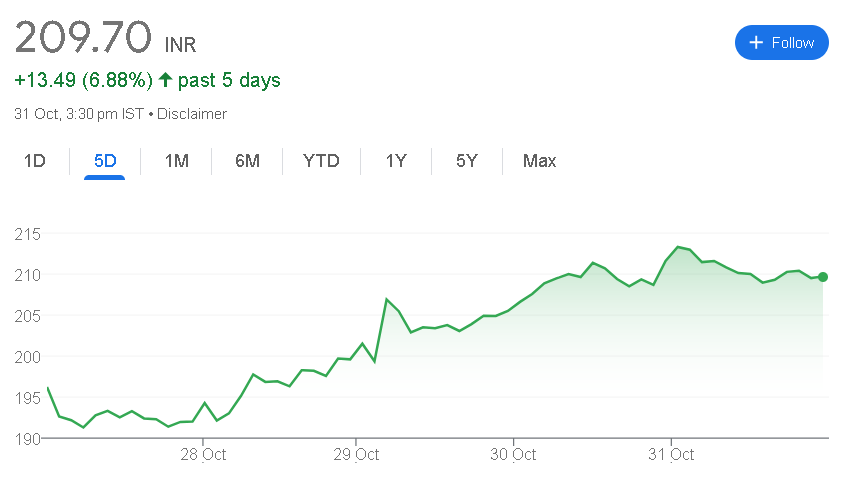

IREDA Share Price Update: Gains 6.88% in the Past 5 Days. Indian Renewable Energy Development Agency Limited (IREDA), a public sector entity focused on providing financial assistance for renewable energy and energy efficiency projects, has experienced a significant . This recent upward trend has garnered attention among investors and analysts, encouraging a closer examination of IREDA’s current position, recent performance, and the broader market forces propelling its growth trajectory.

Overview of Indian Renewable Energy Development Agency Limited (IREDA)

Founded in 1987, IREDA operates as a crucial financial pillar in India’s renewable energy landscape, providing essential funding to various projects that support sustainable energy growth. Positioned under the Ministry of New and Renewable Energy (MNRE), IREDA has established a significant role in India’s transition to greener energy sources by facilitating funding for initiatives in solar, wind, hydro, and bio-energy sectors.

- Founded: 1987

- Headquarters: India

- Employees: 173 (2024)

- Revenue: ₹3,482 crores (US$440 million, FY23)

- Market Capitalization: ₹56,490 crores

- P/E Ratio: 38.09

- 52-Week High: ₹310.00

- 52-Week Low: ₹50.00

IREDA’s role in renewable energy development, supported by its financial resources and government backing, provides it with a stable position in the Indian financial markets, especially with the rising focus on renewable energy investments.

Recent Market Performance of IREDA Shares

As of the last trading session on October 31, IREDA’s stock opened at ₹210.90, peaked at ₹213.95, and closed at ₹209.70, reflecting a solid gain. Over the past five days, its share price has surged by approximately 6.88%, reflecting strong investor confidence and interest in IREDA’s role in the renewable energy space.

Key Market Data for IREDA:

- Current Price: ₹209.70

- 5-Day Performance: +6.88%

- Day Change: +₹13.49

- 52-Week Range: ₹50.00 to ₹310.00

This recent price surge suggests a renewed interest in IREDA’s stock, likely influenced by strategic investments in the renewable energy sector, government support for clean energy projects, and IREDA’s consistent financial performance.

Factors Contributing to Recent Gains

Several factors may be driving IREDA’s 6.88% increase over the past five days:

- Government Backing and Focus on Renewable Energy: With India’s push toward renewable energy, the government has continued to support entities like IREDA, which play a vital role in financing green projects. This support from the Indian government fosters a sense of stability and trust among investors.

- Strong Financial Position and Revenue Growth: IREDA’s revenue of ₹3,482 crores reflects robust financial health, which likely contributes to investor confidence. As a profitable entity in the renewable energy finance sector, IREDA’s revenue base adds strength to its financial standing.

- Increased Demand for Renewable Energy Financing: The demand for renewable energy projects in India has led to a corresponding increase in the need for financing, which positions IREDA favorably within the energy finance market. This trend supports both revenue growth and market stability for the company.

- Investor Interest in Sustainable Investments: The global push toward sustainable and green investments has brought additional focus to companies like IREDA. With more investors prioritizing ESG (environmental, social, and governance) criteria, IREDA’s profile as a public-sector entity focused on renewable energy aligns well with this growing demand.

Strategic Outlook and Investor Sentiment

The recent increase in IREDA’s share price points to a positive investor sentiment, as both retail and institutional investors recognize its strategic importance in renewable energy financing. As India’s focus on clean energy intensifies, IREDA’s position within this sector makes it an attractive long-term investment.

Considerations for Investors:

- Long-Term Growth in Renewable Energy: As India’s commitment to renewable energy deepens, IREDA’s role as a financier is set to grow, contributing to its long-term value.

- Stable Government-Backed Revenue Stream: IREDA’s government support and established revenue sources appeal to risk-averse investors seeking stable returns.

- Policy Shifts and Energy Initiatives: With potential changes in government policies surrounding renewable energy, IREDA’s growth could be further influenced by increased financial backing and new initiatives.

Financial Performance of IREDA

IREDA’s financials illustrate a steady trajectory, highlighted by a market capitalization of ₹56,490 crores and a P/E ratio of 38.09. Despite a highly competitive renewable energy market, IREDA’s consistent revenue stream supports its stable financial outlook.

Key Financial Metrics:

- Revenue: ₹3,482 crores (FY23)

- Market Capitalization: ₹56,490 crores

- P/E Ratio: 38.09

- 52-Week High/Low: ₹310.00/₹50.00

Future Outlook for IREDA Shares

The future outlook for IREDA appears favorable as India’s renewable energy needs continue to grow. The government’s commitment to increasing clean energy capacity could further enhance IREDA’s role in financing green projects. Potential areas of interest for investors include:

- Expansion in Renewable Energy Financing: As India expands its renewable energy capacity, IREDA is expected to see a rise in financing demand, which could positively impact its growth.

- Strategic Position in the Renewable Energy Ecosystem: IREDA’s prominent role within the renewable energy sector in India makes it a crucial player, likely to benefit from government incentives aimed at accelerating green energy initiatives.

- Potential for Sustainable Dividends and Growth: Although IREDA’s dividend yield remains unreported, its stable revenue model could attract dividend-focused investors seeking long-term income stability.

Conclusion

IREDA’s recent 6.88% gain over the past week underscores its position as a stable, government-backed investment in the renewable energy finance sector. With a critical role in India’s green energy initiatives and consistent financial performance, IREDA stands out as an appealing investment for those seeking long-term growth in sustainable sectors. The company’s stable market presence and its contribution to renewable energy financing align well with the broader market interest in ESG-aligned investments.