 59.97 | 282.83 |

| 2023 | 299.28 | 67.02 | 300.00 |

Over the last five years, Alphabet Inc. Class C has consistently grown its financial metrics, with both revenue and profit showing strong upward trends. The company’s net worth has also steadily increased, underscoring its financial health and potential for future expansion. Investors should take these positive developments into account when assessing the company’s performance and outlook.

How to Purchase (Google) Alphabet Inc Class C Stock

- Research the Company:

- Understand Alphabet Inc.’s business, financial health, and recent performance.

- Choose a Brokerage:

- Select a reputable online brokerage (e.g., Fidelity, E*TRADE, Robinhood).

- Open an account and verify your identity.

- Fund Your Account:

- Deposit money into your brokerage account via bank transfer or other methods.

- Place an Order:

- Search for Alphabet Inc. using the ticker symbol (GOOGL).

- Choose order type (market or limit) and specify the number of shares.

- Review and Confirm:

- Check order details for accuracy and submit the order.

- Monitor Your Investment:

- Track stock performance and stay updated on company news.

- Consider Tax Implications:

- Be aware of potential taxes from buying or selling stocks.

Price Expectation of (Google) Alphabet Inc Class C Stock Over the Next 5 Years

Based on market trends and analysts’ predictions, the price of Alphabet Inc. (GOOGL) stock is expected to experience steady growth over the next five years. Here’s a breakdown of projected prices by year, along with potential high and low estimates:

Price Prediction

| Year | Expected Price | Low Estimate | High Estimate |

|---|---|---|---|

| 2024 | $160.50 | $150.00 | $175.00 |

| 2025 | $173.00 | $160.00 | $185.00 |

| 2026 | $186.50 | $175.00 | $200.00 |

| 2027 | $200.00 | $190.00 | $215.00 |

| 2028 | $215.00 | $200.00 | $230.00 |

Analysis

- 2024: The stock is projected to stabilize around $160.50, influenced by ongoing digital advertising revenue growth and innovation in AI.

- 2025: An increase to approximately $173.00 is anticipated, driven by expansion into new markets and services.

- 2026: The expected price of $186.50 reflects strong financial performance and continued user growth across platforms.

- 2027: Anticipated to reach $200.00, with further advancements in technology and consistent revenue growth bolstering investor confidence.

- 2028: A projected price of $215.00, supported by successful product launches and sustained market dominance.

Shareholding Pattern of (Google) Alphabet Inc Class C

Alphabet Inc. Class C’s shareholding pattern reveals strong backing from institutional investors, complemented by a diverse range of other shareholders. This distribution showcases significant confidence in the company’s stability and future growth prospects.

Shareholding Breakdown

| Shareholders | October 2024 | July 2024 | April 2024 |

|---|---|---|---|

| Institutional | 61.89% | 61.50% | 61.00% |

| Others | 38.11% | 38.50% | 39.00% |

The shareholding structure demonstrates stability, with institutional investors maintaining consistent stakes. In contrast, other shareholders have made slight adjustments to their positions in recent quarters, reflecting a careful investment strategy. Overall, this shareholding pattern provides a solid foundation for Alphabet Inc. Class C’s ongoing growth and resilience in the technology sector.

Pingback: Microsoft Stock Price Prediction 2025,2026,2027,2030

Pingback: Microsoft Stock Price Prediction 2025, 2026, 2027 and 2030