IREDA Share Price Target 2025, 2026, 2027, and 2030: IREDA’s (Indian Renewable Energy Development Agency) share price targets are projected to show stable growth in the coming years and are focused on India’s expansion of renewable energy capacity, and IREDA forecasts based on its strength or position in the market. So in this article we discuss you and give you full information about the IREDA share price target for 2024, 2025, 2026, 2027, and 2030.

In this article, we will tell you what IREDA is, its current share price, its history of share price, and its fundamentals of share price and target price. All the information we discuss with you, like its BSE and NSE share price, its pros and cons, which are its competitors, who are its shareholders, how many shares are held, its share price, where and how to buy, so in this article I will tell you all the information about its IREDA share price target for 2024, 2025, 2026, 2027, and 2030.

Overview of IREDA (Indian Renewable Energy Development Agency):

What is IREDA?

The full form of IREDA is Indian Renewable Energy Development Agency Limited. IREDA (Indian Renewable Energy Development Agency Limited) is a public sector undertaking (PSU) under the Ministry of New and Renewable Energy (MNRE) in India. It was established in 1987 to promote, develop, and finance projects related to renewable energy and energy efficiency. Let me tell you that IREDA plays an important role in moving India towards clean and sustainable energy.IREDA is a premier financial institution under the Ministry of New and Renewable Energy, India, which is helping accelerate the adoption of renewable energy and achieve energy security and sustainability in the country.

It provides loans and financial assistance for solar, wind, biomass, small hydro, and energy efficiency projects, while encouraging public-private partnerships and promoting research and development in clean energy. IREDA offers various financial products, including term loans, short-term loans, bridge loans, and refinance facilities. Its focus areas include solar, wind, hydro, biomass, and energy efficiency. Over the years, IREDA has funded more than 2,800 renewable energy projects, contributing to over 19,500 MW of installed capacity and reducing CO2 emissions by more than 50 million metric tons. IREDA plays a key role in supporting India’s renewable energy goals, such as the target of achieving 500 GW by 2030, and collaborating with international financial institutions for financing and technology transfer.

Overview of IREDA (Indian Renewable Energy Development Agency Limited)

| Feature | Details |

|---|---|

| Website | ireda.in |

| Founded | 11th March 1987 |

| Headquarters | New Delhi, India |

| Key Services | Financial assistance for renewable energy projects, energy efficiency, and conservation |

| Chairman & MD | Pradip Kumar Das (as of 2024) |

| Revenue | ₹3,482 crore INR (US$440 million, FY 2023) |

| Net Profit | ₹865 crore INR (FY 2023) |

| Number of Employees | 173 (as of 2024) |

| Market Presence | Nationwide operations with growing global partnerships |

| Key Focus Areas | Solar energy, wind energy, biomass, hydropower, energy efficiency projects |

| Parent Organization | Ministry of New and Renewable Energy (MNRE), Government of India |

| Notable Initiatives | Green financing, subsidies, loans for renewable energy projects |

| Certifications | ISO 9001:2015 certified |

Current Market Position of IREDA and Share Price History:

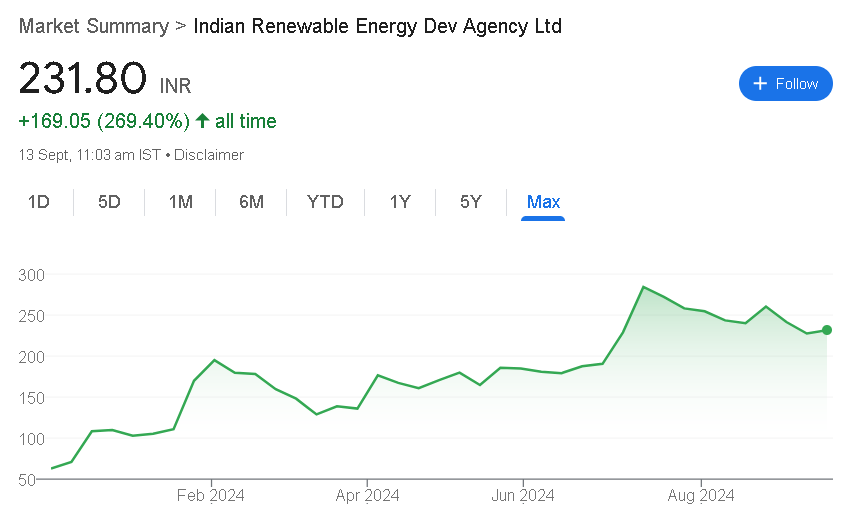

Let me tell you about IREDA share price history. The stock price has experienced a range of fluctuations over different time periods. Over the past day, the price has slightly decreased by 0.34%. In the last five days, however, it saw a positive gain of 4.11%. Over the past month, the stock has dropped by 3.60%. But in the last 6 months, the price surged by 82.06%. Year-to-date, the stock has climbed an impressive 121.55%, and over the past year, it skyrocketed by 286.42%. Looking back over the past five years, the stock price rose by 269.48%, and its all-time increase stands at 269.40%.

| Time | Returns of Share Price (IREDA) |

|---|---|

| 1-Day | -0.34% |

| 5-Days | +4.11% |

| 1-Month | -3.60% |

| 6-Months | +82.06% |

| Year-to-Date | +121.55% |

| 1-Year | +286.42% |

| 5-Years | +269.48% |

| All-Time | +269.40% |

IREDA Share Price Latest news of BSE & NSE:

The IREDA share price opened at ₹232.50, reaching a high of ₹235.45 and a low of ₹229.82. The market capitalization of the company stands at ₹62.27 thousand crore. The price-to-earnings (P/E) ratio is 43.56. IREDA has a 52-week high of ₹310.00 and a 52-week low of ₹50.00.

Overview of IREDA Share Price:

| Overview | IREDA IMP Data |

|---|---|

| Open | 232.50 |

| High | 235.45 |

| Low | 229.82 |

| Mkt Cap | 62.27K Cr |

| P/E Ratio | 43.56 |

| Div Yield | – |

| 52-wk High | 310.00 |

| 52-wk Low | 50.00 |

IREDA Share Price Financial Condition:

IREDA has been on a solid growth path, with its revenue climbing to ₹4,500 crore in 2024. This year also marked a significant boost in net profit, which soared to an impressive ₹1,252.23 crore, setting a new record for the company. On top of that, IREDA’s net worth has seen substantial growth, reflecting a strong and healthy financial standing.

IREDA Share Price Target for 2024:

In 2024, the IREDA share price target is forecast to see gradual increases throughout the year. Starting at ₹185 in January, the price is expected to rise modestly each month. By February, it should reach ₹186.60, followed by ₹188.20 in March and ₹189.80 in April. The trend continues with₹191.40 in May and ₹192 in June. July is forecast to see a more notable increase to ₹195.20. Despite a minor dip to₹188.70 in August, the price is anticipated to climb again, reaching₹190.50 in September and₹194.10 in October. By November, it should hit₹197.90 and conclude the year at₹212.10 in December.

| Month | Target Price (₹) |

|---|---|

| January | ₹185.00 |

| February | ₹186.60 |

| March | ₹188.20 |

| April | ₹189.80 |

| May | ₹191.40 |

| June | ₹192.00 |

| July | ₹195.20 |

| August | ₹188.70 |

| September | ₹190.50 |

| October | ₹194.10 |

| November | ₹197.90 |

| December | ₹212.10 |

IREDA Share Price Target for 2025:

In 2025, IREDA share price target is anticipated to begin at ₹212.10 in January and experience a gradual increase throughout the year. By December, the price is expected to reach ₹248.30. Each month shows steady growth, reflecting an overall positive trend. The price rises consistently, with significant gains particularly noticeable towards the end of the year, suggesting a strong upward trajectory for IREDA’s shares.

| Month | Target Price (₹) |

|---|---|

| January 2025 | 212.10 |

| February 2025 | 213.10 |

| March 2025 | 219.80 |

| April 2025 | 221.80 |

| May 2025 | 223.75 |

| June 2025 | 224.70 |

| July 2025 | 226.80 |

| August 2025 | 230.40 |

| September 2025 | 233.65 |

| October 2025 | 238.50 |

| November 2025 | 242.70 |

| December 2025 | 248.30 |

IREDA Share Price Target for 2026:

In 2026, IREDA share price target is expected to start at ₹248.60 in January and rise by ₹0.30 each month. By December, the price should reach ₹251.90. This steady increase throughout the year suggests a positive growth trend, with a final target of ₹269.70 by the end of the year.

| Month | Target Price (₹) |

|---|---|

| January 2026 | 248.60 |

| February 2026 | 248.90 |

| March 2026 | 249.20 |

| April 2026 | 249.50 |

| May 2026 | 249.80 |

| June 2026 | 250.10 |

| July 2026 | 250.40 |

| August 2026 | 250.70 |

| September 2026 | 251.00 |

| October 2026 | 251.30 |

| November 2026 | 251.60 |

| December 2026 | 251.90 |

IREDA Share Price Target for 2027:

In 2027, the IREDA share price target is expected to gradually rise each month, starting at ₹269.60 in January. By February, it’s projected to reach₹270.45, with a steady increase to₹271.30 by March. The price continues to climb, reaching₹273.55 in April,₹275.60 in May, and₹277.60 in June. By mid-year, the share price is anticipated to hit₹280.10 in July and₹282.60 in August. The growth persists through September at₹284.05, October at₹286.60, and November at₹287.90. The year is expected to close with the share price reaching ₹292.70 by December.

| Month | Target Price (₹) |

|---|---|

| January 2027 | 269.60 |

| February 2027 | 270.45 |

| March 2027 | 271.30 |

| April 2027 | 273.55 |

| May 2027 | 275.60 |

| June 2027 | 277.60 |

| July 2027 | 280.10 |

| August 2027 | 282.60 |

| September 2027 | 284.05 |

| October 2027 | 286.60 |

| November 2027 | 287.90 |

| December 2027 | 292.70 |

IREDA Share Price Target for 2030:

In 2030, the IREDA share price target is expected to gradually rise each month. Starting at ₹337.10 in January, the price is projected to increase steadily, reaching ₹377.50 by December. This upward trend reflects a consistent growth trajectory, with monthly targets climbing from ₹340.20 in February to ₹373.90 in November and finally hitting ₹377.50 by the end of the year.

| Month | Target Price (₹) |

|---|---|

| January | 337.10 |

| February | 340.20 |

| March | 343.40 |

| April | 347.60 |

| May | 350.65 |

| June | 354.80 |

| July | 357.00 |

| August | 360.30 |

| September | 364.60 |

| October | 370.70 |

| November | 373.90 |

| December | 377.50 |

How to Purchase on IREDA Share Price:

- Choose a Trading Platform: Select a broker or platform (e.g., Zerodha, ICICI Direct).

- Open Accounts: Set up a trading and demat account.

- Complete KYC: Submit required identity and address proofs.

- Deposit Funds: Transfer money into your trading account.

- Search for IREDA Shares: Find IREDA using the search function on the platform.

- Place an Order: Choose the number of shares and type of order (market or limit).

- Confirm Purchase: Review and confirm your order.

- Monitor: Check your portfolio to see the shares in your demat account.

Competitors Companies for IREDA Share Price:

- NTPC Limited – An Indian public sector undertaking involved in electricity generation, with a focus on renewable energy projects.

- Tata Power Renewable Energy Ltd. – A subsidiary of Tata Power, focused on renewable energy projects including solar and wind power.

- Adani Green Energy Ltd. – Part of the Adani Group, it is a major player in the renewable energy sector with large-scale solar and wind projects.

- JSW Energy Ltd. – Engaged in power generation with a growing emphasis on renewable energy sources.

- Power Grid Corporation of India Ltd. – While primarily a transmission company, it is involved in renewable energy projects and infrastructure.

IREDA Share Price Holders:

- Government of India: ~100%

- Institutional Investors: Varies, but typically small percentages.

- Retail Investors: Varies, typically a small percentage.

- Corporate Investors: Varies, but generally a minor percentage.

Pros and Cons of IREDA Share Price:

| Pros | Cons |

|---|---|

| Strong revenue growth to ₹4,500 crore in 2024. | High P/E ratio of 43.56, suggesting potential overvaluation. |

| Record high net profit of ₹1,252.23 crore. | Lack of information on dividend yield. |

| Substantial increase in net worth. | Significant stock price volatility (52-week high of ₹310.00, low of ₹50.00). |

| High market capitalization of ₹62.27K crore. |

Conclusion:

In this article, I have told you well about its share price target, its BSE and NSE price listed and its share holders and pros and cons with full details IREDA Share Price Target 2024, 2025, 2026, 2027 and 2030. Where and how to buy its share price, what will be its future value.

FAQs:

1. What is IREDA?

Answer: IREDA stands for Indian Renewable Energy Development Agency. It is a government-owned financial institution that promotes, develops, and extends financial assistance for renewable energy and energy efficiency projects in India.

2. What services does IREDA offer?

Answer: IREDA provides a range of services including:

- Project financing for renewable energy projects (solar, wind, hydro, biomass, etc.)

- Financial assistance for energy efficiency and conservation projects

- Consultancy services for project development and implementation

- Loan syndication and refinancing

3. How is IREDA performing financially?

Answer: IREDA has shown strong financial performance over the years. Key highlights include:

- Consistent revenue growth

- Significant increase in net profit, especially in recent years

- Strong net worth, reflecting a robust financial position

4. What are the key growth drivers for IREDA?

Answer: The key growth drivers for IREDA include:

- Government policies and targets for renewable energy capacity

- Increasing demand for green financing

- Diversified loan portfolio across various renewable energy sectors

- Strong presence in regions with high renewable energy potential

5. What are the risks associated with investing in IREDA?

Answer: Some potential risks include:

- Regulatory changes affecting the renewable energy sector

- Market competition from other financial institutions

- Project execution risks and delays

- Changes in interest rates impacting borrowing costs