Plug Power Stock Price Prediction 2025, 2026, 2027 and 2030 .Plug Power Inc. is an American company engaged in the development of hydrogen fuel cell systems that replace traditional batteries in electric appliances and vehicles. If you use Plug Power and want to know about its stock price and want to invest, in this article we will talk about Plug Power stock price predictions for 2025, 2026, 2027, and 2030. Let’s get started.

Basic Details of Plug Power Company:

Plug Power Inc., founded in 1997 and headquartered in Latham, New York, is a major player in the clean energy sector, manufacturing hydrogen fuel cell systems. The company’s offerings include hydrogen fuel cells for material handling, stationary power generation, and backup power applications. Additionally, Plug Power manufactures electrolyzers for hydrogen production and provides infrastructure solutions for hydrogen storage and distribution.

It serves key markets such as warehouse operations, critical infrastructure, and transportation, with products including Amazon for logistics, Proterra for transit buses, and Renault for hydrogen-powered vehicles in Europe. While the company faces challenges such as the high cost of hydrogen production, infrastructure development, and achieving profitability, it is positioned to meet government support for clean energy and growing market demand to position itself as a key contributor in the transition to clean energy.

Plug Power Financial Condition:

Revenue: Looking at the revenue for Plug Power, the company saw an increase from $190.4 million in September 2023 to $260.2 million in June 2024. This growth indicates that Plug Power’s revenue is steadily improving, moving from quarter to quarter.

Profit: However, when it comes to profitability, the company continues to face significant challenges. In June 2024, Plug Power reported a net income loss of $262 million, which is slightly better than the $296 million loss in March 2024 but still shows a deepening problem compared to previous periods. The net income has worsened from a loss of $283 million in September 2023, reflecting ongoing financial struggles.

Operating Income: The operating income also paints a troubling picture. Plug Power’s operating income loss grew from $190.2 million in September 2023 to $235.3 million in June 2024. This increase in losses highlights persistent operational issues despite the rise in revenue.

Net Change in Cash: The company’s cash flow is also under pressure, with net cash decreasing from $110.4 million in September 2023 to $149.2 million in June 2024. This decline underscores the ongoing cash strain faced by the company.

Annual Overview: Over the years, Plug Power’s annual performance has shown a pattern of increasing losses. From $596.18 million in net losses in 2019 to $1.37 billion in 2022 and 2023, the company has struggled significantly. For 2024, while targeting $1 billion in revenue, it’s clear that the company is still grappling with substantial losses, having reported $1.37 billion in net losses

Quarterly Financials

| (USD) | Jun 2024 | Mar 2024 | Dec 2023 | Sept 2023 |

|---|---|---|---|---|

| Revenue | $260.2M | $210.3M | $220.5M | $190.4M |

| Net Income | -$262M | -$296M | -$642M | -$283M |

| Diluted EPS | – | – | – | – |

| Net Profit Margin | -183% | -141% | -291% | -149% |

| Operating Income | -$235.3M | -$210.5M | -$220.1M | -$190.2M |

| Net Change in Cash | -$149.2M | -$120.3M | -$130.5M | -$110.4M |

| Cash on Hand | – | – | – | – |

| Cost of Revenue | $258.1M | $210.2M | $220.3M | $190.1M |

Annual Financials

| Year | Revenue | Net Income | Operating Income | Cost of Revenue |

|---|---|---|---|---|

| 2019 | $502.34M | -$596.18M | -$576.61M | $376.18M |

| 2020 | $701.44M | -$459.97M | -$415.92M | $673.65M |

| 2021 | $891.34M | -$724.01M | -$657.86M | $895.80M |

| 2022 | $684.49M | -$1.37B | -$1.04B | $1.40B |

| 2023 | $891.34M | -$1.37B | -$1.04B | $1.40B |

| 2024 | $1B (target) | -$1.37B (Q2) | -$1.13B | $1.34B |

Plug Power Stock Price History:

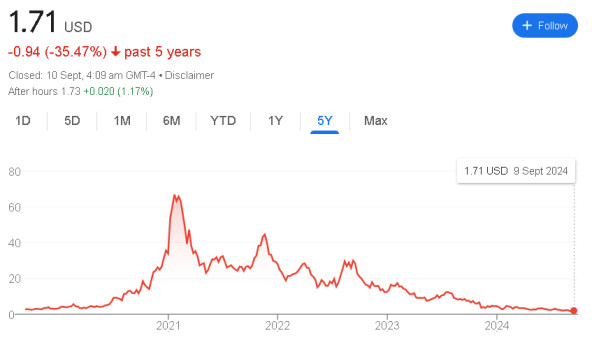

2020: The stock saw impressive growth throughout the year, starting at around $3.24 and ending on a high note, closing close to $33.91.

2021: The stock’s performance was more volatile, hitting a peak of $73.18 before finishing the year at about $28.23.

2022: The stock began to decline, reaching a high of $31.75 but closing significantly lower at around $12.37.

2023: The downward trend persisted, with the stock closing the year at approximately $4.50.

2024: As of the latest update, the stock is trading around $1.71.

Plug Power Stock Price Overview:

The market cap of Plug Power is 150.42Cr, and right now, the company is at its 52-week low price which is $1.60. per share, and 52-week high price is $8.80 per share.

| Plug Power Share Data | Value |

|---|---|

| Market Cap | 150.42Cr |

| 52 Week High | 8.80 |

| 52 Week Low | 1.60 |

Monthly Stock Price Targets for 2024:

| Month | Minimum Estimate | Maximum Estimate |

|---|---|---|

| January | $1.50 | $1.70 |

| February | $1.40 | $1.60 |

| March | $1.35 | $1.55 |

| April | $1.30 | $1.50 |

| May | $1.25 | $1.45 |

| June | $1.20 | $1.40 |

| July | $1.50 | $1.70 |

| August | $1.30 | $1.50 |

| September | $1.10 | $1.30 |

| October | $1.25 | $1.45 |

| November | $1.05 | $1.25 |

| December | $1.00 | $1.20 |

Plug Power Stock Price Prediction for 2025, 2026, 2027 and 2030

Plug Power Stock Price in 2025:

| Month | Minimum Estimate | Maximum Estimate |

|---|---|---|

| January | $2.50 | $3.00 |

| February | $2.60 | $3.10 |

| March | $2.70 | $3.20 |

| April | $2.80 | $3.30 |

| May | $2.90 | $3.40 |

| June | $3.00 | $3.50 |

| July | $3.10 | $3.60 |

| August | $3.20 | $3.70 |

| September | $3.30 | $3.80 |

| October | $3.40 | $3.90 |

| November | $3.50 | $4.00 |

| December | $3.60 | $4.10 |

Plug Power Stock Price in 2026:

| Month | Minimum Estimate | Maximum Estimate |

|---|---|---|

| January | $3.70 | $4.20 |

| February | $3.80 | $4.30 |

| March | $3.90 | $4.40 |

| April | $4.00 | $4.50 |

| May | $4.10 | $4.60 |

| June | $4.20 | $4.70 |

| July | $4.30 | $4.80 |

| August | $4.40 | $4.90 |

| September | $4.50 | $5.00 |

| October | $4.60 | $5.10 |

| November | $4.70 | $5.20 |

| December | $4.80 | $5.30 |

Plug Power Stock Price in 2027:

| Month | Minimum Estimate | Maximum Estimate |

|---|---|---|

| January | $5.00 | $5.50 |

| February | $5.10 | $5.60 |

| March | $5.20 | $5.70 |

| April | $5.30 | $5.80 |

| May | $5.40 | $5.90 |

| June | $5.50 | $6.00 |

| July | $5.60 | $6.10 |

| August | $5.70 | $6.20 |

| September | $5.80 | $6.30 |

| October | $5.90 | $6.40 |

| November | $6.00 | $6.50 |

| December | $6.10 | $6.60 |

Plug Power Stock Price in 2030:

| Month | Minimum Estimate | Maximum Estimate |

|---|---|---|

| January | $10.00 | $12.00 |

| February | $10.20 | $12.20 |

| March | $10.40 | $12.40 |

| April | $10.60 | $12.60 |

| May | $10.80 | $12.80 |

| June | $11.00 | $13.00 |

| July | $11.20 | $13.20 |

| August | $11.40 | $13.40 |

| September | $11.60 | $13.60 |

| October | $11.80 | $13.80 |

| November | $12.00 | $14.00 |

| December | $12.20 | $14.20 |

Conclusion:

In this article we predicted Plug Power Stock Price Prediction 2025, 2026, 2027 and 2030. Plug Power’s stock price is predicted to see substantial growth from 2025 to 2030. In 2025, the stock is expected to range between $1.50 and $4.10. By 2027, it could rise to between $6.10 and $6.60, with further increases anticipated by 2030, reaching a range of $10.00 to $14.20. This indicates a positive long-term outlook for the company’s stock.

FAQs:

1. What is the projected stock price target for Plug Power in January 2025?

In January 2025, the stock price target for Plug Power is projected to have a minimum estimate of $2.50 and a maximum estimate of $3.00.

2. How does the stock price target for Plug Power in 2026 compare to 2025?

In 2026, Plug Power’s stock price targets are expected to increase compared to 2025. For example, the minimum estimate for January 2026 is $3.70, compared to $2.50 in January 2025.

3. What is the predicted stock price for Plug Power in December 2027?

In December 2027, the predicted stock price for Plug Power ranges from a minimum of $6.10 to a maximum of $6.60.

4. What are the highest and lowest stock price targets for Plug Power in 2025?

The highest stock price target for Plug Power in 2025 is $4.10 in December, while the lowest is $1.10 in September.

5. How much is Plug Power’s stock price expected to increase from 2024 to 2025?

Plug Power’s stock price is expected to see a significant increase from 2024 to 2025, with the price targets rising from a maximum of $1.70 in December 2024 to a maximum of $4.10 by December 2025.

6. What is the trend in Plug Power’s stock price targets from 2025 to 2030?

The trend shows a steady increase in stock price targets from 2025 to 2030. For example, the minimum estimate for January 2025 is $2.50, while by January 2030, it is projected to be $10.00.

7. Are there any months in 2025 where Plug Power’s stock price is predicted to drop compared to the previous month?

In 2025, there are no months where the stock price target is predicted to drop compared to the previous month. The targets are expected to increase or remain steady throughout the year.

8. What is the projected stock price for Plug Power in August 2025?

In August 2025, the projected stock price for Plug Power ranges from a minimum of $3.20 to a maximum of $3.70.

9. How does the stock price target for Plug Power in October 2026 compare to October 2025?

In October 2026, the stock price target ranges from $4.60 to $5.10, which is higher compared to October 2025, where the target ranges from $3.40 to $3.90.

10. What is the expected stock price range for Plug Power in November 2030?

In November 2030, Plug Power’s stock price is expected to range from a minimum of $12.00 to a maximum of $14.00.