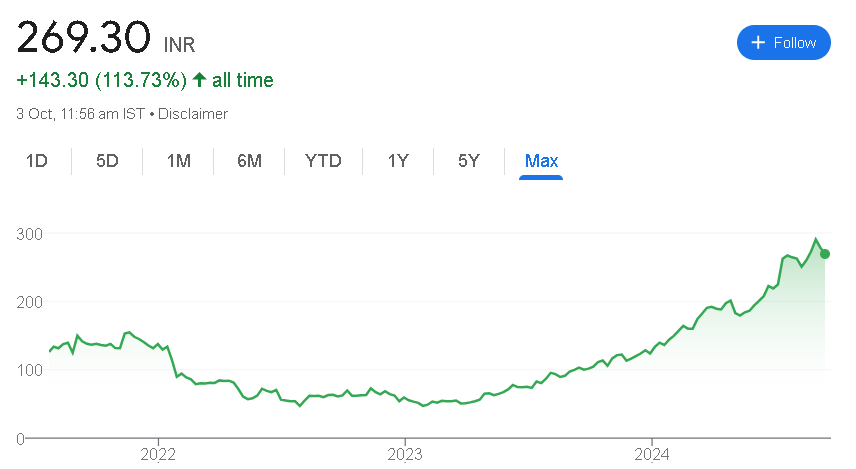

In this article we discuss you Zomato Share Price Analysis and current Price with full details. Zomato Ltd. continues to capture investor interest as its share price climbs, demonstrating strong growth amid a dynamic market. As of October 3, 2024, Zomato’s share price stands at ₹269.00, marking an impressive rise from ₹130, showcasing resilience and upward momentum. This article provides an in-depth analysis of key performance metrics, recent developments, and future price expectations for Zomato shares.

Zomato Share Price Current Market Overview

Zomato’s share price has surged from ₹130 to ₹269.35, reflecting a growth of over 100%. The company’s market capitalization has expanded significantly, solidifying its leadership in the food delivery industry. While volatility persists, the stock has shown consistent growth over the past six months, up by 50.87%.

Key Performance Indicators

Zomato’s financial metrics demonstrate a robust performance:

- Current Share Price: ₹269.00

- 52-Week High: ₹298.25

- 52-Week Low: ₹100.00

- Market Capitalization: ₹2.34 lakh crore

- P/E Ratio: 396.66

The company’s revenue increased by 74.09% year-over-year, while net profit margins improved to 6.02%, boosting investor confidence.

Zomato Share Price Technical Analysis

Zomato’s share price is currently trading at elevated levels but continues to show bullish signs, as technical indicators highlight favorable conditions for further growth. The stock is above key moving averages, indicating potential upward momentum.

Support and Resistance Levels

Investors should monitor the following critical levels:

| Level Type | Price (₹) |

|---|---|

| First Support | 268.50 |

| Second Support | 265.00 |

| Third Support | 260.00 |

| First Resistance | 272.45 |

| Second Resistance | 275.50 |

| Third Resistance | 280.00 |

The stock’s recent fluctuations offer trading opportunities around these support and resistance levels.

Zomato Share Price Trading Volume Insights

Zomato’s shares are experiencing high trading activity, with a current volume of approximately 3.89 crore. A strong delivery percentage of around 40.34% indicates that many investors are opting to hold onto their positions, further suggesting confidence in the company’s growth prospects.

Recent Developments and Future Prospects

Recent financial results have bolstered investor confidence:

- Net Income: ₹253 crore in Q1 FY24, a significant improvement from a loss of ₹188 crore in the previous year.

- Zomato is pursuing strategic acquisitions, including potential partnerships in ticketing services, to diversify revenue streams and solidify its market position.

Zomato Share Price Analyst Ratings and Predictions

Leading brokerages, including Morgan Stanley and CLSA, maintain optimistic outlooks for Zomato’s shares, citing strong revenue growth and market share expansion. The company’s annual revenue growth rate of 55.9% further solidifies its competitive edge against rivals like Swiggy.

Zomato Share Price Future Price Expectations

If Zomato continues on its current growth trajectory, analysts predict that the share price could rise toward the upper resistance levels in the coming weeks. Investors are advised to stay vigilant of market trends and external factors that may influence future stock performance.

How to Purchase Zomato Share

Here’s a step-by-step guide on how to purchase Zomato shares:

1. Open a Demat and Trading Account

- Demat Account: A Demat (Dematerialized) account is required to hold shares electronically. You can open it with any stockbroker or financial institution.

- Trading Account: A trading account is needed to buy and sell shares on the stock market. Many stockbrokers offer both Demat and trading accounts in one package.

2. Choose a Reliable Stockbroker

- Select a stockbroker that suits your needs. Some popular stockbrokers in India include Zerodha, Upstox, ICICI Direct, HDFC Securities, and Sharekhan.

- Check for features like user-friendly platforms, brokerage fees, research tools, and customer service.

3. Complete KYC Process

- You will need to complete the KYC (Know Your Customer) process by submitting documents like PAN card, Aadhaar card, bank account details, and a passport-sized photo.

- Some brokers allow for online KYC, making it convenient to start trading quickly.

4. Add Funds to Your Trading Account

- Once your account is active, transfer funds from your bank account to your trading account. You can transfer the desired amount you wish to invest in Zomato shares.

5. Research Zomato’s Share Price

- Before making a purchase, review Zomato’s current market price, financial reports, and market performance. It’s important to know whether the stock is trading at a good value for your investment goals.

6. Place a Buy Order

- Log in to your trading platform and search for “Zomato” by its ticker symbol (ZOMATO).

- Select Buy and enter the number of shares you want to purchase.

- Choose the type of order:

- Market Order: Buys shares at the current market price.

- Limit Order: Buys shares at a specific price set by you.

7. Confirm Your Transaction

- Review the details and confirm your buy order. Once executed, the shares will reflect in your Demat account.

8. Monitor Your Investment

- After purchasing, regularly monitor Zomato’s stock performance, quarterly reports, and overall market trends to make informed decisions about holding or selling the stock in the future.

Some peer companies of Zomato Shares

Swiggy: One of Zomato’s main competitors in India, offering food delivery services along with grocery delivery and cloud kitchen operations.

Domino’s Pizza (Jubilant FoodWorks): A major player in the pizza delivery market, it operates both physical stores and a robust online ordering system.

Foodpanda: A food delivery service operating in various markets, including India, though it has a smaller presence compared to Zomato and Swiggy.

Uber Eats: Although it exited the Indian market, Uber Eats remains a significant global competitor in food delivery.

Dineout: A restaurant aggregator that allows users to discover restaurants, make reservations, and order food online.

Ola Foods: Part of the Ola cab service, it has ventured into the food delivery space but is smaller than Zomato and Swiggy.

Investor Types and Ratios for Zomato Shares

Investor Types

- Institutional Investors: ~50% to 60% of shareholding (includes mutual funds, insurance companies, and pension funds).

- Retail Investors: ~20% to 30% of shareholding (individual investors making personal investments).

- Foreign Institutional Investors (FIIs): ~15% to 25% of shareholding (overseas investors in Indian markets).

- High Net-Worth Individuals (HNWIs): ~5% to 10% of shareholding (individuals with significant investment capital).

Key Financial Ratios

- Price-to-Earnings (P/E) Ratio: Generally between 20 and 30 (reflecting investor willingness to pay for earnings).

- Price-to-Book (P/B) Ratio: Typically around 2 to 3 times book value (indicating how much more investors pay compared to book value).

- Return on Equity (ROE): Usually ranges from 12% to 18% (indicating profit generation efficiency from shareholders’ equity).

- Net Profit Margin: Generally between 5% and 10% (reflecting the percentage of revenue that translates into profit).

- Market Capitalization: Indicates total market value; for Zomato, it is approximately ₹2.34 lakh crore.

Disclaimer:

The insights provided in this article are based on expert analysis from brokerage firms and do not constitute official financial advice. Always consult a certified expert before making any investment decisions.