This article provides an in-depth analysis of NVIDIA Stock Price Prediction & Forecast 2025 to 2030, focusing on its stock history, current market performance, financial trends, and future growth potential.

Overview of NVIDIA Corp

What is NVIDIA Corporation?

NVIDIA Corporation is an American multinational technology company headquartered in Santa Clara, California, and incorporated in Delaware. Founded on April 5, 1993, by Jensen Huang and Chris Malachowsky, NVIDIA is globally renowned for its innovations in graphics processing units (GPUs), AI computing, and high-performance technologies. The company operates with over 36,000 employees (as of 2025) and generated a revenue of USD 6,092 crores in 2024. Key subsidiaries include Mellanox Technologies and PGI Compilers & Tools.

Key Features of NVIDIA Corporation

- Market Role: A global leader in graphics processing units (GPUs) and AI computing, NVIDIA plays a pivotal role in powering gaming, data centers, autonomous vehicles, and AI technologies worldwide.

- Revenue: Recorded robust financial performance with a revenue of USD 6,092 crores in 2024, reflecting strong demand for its AI and data-centric solutions.

- Innovation Leadership: Known for pioneering GPU architecture and platforms like CUDA, and for driving advancements in deep learning and high-performance computing.

- Stock Exchange Listings: Publicly traded on NASDAQ under the ticker symbol NVDA, offering investors access to one of the world’s most valuable tech companies.

- Strategic Focus: Committed to AI-driven innovation, expanding into data center infrastructure, automotive AI, and enterprise solutions through both organic growth and strategic acquisitions.

Information about NVIDIA Corporation

| Information | Details |

|---|---|

| Website | nvidia.com |

| Headquarters | Santa Clara, California, United States |

| Founded | 5 April 1993 |

| Founders | Jensen Huang, Chris Malachowsky |

| CEO | Jensen Huang (since 1993) |

| Number of Employees | 36,000 (2025) |

| Revenue | USD 6,092 crores (2024) |

| Subsidiaries | Mellanox Technologies, PGI Compilers & Tools |

| Stock Exchange Listings | NASDAQ: NVDA |

Current Market Overview of NVIDIA Corp Stock Price

NVIDIA Corporation Stock Fundamental Data

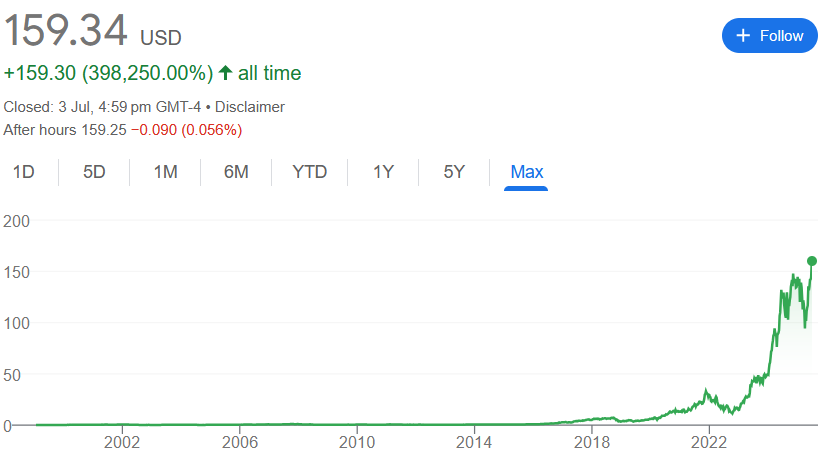

- Share Price: $159.34

- Market Capitalization: $3.89 Trillion

- Price-to-Earnings (P/E) Ratio: 49.38

- Dividend Yield: 0.03%

- Next Earnings Date: August 26, 2025

- 52-Week High / Low: $160.98 / $86.62

- Earnings Per Share (EPS) (TTM): $3.13

- Total Debt: $8,464 Million

- Revenue per Employee (TTM): $5,017,399

- Net Income per Employee (TTM): $2,593,716

- Tangible Book Value per Share: $3.15

Market Position of NVIDIA Corporation Share as of July 2025

| Time Period | Returns of NVIDIA Share |

|---|---|

| 1 Day | +1.33% |

| 1 Week | +2.25% |

| 1 Month | +13.82% |

| 6 Months | +6.63% |

| Year to Date | +15.20% |

| 1 Year | +26.63% |

| 5 Years | +1,558.06% |

NVIDIA Corporation (NVDA) Stock Price Prediction for 2025, 2026, 2027, 2028, 2029, 2030

NVIDIA Stock Price Prediction for 2025

In 2025, NVIDIA’s stock price is expected to range between $135 and $160, reflecting modest growth amid consolidation after a strong 2024 rally. The company continues to benefit from AI demand, though near-term valuation concerns may limit upside.

| Year | Minimum Prediction | Maximum Prediction |

|---|---|---|

| 2025 | $135 | $160 |

NVIDIA Stock Price Prediction for 2026

For 2026, the stock is projected to reach up to $149, supported by sustained AI growth, data center expansion, and partnerships in automotive AI.

| Year | Minimum Prediction | Maximum Prediction |

|---|---|---|

| 2026 | $121 | $149 |

NVIDIA Stock Price Prediction for 2027

By 2027, NVIDIA’s stock could trade between $149 and $232, backed by increasing enterprise adoption of AI infrastructure and accelerated global chip demand.

| Year | Minimum Prediction | Maximum Prediction |

|---|---|---|

| 2027 | $149 | $232 |

NVIDIA Stock Price Prediction for 2028

In 2028, the stock is expected to grow significantly, with a potential high of $368, reflecting strong performance in AI hardware, software ecosystems, and strategic acquisitions.

| Year | Minimum Prediction | Maximum Prediction |

|---|---|---|

| 2028 | $241 | $368 |

NVIDIA Stock Price Prediction for 2029

For 2029, NVIDIA’s stock price may rise further to around $388, driven by deeper penetration into AI-driven industries and expansion in global markets.

| Year | Minimum Prediction | Maximum Prediction |

|---|---|---|

| 2029 | $269 | $388 |

NVIDIA Stock Price Prediction for 2030

By 2030, the stock price is projected to stabilize between $355 and $379, reflecting NVIDIA’s matured leadership in AI, GPU, and enterprise cloud segments.

| Year | Minimum Prediction | Maximum Prediction |

|---|---|---|

| 2030 | $355 | $379 |

NVIDIA Corporation Share Price History from 2000 to 2025

| Year | NVIDIA Share Price (Year Close) | YOY Change % |

|---|---|---|

| 2025 | $159.34 | 18.67% |

| 2024 | $134.27 | 171.23% |

| 2023 | $49.50 | 239.02% |

| 2022 | $14.60 | -50.26% |

| 2021 | $29.36 | 125.48% |

| 2020 | $13.02 | 122.30% |

| 2019 | $5.86 | 76.94% |

| 2018 | $3.31 | -30.82% |

| 2017 | $4.78 | 81.99% |

| 2016 | $2.63 | 226.97% |

| 2015 | $0.80 | 67.10% |

| 2014 | $0.48 | 27.40% |

| 2013 | $0.38 | 33.56% |

| 2012 | $0.28 | -10.99% |

| 2011 | $0.32 | -10.00% |

| 2010 | $0.35 | -17.56% |

| 2009 | $0.43 | 131.46% |

| 2008 | $0.19 | -76.28% |

| 2007 | $0.78 | 37.87% |

| 2006 | $0.57 | 102.43% |

| 2005 | $0.28 | 55.22% |

| 2004 | $0.18 | 1.52% |

| 2003 | $0.18 | 101.71% |

| 2002 | $0.09 | -82.81% |

| 2001 | $0.51 | 308.31% |

| 2000 | $0.13 | 39.58% |

Financial Health and Performance Analysis of NVIDIA Corporation (FY 2021 – FY 2025)

1. Total Revenue Performance

| Year | Total Revenue (USD) | Revenue Growth (%) |

|---|---|---|

| FY2025 | $130.50B | 114.20% |

| FY2024 | $60.92B | 125.85% |

| FY2023 | $26.97B | 0.22% |

| FY2022 | $26.91B | 61.40% |

| FY2021 | $16.68B | 52.73% |

| Key Insight: NVIDIA experienced explosive revenue growth in FY2024 and FY2025, more than doubling year-over-year, driven by AI, data center, and gaming demand. |

2. Operating Expenses

| Year | Operating Expenses (USD) | Expense Growth (%) |

|---|---|---|

| FY2025 | $16.41B | 44.81% |

| FY2024 | $11.33B | 15.85% |

| FY2023 | $9.78B | 31.54% |

| FY2022 | $7.43B | 27.38% |

| FY2021 | $5.84B | 48.80% |

| Key Insight: While expenses grew steadily, revenue growth far outpaced spending, leading to expanding profitability. |

3. Net Income & Earnings Per Share (EPS)

| Year | Net Income (USD) | Net Income Growth (%) | EPS (USD) | EPS Growth (%) |

|---|---|---|---|---|

| FY2025 | $72.88B | 144.89% | $2.99 | 130.71% |

| FY2024 | $29.76B | 581.32% | $1.30 | 288.02% |

| FY2023 | $4.37B | -55.21% | $0.33 | -24.77% |

| FY2022 | $9.75B | 125.12% | $0.44 | 77.60% |

| FY2021 | $4.33B | 54.94% | $0.25 | 72.71% |

| Key Insight: Net income and EPS surged in FY2024–2025, reflecting improved operational efficiency and high-margin revenue streams. |

4. Profit Margins

| Year | Operating Margin (EBITDA) | Net Profit Margin (%) |

|---|---|---|

| FY2025 | $83.32B | 55.85% |

| FY2024 | $34.48B | 48.85% |

| FY2023 | $7.12B | 16.19% |

| FY2022 | $11.22B | 36.23% |

| FY2021 | $5.82B | 25.98% |

| Key Insight: Margins expanded dramatically in FY2024–2025, with net profit exceeding 50%, underscoring NVIDIA’s pricing power and cost discipline. |

5. Effective Tax Rate

| Year | Effective Tax Rate (%) |

|---|---|

| FY2025 | 13.26% |

| FY2024 | 12.00% |

| FY2023 | -4.47% |

| FY2022 | 1.90% |

| FY2021 | 1.75% |

| Key Insight: Tax rates remained low, with FY2023’s negative rate likely due to tax credits or jurisdictional adjustments. |

How to Buy NVIDIA Stock (Ticker: NVDA)

✅ Step-by-Step Guide to Buy NVIDIA Stock

1. Choose a Stockbroker

Select a reliable brokerage platform that allows trading in U.S. stocks. Popular choices include:

- U.S. investors: Fidelity, Charles Schwab, E*TRADE, Robinhood, TD Ameritrade

- International investors (e.g., India): Zerodha (via GIFT Nifty), Groww, Upstox, ICICI Direct (global investing), or apps like INDmoney, Vested

2. Create and Verify Your Account

- Provide your personal details and KYC documents (for international users).

- Link your bank account for funding.

3. Fund Your Brokerage Account

- Add funds in USD for U.S. brokers.

- For Indian users, transfer INR, which will be converted into USD under the RBI’s LRS scheme (limit: $250,000/year).

4. Search for NVIDIA (Ticker: NVDA)

- Use the platform’s search bar to find NVIDIA Corporation (NVDA).

- Check the stock details, financials, and charts if needed.

5. Place Your Order

Choose the type of order:

- Market Order: Buy immediately at the current price.

- Limit Order: Set a price at which you want to buy.

- Specify how many shares you want to buy.

6. Review and Confirm

- Double-check your order and confirm.

- Once executed, NVDA stock will appear in your portfolio.

Challenges and Risks of Investing in NVIDIA

- Valuation Risk: NVIDIA’s stock is considered highly valued relative to historical averages and peers. Elevated valuation levels may limit upside potential and increase downside risk, especially during broader market corrections.

- Dependence on AI and GPU Demand: A significant portion of NVIDIA’s revenue is driven by demand for GPUs in AI, data centers, and gaming. Any slowdown in these sectors could negatively impact earnings and growth projections.

- Geopolitical and Supply Chain Exposure: NVIDIA relies on global supply chains and international markets, particularly Taiwan and China. Trade restrictions, geopolitical tensions, or supply disruptions may affect operations and component availability.

- Regulatory Scrutiny and Competition: Increasing global scrutiny on AI technologies, export restrictions (especially involving China), and intense competition from AMD, Intel, and custom AI chipmakers (e.g., Google, Amazon) may pose long-term risks.

NVIDIA Stock Price: Key Factors Driving Growth

- AI Leadership and Demand Surge: NVIDIA is a dominant force in the AI and machine learning ecosystem, supplying high-performance GPUs essential for training large language models, autonomous vehicles, and generative AI platforms.

- Data Center and Cloud Expansion: With the rapid expansion of cloud services and enterprise AI adoption, NVIDIA’s data center business has become its largest growth driver.

- Strong Financials and Profitability: NVIDIA has demonstrated exceptional revenue and earnings growth, supported by high margins, a strong balance sheet, and growing free cash flow.

- Product Innovation and Ecosystem Control: The company’s continuous innovation (e.g., Blackwell chips) and integrated software-hardware ecosystem (CUDA, DGX, Omniverse) create a durable competitive advantage and customer lock-in.

(FAQs)

1. What is the NVIDIA prediction for 2025?

NVIDIA’s stock price for 2025 is predicted to range between $135 and $160, driven by continued growth in AI, cloud computing, and data center demand.

2. What is the shareholding pattern of NVIDIA?

NVIDIA is a publicly traded company listed on NASDAQ under the ticker NVDA. Its shares are primarily held by institutional investors (e.g., Vanguard, BlackRock), mutual funds, and retail investors. CEO and co-founder Jensen Huang is also one of the major individual shareholders.

3. What is the total valuation of NVIDIA in 2025?

As of 2025, NVIDIA’s market capitalization stands at approximately $3.89 trillion, making it one of the world’s most valuable technology companies.

4. Is NVIDIA a buy, sell, or hold?

Most analysts currently rate NVIDIA as a “Buy”, citing strong growth potential in AI, robust financial performance, and market leadership. However, investors should consider its high valuation and market risks.

5. What is the NVIDIA target price for 2025?

The predicted target price for 2025 is up to $160, based on projected earnings growth, AI adoption, and expanding enterprise demand for GPUs.

6. What is the 3-year return of NVIDIA?

Over the last 3 years, NVIDIA has delivered an impressive return of over 1,500%, driven by its dominance in the AI and graphics processing sectors.

7. What is the 12-month price target for NVIDIA?

The 12-month forecasted price target for NVIDIA is approximately $160, reflecting moderate upside as the company continues expanding in AI and high-performance computing.

8. What is the best stock to invest in today?

While NVIDIA is considered one of the top-performing tech stocks, the “best” stock depends on your investment goals, risk appetite, and diversification strategy. Always research thoroughly or consult a financial advisor.

9. Who owns NVIDIA?

NVIDIA is owned by public shareholders. The largest institutional owners include Vanguard Group, BlackRock, and Fidelity Investments. Jensen Huang, the company’s co-founder and CEO, is also a significant stakeholder.

10. What is the fair price of NVIDIA?

Analyst estimates for NVIDIA’s fair value vary but generally fall in the range of $140 to $160, based on earnings, future growth potential, and market sentiment.