Meta Platforms Stock Price Prediction 2025, 2026, 2027 and 2030: today we will discuss a comprehensive analysis of Meta Platforms stock price prediction for 2025, 2026, 2027, and 2030. We will examine various reports and analyze data from the past few years to provide insights into the company’s growth potential in the coming years. Meta, the parent company of Facebook, Instagram, and WhatsApp, has been expanding its operations in areas like virtual reality and artificial intelligence, positioning itself as a leader in the tech industry.

We will also focus on the company’s fundamental and technical analysis. If Meta Platforms continues its current growth trajectory, it has the potential to deliver significant returns for investors in the future. If you’re interested in a complete analysis of the company, this article will provide you with all the necessary information.

Overview of Meta Platforms Inc

What is Meta Platforms Inc ?

Meta Platforms, Inc., formerly known as Facebook, Inc., is a multinational technology conglomerate headquartered in Menlo Park, California. Founded by Mark Zuckerberg and his Harvard College roommates in 2004, the company originally launched as Facebook, a social media platform. Over the years, Meta expanded its portfolio to include several leading platforms, such as:

- Facebook: The flagship social networking site, connecting billions of users worldwide.

- Instagram: A popular photo and video-sharing platform.

- WhatsApp: A global messaging service.

- Messenger: A messaging app integrated with Facebook.

In 2021, the company rebranded as Meta Platforms, Inc. to emphasize its focus on the emerging metaverse—a virtual reality space where users can interact in a computer-generated environment. Meta has been investing heavily in virtual reality (VR) and augmented reality (AR) technologies through its Reality Labs division, which includes products like the Meta Quest (formerly Oculus) VR headsets.

Meta’s core business remains social media and digital advertising, but its long-term vision includes dominating the metaverse and creating interconnected digital worlds. The company also invests in artificial intelligence (AI), machine learning, and other frontier technologies to stay competitive in the evolving tech landscape.

Meta is publicly traded on the NASDAQ under the ticker symbol META and is part of the FAANG group of large-cap tech stocks, which includes Facebook (Meta), Apple, Amazon, Netflix, and Google (Alphabet).

| Overview of Meta Platforms, Inc. | Details |

|---|---|

| Website | www.meta.com |

| CEO | Mark Zuckerberg (since July 2004) |

| CFO | Susan Li |

| Founded | February 2004, Cambridge, Massachusetts, United States |

| Founders | Mark Zuckerberg, Eduardo Saverin, Dustin Moskovitz, Chris Hughes |

| Headquarters | Menlo Park, California, United States |

| Number of Employees | 70,799 (as of 2024) |

| Revenue | $134.9 billion USD (2024) |

| Stock Listing | NASDAQ: META |

| Key Operations | Social media platforms, digital advertising, virtual reality, and augmented reality |

| Key Focus Areas | Metaverse development, virtual reality, artificial intelligence, digital communication services |

| Subsidiaries | Facebook, Instagram, WhatsApp, Threads, Reality Labs |

| Notable Initiatives | Development of the metaverse, innovation in AI and VR technologies, expansion of Reality Labs |

Current Market Overview of Meta Platforms Stock Price

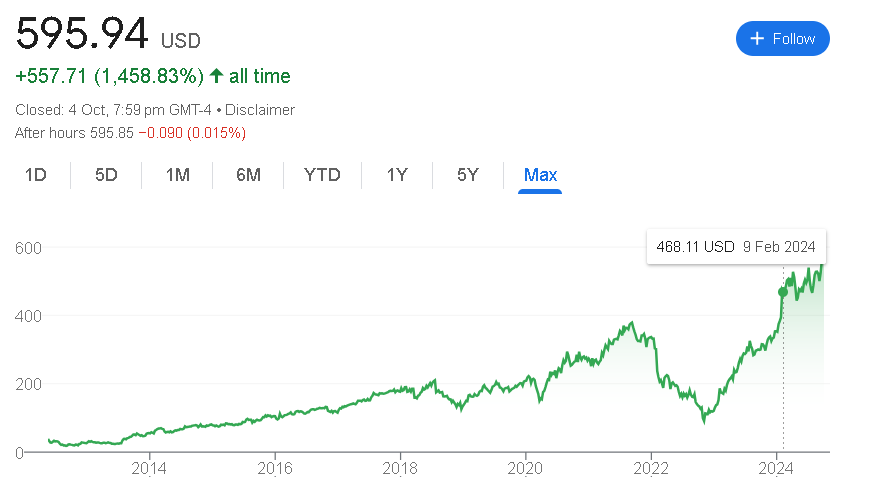

Meta Platforms, Inc. (NASDAQ: META) has shown impressive growth in 2024, with its stock price currently trading at $595.94. Over the past year, Meta’s stock has nearly doubled, up by 95.52%, fueled by its advancements in AI, virtual reality, and strong digital advertising revenues. The company’s ongoing innovation in the metaverse and its investment in Reality Labs have further boosted investor confidence, pushing the stock to new heights.

Year-to-date, Meta has seen a 72.09% increase in its stock price, reflecting its resilience and ability to capitalize on emerging technologies. With a five-year gain of 230.25%, Meta continues to be a top performer in the tech sector, positioning itself as a leader in both social media and next-gen tech innovations. Investors are optimistic about its future growth, given its focus on virtual reality, AI, and digital platforms.

Meta Platforms Stock Price Important Data

- Open: $583.73

- High: $596.85

- Low: $581.43

- Market Cap: $1.51 trillion

- P/E Ratio: 30.48

- Dividend Yield: 0.34%

- CDP Score: B

- 52-Week High: $596.85

- 52-Week Low: $279.40

- Book Value: $53.24

- Face Value: N/A (Face value is typically not applicable for U.S. stocks)

The Market Position of Meta Platforms Stock Price as of October 2024

| Time | Returns of Meta Platforms Stock Price |

|---|---|

| Today | +13.17 (2.26%) |

| Past 5 Days | +28.24 (4.97%) |

| Past Month | +79.08 (15.30%) |

| Past 6 Months | +68.60 (13.01%) |

| Year to Date | +249.65 (72.09%) |

| Past Year | +291.15 (95.52%) |

| Past 5 Years | +415.49 (230.25%) |

| All Time | +557.71 (1,458.83%) |

Meta Platforms Stock Price Prediction 2025

According to current market analysis and performance, the company’s stock price can reach approximately $573.85 per share by the end of December 2025, based on the high for that month. Additionally, in January 2025, the stock is anticipated to trade between a low of $517.07 and a high of $540.32, with a midpoint estimate of around $528.70.

| Month | Low | High |

|---|---|---|

| January | $517.07 | $540.32 |

| February | $515.56 | $545.43 |

| March | $519.07 | $549.16 |

| April | $527.33 | $547.96 |

| May | $524.85 | $546.74 |

| June | $522.10 | $541.38 |

| July | $534.07 | $553.53 |

| August | $530.54 | $555.07 |

| September | $539.35 | $561.89 |

| October | $536.76 | $565.50 |

| November | $544.34 | $569.03 |

| December | $541.85 | $573.85 |

Meta Platforms Stock Price Prediction 2026

current market analysis and performance, the company’s stock price can reach approximately $632.98 per share by the end of December 2026, based on the high for that month. Additionally, in January 2026, the stock is anticipated to trade between a low of $585.96 and a high of $611.96, with a midpoint estimate of around $598.96.

| Month | Low | High |

|---|---|---|

| January | $585.96 | $611.96 |

| February | $588.44 | $607.54 |

| March | $589.54 | $612.33 |

| April | $587.96 | $616.87 |

| May | $591.65 | $619.74 |

| June | $598.25 | $617.98 |

| July | $594.52 | $617.96 |

| August | $595.42 | $618.27 |

| September | $590.96 | $639.59 |

| October | $591.57 | $628.34 |

| November | $587.66 | $627.89 |

| December | $579.07 | $632.98 |

Meta Platforms Stock Price Prediction 2027

According to current market analysis and performance, the company’s stock price can reach approximately $722.60 per share by the end of December 2027, based on the high for that month. Additionally, in January 2027, the stock is anticipated to trade between a low of $649.96 and a high of $689.07, with a midpoint estimate of around $669.02.

| Month | Low | High |

|---|---|---|

| January | $649.96 | $689.07 |

| February | $644.07 | $693.47 |

| March | $654.87 | $698.65 |

| April | $658.43 | $709.85 |

| May | $659.84 | $707.33 |

| June | $655.10 | $704.07 |

| July | $661.33 | $711.54 |

| August | $665.07 | $718.96 |

| September | $668.76 | $713.13 |

| October | $669.85 | $710.09 |

| November | $671.74 | $721.52 |

| December | $673.07 | $722.60 |

Meta Platforms Stock Price Prediction 2030

Current market analysis and performance, the company’s stock price can reach approximately $1,080.98 per share by the end of December 2030, based on the high for that month. Additionally, in January 2030, the stock is anticipated to trade between a low of $946.85 and a high of $1,056.96, with a midpoint estimate of around $1,001.90.

| Month | Low | High |

|---|---|---|

| January | $946.85 | $1,056.96 |

| February | $949.47 | $1,089.54 |

| March | $978.97 | $1,076.96 |

| April | $967.44 | $1,067.43 |

| May | $965.08 | $1,045.40 |

| June | $929.07 | $1,039.85 |

| July | $948.96 | $1,056.07 |

| August | $963.85 | $1,059.43 |

| September | $971.37 | $1,060.74 |

| October | $975.38 | $1,076.49 |

| November | $967.96 | $1,073.53 |

| December | $979.69 | $1,080.98 |

Meta Platforms Inc Financial Condition

Meta Platforms Inc has shown strong financial performance, with significant growth in revenue and profits over the past few years. The company reported a net income of $39.07 billion in FY 2023, with revenue reaching $134.90 billion during that period

For the past five quarters, Meta Platforms Inc’s revenue and profits have demonstrated consistent growth, reflecting the company’s robust business operations.

| Year | Revenue ($ Billion) | Profit ($ Billion) | Net Worth ($ Billion) |

|---|---|---|---|

| 2019 | 70.70 | 18.49 | 101.00 |

| 2020 | 85.97 | 29.15 | 128.29 |

| 2021 | 117.93 | 39.37 | 142.76 |

| 2022 | 116.61 | 23.20 | 123.00 |

| 2023 | 134.90 | 39.07 | 153.17 |

Shareholding Pattern of Meta Platforms Inc

Meta Platforms Inc’s shareholding pattern reflects a diverse distribution among institutional investors, indicating strong market confidence in the company’s future prospects.

| Shareholders | March 2024 | December 2023 | September 2023 |

|---|---|---|---|

| Promoters | 13.0% | 13.5% | 14.0% |

| FII Holding | 55.0% | 54.0% | 53.5% |

| DII Holding | 20.0% | 20.5% | 21.0% |

| Public | 12.0% | 12.0% | 11.5% |

| Others | 0% | 0% | 0% |

Pingback: Google Stock Price Prediction 2025,2026,2027,2030

Pingback: Google Stock Price Prediction 2025,2026,2027 and 2030